NR5 Application 2013

What is the NR5 Application

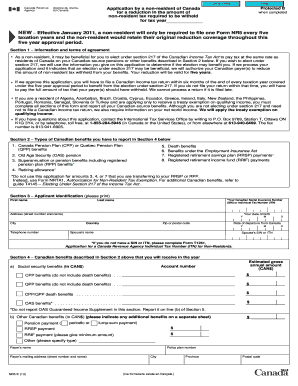

The NR5 Application is a form used by taxpayers in the United States to apply for a tax refund on foreign income that has been subject to withholding tax. This application is particularly relevant for individuals and businesses that earn income from foreign sources and wish to reclaim some of the taxes withheld by foreign governments. Understanding the NR5 Application is crucial for ensuring that taxpayers can maximize their refunds and comply with tax regulations.

Steps to complete the NR5 Application

Completing the NR5 Application involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of foreign income and any withholding tax paid. Next, fill out the application form with accurate personal information and details of the income earned. It is essential to review the form for any errors before submission. Finally, submit the completed NR5 Application to the appropriate tax authority, either electronically or via mail, depending on the submission guidelines.

Legal use of the NR5 Application

The NR5 Application is legally binding when completed correctly and submitted in accordance with IRS guidelines. To ensure that the application is valid, it must include accurate information and be signed by the taxpayer or an authorized representative. Additionally, compliance with relevant tax laws and regulations is necessary for the application to be accepted. Using a reliable eSignature solution can enhance the legal standing of the application by providing an electronic certificate and ensuring adherence to eSignature laws.

Required Documents

To successfully complete the NR5 Application, several documents are required. These typically include:

- Proof of foreign income, such as pay stubs or tax documents from the foreign government.

- Documentation of taxes withheld, which may include withholding tax certificates.

- Identification documents, such as a Social Security number or taxpayer identification number.

Ensuring that all required documents are submitted with the application can help prevent delays in processing and increase the likelihood of receiving a refund.

Who Issues the Form

The NR5 Application is issued by the Internal Revenue Service (IRS) in the United States. The IRS is responsible for overseeing tax compliance and processing applications related to foreign income and withholding tax refunds. It is important for taxpayers to refer to the IRS guidelines when completing the NR5 Application to ensure that all requirements are met and that the form is correctly submitted.

Filing Deadlines / Important Dates

Filing deadlines for the NR5 Application can vary based on individual circumstances, such as the type of income earned and the tax year in question. Generally, it is advisable to submit the application as soon as possible after the end of the tax year in which the foreign income was earned. Taxpayers should be aware of any specific deadlines set by the IRS to avoid penalties or delays in processing their refund requests.

Quick guide on how to complete nr5 application

Effortlessly Prepare NR5 Application on Any Device

Digital document management has become increasingly popular among enterprises and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed paperwork, enabling you to locate the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle NR5 Application on any device with the airSlate SignNow applications available for Android or iOS, and streamline your document-related tasks today.

The Easiest Method to Modify and Electronically Sign NR5 Application

- Obtain NR5 Application and click on Get Form to initiate the process.

- Utilize the tools provided to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to share your form, via email, SMS, invitation link, or download it to your computer.

Forget the hassle of lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in a few clicks from any device you choose. Edit and electronically sign NR5 Application to maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nr5 application

Create this form in 5 minutes!

How to create an eSignature for the nr5 application

The best way to generate an eSignature for a PDF in the online mode

The best way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to create an eSignature right from your smart phone

How to create an eSignature for a PDF on iOS devices

The way to create an eSignature for a PDF on Android OS

People also ask

-

What is the NR5 Application in airSlate SignNow?

The NR5 Application is a streamlined electronic method used within airSlate SignNow to securely submit and eSign important documents. This feature simplifies the process, ensuring that your forms are completed accurately and swiftly.

-

How does the NR5 Application enhance document security?

The NR5 Application utilizes advanced encryption and authentication protocols to protect your documents. By leveraging airSlate SignNow's robust security measures, your sensitive information remains confidential and compliant with regulations.

-

What are the pricing options for using the NR5 Application?

airSlate SignNow offers flexible pricing plans to accommodate different user needs. The NR5 Application is included in all subscription tiers, providing excellent value for businesses looking to manage their document workflows effectively.

-

Can I integrate the NR5 Application with other software?

Yes, the NR5 Application in airSlate SignNow supports integrations with popular business software like CRM and project management tools. This compatibility allows for a seamless workflow, enhancing productivity across your organization.

-

What are the key features of the NR5 Application?

The NR5 Application boasts features such as customizable templates, real-time tracking, and automated reminders. These tools make document management easy and ensure timely completion of important tasks.

-

How can the NR5 Application benefit my business?

By using the NR5 Application, your business can reduce the time spent on paperwork, minimize errors, and improve overall efficiency. airSlate SignNow streamlines your document processes, enabling quicker decision-making.

-

Is training available for using the NR5 Application?

Absolutely! airSlate SignNow provides comprehensive training resources and customer support for users of the NR5 Application. These resources can help you maximize the benefits of the application and ensure a smooth onboarding experience.

Get more for NR5 Application

Find out other NR5 Application

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter