Sss Disclosure Statement on Loan Credit Transaction Form

What is the SSS Disclosure Statement on Loan Credit Transaction

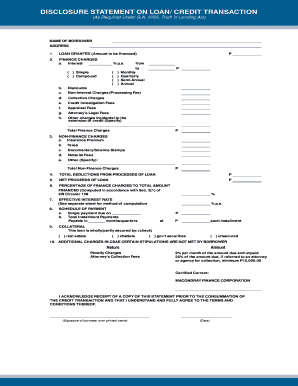

The SSS disclosure statement on loan credit transactions is a crucial document that outlines the terms and conditions associated with a loan provided by the Social Security System (SSS). This statement includes essential information such as the loan amount, interest rates, repayment terms, and any applicable fees. It serves to inform borrowers about their rights and obligations, ensuring transparency in the lending process. Understanding this document is vital for borrowers to make informed financial decisions and to avoid potential pitfalls related to their loans.

How to Obtain the SSS Disclosure Statement on Loan Credit Transaction

To obtain the SSS disclosure statement on loan credit transactions, borrowers typically need to follow a straightforward process. First, they can visit the official SSS website or their local SSS office. Online access may require creating an account or logging in to an existing one. Once logged in, borrowers can navigate to the loan section to request their disclosure statement. Alternatively, they can directly contact SSS customer service for assistance. It’s important to have personal identification and loan details ready to facilitate the process.

Steps to Complete the SSS Disclosure Statement on Loan Credit Transaction

Completing the SSS disclosure statement on loan credit transactions involves several key steps. Initially, borrowers should carefully read through the entire document to understand the terms. Next, they need to fill in any required personal information, including their name, loan number, and contact details. After entering the necessary information, borrowers should review the statement for accuracy before signing it. Finally, the completed disclosure statement can be submitted online or in person, depending on the preferred method of communication with SSS.

Key Elements of the SSS Disclosure Statement on Loan Credit Transaction

The key elements of the SSS disclosure statement on loan credit transactions include several critical components. These typically encompass the loan amount, interest rate, total repayment amount, repayment schedule, and any associated fees. Additionally, the statement may outline the borrower’s rights, such as the right to prepay the loan without penalties. Understanding these elements is essential for borrowers to grasp the full financial implications of their loan agreement and to ensure they comply with the terms set forth by SSS.

Legal Use of the SSS Disclosure Statement on Loan Credit Transaction

The legal use of the SSS disclosure statement on loan credit transactions is governed by various regulations that protect both borrowers and lenders. This document must comply with federal and state laws regarding consumer lending, ensuring that borrowers receive all necessary information to make informed decisions. When properly executed, the disclosure statement serves as a binding agreement between the borrower and SSS, outlining the rights and responsibilities of both parties. It is crucial for borrowers to retain a copy of this document for their records.

Examples of Using the SSS Disclosure Statement on Loan Credit Transaction

Examples of using the SSS disclosure statement on loan credit transactions can vary based on individual circumstances. For instance, a borrower seeking a loan for home improvement would review the disclosure statement to understand the interest rates and repayment terms before proceeding. Another example includes a borrower who may wish to compare different loan offers; having the SSS disclosure statement allows them to evaluate the financial implications effectively. These examples illustrate the importance of the disclosure statement in guiding borrowers through their loan decisions.

Quick guide on how to complete sss disclosure statement on loan credit transaction

Affordably Prepare Sss Disclosure Statement On Loan Credit Transaction on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents swiftly without interruptions. Handle Sss Disclosure Statement On Loan Credit Transaction on any platform using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

Effortlessly Modify and Electronically Sign Sss Disclosure Statement On Loan Credit Transaction

- Locate Sss Disclosure Statement On Loan Credit Transaction and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Verify all the details and then click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs within a few clicks from any device of your choice. Alter and electronically sign Sss Disclosure Statement On Loan Credit Transaction while ensuring outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sss disclosure statement on loan credit transaction

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a disclosure statement on a loan SSS?

A disclosure statement on a loan SSS provides borrowers with important information about the terms and conditions of their loans. It outlines details such as interest rates, fees, and repayment schedules. Understanding how to get a disclosure statement on loan SSS is crucial for making informed financial decisions.

-

How can I obtain a disclosure statement on my loan SSS?

To get a disclosure statement on loan SSS, you should contact your lending institution directly. Most lenders provide this information upon request. Additionally, you can often find it in your online banking portal or loan documentation.

-

What information is included in a loan SSS disclosure statement?

A loan SSS disclosure statement typically includes your loan amount, interest rate, payment schedule, and any applicable fees. It is designed to give borrowers a transparent view of the financial responsibilities associated with their loan. Knowing how to get a disclosure statement on loan SSS ensures you understand these critical details.

-

Are there any fees associated with obtaining a loan SSS disclosure statement?

Generally, there are no fees for obtaining a disclosure statement on a loan SSS, as it is part of the loan documentation provided by the lender. However, it is advisable to check with your lender to confirm any potential charges. Understanding how to get a disclosure statement on loan SSS can help you avoid unexpected costs.

-

Can airSlate SignNow help me with obtaining disclosure statements?

Yes, airSlate SignNow can streamline the process of obtaining and managing your disclosure statements on loans. By using our electronic signing and document management features, you can easily request and store necessary loan documents. Learn how to get a disclosure statement on loan SSS efficiently with airSlate SignNow.

-

What are the benefits of having a disclosure statement on a loan SSS?

Having a disclosure statement on a loan SSS helps you understand your financial obligations, ensuring you are fully informed before proceeding with a loan. It can also protect you from hidden fees and unexpected terms. Knowing how to get a disclosure statement on loan SSS is essential for any borrower seeking transparency.

-

How does airSlate SignNow's integration help in document management for loans?

airSlate SignNow integrates with various platforms to simplify document management, including loan disclosure statements. These integrations allow for seamless data transfer and secure storage of your important documents. Learning how to get a disclosure statement on loan SSS can be enhanced through our efficient tools.

Get more for Sss Disclosure Statement On Loan Credit Transaction

Find out other Sss Disclosure Statement On Loan Credit Transaction

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors