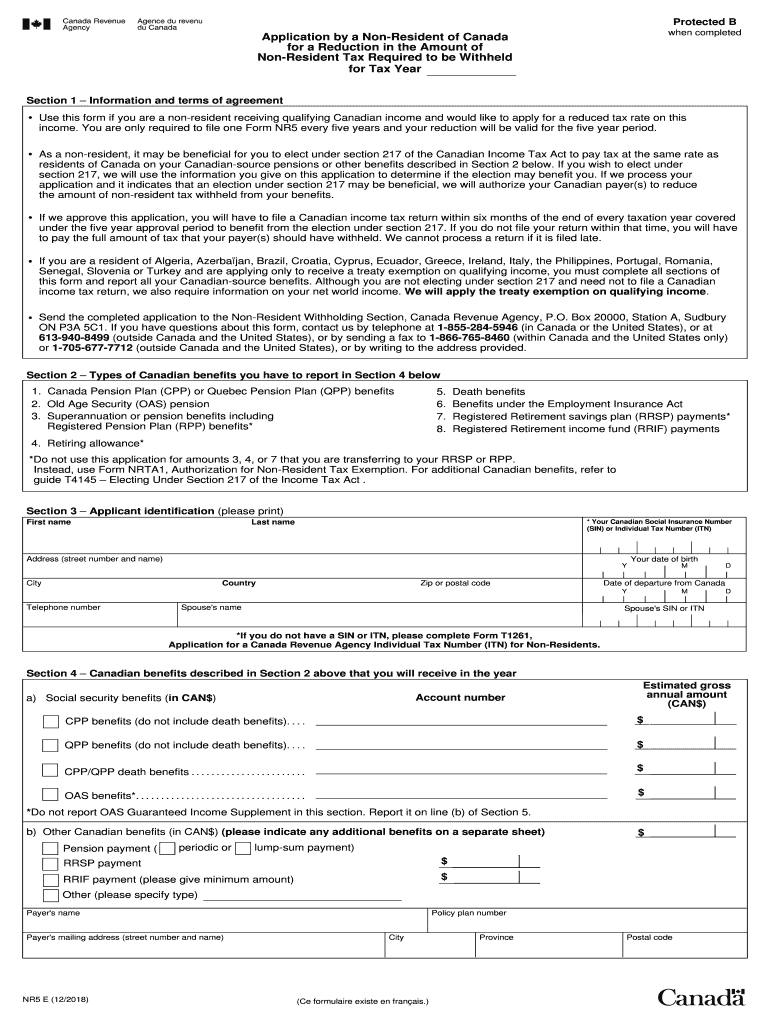

Non Resident Tax Required to Be Withheld 2018-2026

Understanding Non-Resident Tax Withholding

The non-resident tax withholding refers to the amount of tax that must be deducted from payments made to non-residents by U.S. entities. This tax is typically withheld on various types of income, including dividends, interest, and royalties. The rate of withholding can vary based on the type of income and any applicable tax treaties between the U.S. and the non-resident's country of residence. Understanding these regulations is crucial for compliance and to avoid penalties.

Steps to Complete the Non-Resident Tax Withholding

Completing the non-resident tax withholding process involves several key steps:

- Identify the type of income being paid to the non-resident.

- Determine the appropriate withholding tax rate based on IRS guidelines and any relevant tax treaties.

- Collect necessary documentation from the non-resident, such as Form W-8BEN, to establish their foreign status.

- Calculate the amount of tax to withhold from the payment.

- Submit the withheld tax to the IRS using the appropriate forms.

Required Documents for Non-Resident Tax Withholding

To properly execute non-resident tax withholding, certain documents are essential:

- Form W-8BEN: This form is used by non-residents to certify their foreign status and claim any applicable tax treaty benefits.

- Form 1042-S: This form reports income paid to non-residents and the amount of tax withheld.

- IRS Publication 515: This publication provides detailed information on withholding tax for non-residents.

Legal Use of Non-Resident Tax Withholding

The legal framework governing non-resident tax withholding is primarily outlined in the Internal Revenue Code. It mandates that U.S. payers withhold taxes on certain payments made to foreign individuals and entities. Compliance with these regulations ensures that the correct amount of tax is withheld and reported, protecting both the payer and the payee from potential legal issues.

Filing Deadlines for Non-Resident Tax Withholding

Filing deadlines for non-resident tax withholding are crucial for maintaining compliance. Typically, the withheld taxes must be submitted to the IRS on a quarterly basis. Additionally, Form 1042-S must be filed by March fifteenth of the year following the payment. It is important to stay informed about any changes to these deadlines to avoid penalties.

Penalties for Non-Compliance

Failure to comply with non-resident tax withholding requirements can result in significant penalties. These may include fines for late payments, interest on unpaid taxes, and potential audits. It is essential for businesses to understand their obligations and ensure timely and accurate withholding to mitigate these risks.

Quick guide on how to complete non resident tax required to be withheld

Effortlessly Prepare Non Resident Tax Required To Be Withheld on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without complications. Manage Non Resident Tax Required To Be Withheld on any platform using airSlate SignNow's Android or iOS applications and streamline any document-based task today.

A Seamless Way to Edit and eSign Non Resident Tax Required To Be Withheld

- Locate Non Resident Tax Required To Be Withheld and click Get Form to begin.

- Make use of the tools available to complete your form.

- Highlight signNow parts of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you prefer. Update and eSign Non Resident Tax Required To Be Withheld while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct non resident tax required to be withheld

Create this form in 5 minutes!

How to create an eSignature for the non resident tax required to be withheld

How to create an eSignature for your PDF document online

How to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature from your smart phone

How to generate an electronic signature for a PDF document on iOS

The best way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the primary function of airSlate SignNow related to nr5?

airSlate SignNow provides a powerful and efficient solution for eSigning documents, streamlining your workflow with the capabilities of nr5. By facilitating quick and legally binding signatures, businesses can optimize their operations and improve document turnaround times. It's the perfect tool for teams needing reliable signature solutions efficiently.

-

How can airSlate SignNow enhance my business processes with nr5?

By integrating nr5 into your document workflow, airSlate SignNow enhances business processes by simplifying eSigning and document management. This helps reduce bottlenecks, allowing for faster approvals and improved collaboration among team members. The platform's intuitive design ensures ease of use for everyone involved.

-

What pricing plans are available for airSlate SignNow with nr5?

airSlate SignNow offers various pricing plans designed to fit the needs of your business, all while incorporating the powerful features of nr5. Whether you're a small business or a larger enterprise, there are cost-effective options available. Each plan provides access to essential functionalities, making it easier to choose one that best suits your requirements.

-

What are the key features of airSlate SignNow utilizing nr5?

Key features of airSlate SignNow with nr5 include customizable templates, real-time tracking, and multi-user support. These functionalities enable businesses to manage documents effectively, ensuring each step of the signing process is streamlined. The robustness of nr5 enhances the overall capability of the platform, making it a great choice for organizations of all sizes.

-

How does airSlate SignNow ensure document security when using nr5?

With airSlate SignNow, security is a top priority, especially when implementing nr5 for eSigning. The platform uses encryption and compliance with industry standards to protect sensitive information. This ensures that all your documents are safe from unauthorized access while maintaining the integrity of the signatures.

-

Can airSlate SignNow integrate with other software, and how does nr5 fit into this?

Yes, airSlate SignNow offers seamless integration with various applications, enhancing its functionality alongside nr5. This makes it possible to connect your existing tools, such as CRM or project management software, to streamline processes even further. Such integrations allow for automated workflows and improved data management.

-

What benefits can my organization expect from using airSlate SignNow with nr5?

Organizations can expect signNow benefits from using airSlate SignNow with nr5, such as increased efficiency, reduced costs, and improved turnaround times for document signing. By eliminating the need for physical paperwork, your team can focus on more critical tasks while ensuring that all necessary documentation is completed swiftly. This advantage strengthens your business's overall productivity.

Get more for Non Resident Tax Required To Be Withheld

- Wa subpoena form

- Washington motion declaration 497430044 form

- Ju 110410 order for change of judge washington form

- Ju 120100 petition for review of out of home placement washington form

- Ju 120400 order on review of out of home placement washington form

- Hearing permanency planning form

- Petition truancy form

- Washington summons form

Find out other Non Resident Tax Required To Be Withheld

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document