Bank Loan Form

What is the Bank Loan Form

The bank loan form is a formal document that individuals or businesses use to apply for a loan from a financial institution. This form collects essential information about the applicant, including personal details, financial history, and the purpose of the loan. It serves as the primary tool for lenders to assess the creditworthiness of the applicant and determine the terms of the loan. The bank loan form may vary by institution but generally includes sections for income verification, employment status, and collateral details.

How to use the Bank Loan Form

Using the bank loan form involves several steps to ensure accurate completion. First, gather all necessary documentation, such as proof of income, tax returns, and identification. Next, carefully fill out the form, providing truthful and complete information in each section. It is crucial to review the form for any errors before submission. Once completed, the form can be submitted either online or in person, depending on the bank's requirements. Keeping a copy of the submitted form is advisable for future reference.

Steps to complete the Bank Loan Form

Completing the bank loan form requires attention to detail and organization. Follow these steps for a smooth process:

- Gather Documentation: Collect necessary documents, such as pay stubs, bank statements, and identification.

- Fill Out Personal Information: Provide your name, address, social security number, and contact details.

- Detail Financial Information: Include your income, expenses, and any existing debts.

- Specify Loan Details: Indicate the amount you wish to borrow and the intended use of the funds.

- Review and Sign: Double-check all entries for accuracy, then sign and date the form.

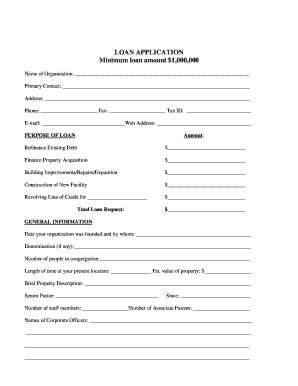

Key elements of the Bank Loan Form

Understanding the key elements of the bank loan form can enhance the application process. Essential components typically include:

- Applicant Information: Basic details about the borrower, including name and contact information.

- Loan Amount Requested: The specific sum the applicant wishes to borrow.

- Purpose of the Loan: A brief explanation of how the funds will be used.

- Income and Employment Details: Information regarding the applicant's job, salary, and financial stability.

- Signature: A declaration that the information provided is accurate and complete.

Required Documents

When applying for a bank loan, specific documents are typically required to support the application. Commonly requested documents include:

- Proof of Identity: Government-issued identification, such as a driver's license or passport.

- Proof of Income: Recent pay stubs, tax returns, or bank statements to verify earnings.

- Credit History: A report that provides insight into the applicant's creditworthiness.

- Loan Purpose Documentation: Any additional paperwork that supports the reason for the loan, such as invoices or contracts.

Application Process & Approval Time

The application process for a bank loan typically involves several stages. After submitting the completed bank loan form and required documents, the lender will review the application. This review may include a credit check and verification of the provided information. The approval time can vary significantly based on the bank's policies and the complexity of the application. Generally, applicants can expect a response within a few days to a couple of weeks, depending on the institution.

Quick guide on how to complete bank loan form 174744

Prepare Bank Loan Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Bank Loan Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Bank Loan Form with ease

- Find Bank Loan Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that function.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, exhausting form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Bank Loan Form and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bank loan form 174744

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a bank loan template?

A bank loan template is a pre-designed document that outlines the terms and conditions of a loan agreement between a borrower and a lender. Using airSlate SignNow, you can customize this template to fit your specific lending needs, ensuring all essential information is included.

-

How can I create a bank loan template using airSlate SignNow?

Creating a bank loan template with airSlate SignNow is simple. You can start with one of our existing templates and customize it to reflect your requirements, or build a new one from scratch. Our user-friendly platform ensures that you can include all necessary fields and clauses easily.

-

What features does the bank loan template offer?

The bank loan template on airSlate SignNow offers a range of features including customizable fields, automatic calculations for interest rates, and secure electronic signatures. These features help streamline the loan process and ensure compliance, making it easier for both lenders and borrowers.

-

Is there a cost associated with using the bank loan template?

Yes, airSlate SignNow offers various pricing plans that include access to the bank loan template. The cost varies based on the features you need, but it remains an affordable solution for businesses looking to streamline their document signing and loan processes.

-

How does the bank loan template benefit my business?

Utilizing a bank loan template can signNowly reduce the time and effort spent on document preparation. It ensures consistency across all loan agreements and helps maintain professional integrity, ultimately improving your business’s efficiency and customer satisfaction.

-

Can I integrate the bank loan template with other software?

Absolutely! The bank loan template in airSlate SignNow can be integrated with various CRM and financial management software. This integration allows for seamless data import and export, enhancing your workflow and making loan management more efficient.

-

What types of loans can I create with the bank loan template?

The bank loan template is versatile and can be adapted for various types of loans, including personal, commercial, and mortgage loans. This flexibility allows you to tailor the document to suit different lending scenarios, ensuring all loan specifics are adequately covered.

Get more for Bank Loan Form

Find out other Bank Loan Form

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure