Az 140 Form

What is the Arizona Fillable Form 140?

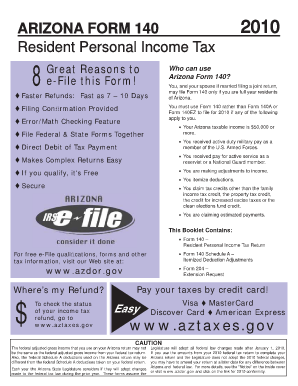

The Arizona fillable form 140 is an essential document used for individual income tax filing in the state of Arizona. This form allows residents to report their income, claim deductions, and calculate their tax liability. It is specifically designed for those who do not qualify for the simplified filing options available through the Arizona form 140A. The fillable version facilitates a more efficient and user-friendly experience, enabling taxpayers to complete their forms electronically.

How to Use the Arizona Fillable Form 140

Using the Arizona fillable form 140 is straightforward. Taxpayers can download the form from official state resources or access it through electronic filing platforms. Once the form is open, users can fill in their personal information, income details, and deductions directly into the fields. The fillable format automatically calculates totals, reducing the chances of errors. After completing the form, it can be saved, printed, or submitted electronically, depending on the chosen filing method.

Steps to Complete the Arizona Fillable Form 140

Completing the Arizona fillable form 140 involves several clear steps:

- Download the form from a reliable source or access it through an e-filing platform.

- Enter personal information, including your name, address, and Social Security number.

- Report your income sources, such as wages, interest, and dividends.

- Claim any applicable deductions and credits to reduce your taxable income.

- Review the calculations provided by the form to ensure accuracy.

- Sign and date the form before submission.

Legal Use of the Arizona Fillable Form 140

The Arizona fillable form 140 is legally recognized for filing state income taxes. To ensure its validity, taxpayers must adhere to specific regulations regarding electronic signatures and document submissions. Utilizing a reliable eSignature solution can help meet legal requirements, ensuring that the form is considered executed and compliant with state laws. It is crucial to maintain records of the completed form for future reference and potential audits.

Form Submission Methods for the Arizona Fillable Form 140

Taxpayers have multiple options for submitting the Arizona fillable form 140. The form can be filed electronically through various e-filing platforms, which often provide immediate confirmation of receipt. Alternatively, individuals may choose to print the completed form and mail it to the appropriate state tax office. In-person submission is also an option at designated tax offices. Each method has its own advantages, such as speed for electronic filing and personal interaction for in-person submissions.

Filing Deadlines for the Arizona Fillable Form 140

Understanding the filing deadlines for the Arizona fillable form 140 is essential for compliance. Generally, the deadline for submitting the form aligns with the federal tax deadline, typically falling on April 15. However, if that date falls on a weekend or holiday, the deadline may be extended. Taxpayers should verify specific dates each year to avoid penalties for late submission.

Quick guide on how to complete az 140 form

Complete Az 140 Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly without any delays. Manage Az 140 Form on any platform with airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

The easiest way to modify and eSign Az 140 Form without any hassle

- Find Az 140 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize signNow sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose your preferred method for submitting your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Az 140 Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the az 140 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Arizona fillable form 140?

The Arizona fillable form 140 is an official tax return form used by individuals to report their income and calculate their Arizona state tax obligations. This form is available in a fillable PDF format, allowing users to easily enter their information digitally before printing or e-signing.

-

How can airSlate SignNow help with the Arizona fillable form 140?

airSlate SignNow streamlines the process for users who need to manage the Arizona fillable form 140 by enabling them to send, eSign, and share the document seamlessly. Our platform simplifies document handling and helps ensure that your form is completed accurately and returned promptly.

-

Is there a cost associated with using airSlate SignNow for the Arizona fillable form 140?

Yes, while airSlate SignNow offers a cost-effective solution for managing documents, there may be a subscription fee to access premium features. However, the pricing plans are designed to fit various budgets, making it an economical choice for anyone needing the Arizona fillable form 140.

-

Can I save my progress on the Arizona fillable form 140 with airSlate SignNow?

Absolutely! With airSlate SignNow, you can save your progress on the Arizona fillable form 140, allowing you to come back and complete it at your convenience. This feature ensures that you never lose any information you’ve entered, making it easier to finalize your tax documentation.

-

What are the key benefits of using airSlate SignNow for tax forms like the Arizona fillable form 140?

Using airSlate SignNow for the Arizona fillable form 140 offers several benefits, including increased efficiency, document security, and compliance with state regulations. Additionally, our platform supports electronic signatures, reducing the time and effort required to submit your form.

-

Are there integrations available for airSlate SignNow to help manage the Arizona fillable form 140?

Yes, airSlate SignNow offers a range of integrations with popular software applications, facilitating a streamlined workflow for managing the Arizona fillable form 140. This feature allows you to connect your document management systems and improve productivity while handling tax documentation.

-

Can multiple users collaborate on the Arizona fillable form 140 using airSlate SignNow?

Yes, airSlate SignNow allows for multi-user collaboration on the Arizona fillable form 140, enabling team members to work together in real time. This feature enhances teamwork and ensures that all necessary inputs are gathered efficiently before submission.

Get more for Az 140 Form

- Club risk assessment form we ask all clubs that ar

- Your cooperation by fully completing the requested information

- Special olympics application form

- Letter of occupancy sample office de tourisme de fuveau form

- Speakers contract template form

- Special event contract template form

- Speech therapy contract template form

- Special order contract template form

Find out other Az 140 Form

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free