Ptax 342 R St Clair County Form

What is the Ptax 342 R St Clair County

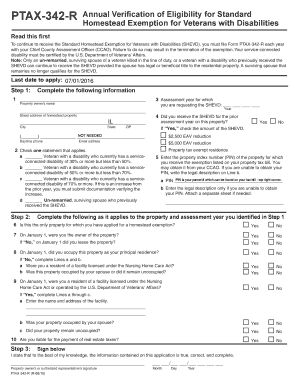

The Ptax 342 R St Clair County form is a property tax exemption application used in St. Clair County, Illinois. This form is specifically designed for property owners seeking to claim exemptions on their property taxes. The exemptions may apply to various categories, including senior citizens, disabled individuals, and veterans. Understanding the purpose and requirements of this form is essential for eligible property owners to reduce their tax liabilities effectively.

How to use the Ptax 342 R St Clair County

To use the Ptax 342 R St Clair County form, property owners must accurately complete the application by providing necessary information, such as property details and the applicant's personal information. It is important to review the eligibility criteria to ensure compliance. Once completed, the form can be submitted to the appropriate county office for processing. Utilizing a digital platform can streamline this process, allowing for easy access and submission.

Steps to complete the Ptax 342 R St Clair County

Completing the Ptax 342 R St Clair County form involves several important steps:

- Gather necessary documentation, including proof of eligibility for the exemption.

- Fill out the form with accurate property and personal information.

- Review the completed form for any errors or omissions.

- Submit the form to the county assessor's office, either online or by mail.

Following these steps carefully can help ensure that the application is processed without delays.

Legal use of the Ptax 342 R St Clair County

The Ptax 342 R St Clair County form is legally binding once submitted and accepted by the county assessor's office. It is crucial for applicants to provide truthful and accurate information, as any discrepancies may lead to penalties or denial of the exemption. Compliance with local tax laws and regulations is essential to maintain the validity of the exemption claimed.

Required Documents

When completing the Ptax 342 R St Clair County form, certain documents may be required to support the application. These may include:

- Proof of age or disability, such as a government-issued ID.

- Documentation of military service for veterans.

- Property tax bills or previous exemption approvals.

Having these documents ready can facilitate a smoother application process.

Form Submission Methods

The Ptax 342 R St Clair County form can be submitted through various methods, including:

- Online submission via the county's official website.

- Mailing the completed form to the county assessor's office.

- In-person delivery at designated county offices.

Choosing the right submission method can depend on personal preference and convenience.

Quick guide on how to complete ptax 342 r st clair county

Effortlessly handle Ptax 342 R St Clair County on any device

The management of online documents has become increasingly favored by both enterprises and individuals. It offers a superb environmentally friendly alternative to traditional printed and signed papers, as you can easily access the needed form and securely archive it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly and without delays. Manage Ptax 342 R St Clair County on any device using the airSlate SignNow apps for Android or iOS, and enhance any document-related process today.

How to edit and electronically sign Ptax 342 R St Clair County effortlessly

- Find Ptax 342 R St Clair County and click Get Form to begin.

- Utilize the tools we provide to finish your form.

- Mark important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Ptax 342 R St Clair County and ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ptax 342 r st clair county

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ptax 342 r st clair county?

Ptax 342 R St Clair County refers to a specific form used in property tax assessments within St. Clair County. It is important for property owners to understand this form as it directly impacts their tax obligations. Utilizing airSlate SignNow can streamline the eSigning of such documents to ensure compliance and accuracy.

-

How can airSlate SignNow help with ptax 342 r st clair county submissions?

AirSlate SignNow simplifies the process of submitting the ptax 342 r st clair county form by providing an intuitive platform for eSigning. Users can upload their documents, sign them electronically, and send them directly to the relevant authorities, saving time and reducing errors. This efficiency is crucial for meeting deadlines associated with tax submissions.

-

Is there a cost associated with using airSlate SignNow for ptax 342 r st clair county forms?

AirSlate SignNow offers competitive pricing designed for businesses of all sizes, making it a cost-effective solution for handling ptax 342 r st clair county forms. Users can choose from various plans depending on their needs, ensuring they get the features required without unnecessary expenses. This transparency in pricing is appealing to budget-conscious users.

-

What features does airSlate SignNow offer for eSigning ptax 342 r st clair county documents?

AirSlate SignNow includes a variety of features for eSigning ptax 342 r st clair county documents, such as customizable templates, real-time collaboration, and mobile access. These features enhance the signing experience and ensure that all parties can interact with the document efficiently. The platform is designed to simplify the entire signing process while maintaining compliance.

-

Are there any integrations available with airSlate SignNow for handling ptax 342 r st clair county forms?

Yes, airSlate SignNow integrates seamlessly with popular applications and platforms which can be beneficial when handling ptax 342 r st clair county forms. Whether it’s a CRM, document management system, or cloud storage service, these integrations allow users to streamline their workflows and enhance productivity. This flexibility is an asset for managing tax-related documents.

-

What are the benefits of using airSlate SignNow for ptax 342 r st clair county processing?

The benefits of using airSlate SignNow for ptax 342 r st clair county processing include speed, security, and convenience. The platform ensures that documents are signed quickly and securely, while also allowing users to track the status of their submissions in real-time. This level of control and efficiency is vital for successful tax document management.

-

How does airSlate SignNow ensure the security of ptax 342 r st clair county documents?

AirSlate SignNow prioritizes security, employing advanced encryption and authentication features to protect ptax 342 r st clair county documents. This means that sensitive information remains confidential and accessible only to authorized users. Such security measures are essential for businesses that handle private tax information.

Get more for Ptax 342 R St Clair County

- Important the grand at olde carrollwood form

- Addendum to lease real estate us info form

- 062415 cc agenda packet form

- Marche suivrenotes explicatives demande de copies form

- Product sale contract template form

- Product purchase contract template form

- Product placement contract template form

- Production assistant contract template form

Find out other Ptax 342 R St Clair County

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement