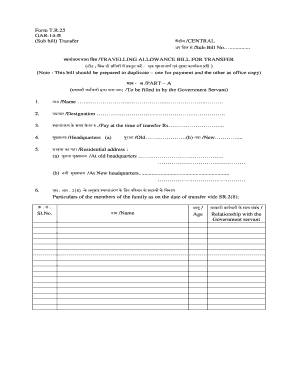

Tr 25 Form

What is the TR 25 Form

The TR 25 form is a document utilized primarily for tax purposes in the United States. It is often associated with specific reporting requirements for various tax situations. This form is essential for individuals and businesses to accurately report their financial activities to the IRS. Understanding the TR 25 form is crucial for ensuring compliance with tax regulations and avoiding potential penalties.

How to Use the TR 25 Form

Using the TR 25 form involves several key steps. First, gather all necessary financial information, including income, deductions, and any relevant supporting documents. Next, fill out the form accurately, ensuring that all required fields are completed. Once the form is filled out, review it for any errors or omissions. After confirming its accuracy, submit the form to the appropriate tax authority by the specified deadline.

Steps to Complete the TR 25 Form

Completing the TR 25 form requires careful attention to detail. Follow these steps for successful completion:

- Collect all relevant financial documents, such as W-2s, 1099s, and receipts.

- Begin filling out the form by entering your personal information, including your name, address, and Social Security number.

- Input your income details, ensuring you report all sources accurately.

- Include any deductions or credits you are eligible for, as these can significantly impact your tax liability.

- Double-check all entries for accuracy before finalizing the form.

- Submit the completed form by the deadline, either electronically or via mail, as per the IRS guidelines.

Legal Use of the TR 25 Form

The TR 25 form is legally binding when filled out and submitted according to IRS regulations. To ensure its legal standing, it is essential to follow all instructions provided with the form. This includes adhering to deadlines and providing accurate information. Failure to comply with these requirements can lead to penalties or legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the TR 25 form vary based on individual circumstances, such as whether you are filing as an individual or a business entity. Typically, the deadline aligns with the annual tax filing date, which is April 15 for most taxpayers. It is important to stay informed about any changes to these dates, as late submissions can incur penalties.

Required Documents

When preparing to complete the TR 25 form, certain documents are necessary to ensure accurate reporting. Required documents may include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Previous year’s tax return for reference

Having these documents on hand will streamline the completion process and help prevent errors.

Quick guide on how to complete tr 25 form

Complete Tr 25 Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your files quickly and without delays. Manage Tr 25 Form across any platform using the airSlate SignNow Android or iOS applications and streamline any document-based process today.

How to modify and eSign Tr 25 Form with ease

- Obtain Tr 25 Form and select Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Tr 25 Form and secure exceptional communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tr 25 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the TR 25 form, and why do I need it?

The TR 25 form is a crucial document required for certain transactions, ensuring compliance and accuracy. airSlate SignNow makes it easy to fill out and eSign the TR 25 form, streamlining your processes and reducing the chance of errors.

-

How does airSlate SignNow help with the TR 25 form?

airSlate SignNow offers a user-friendly platform that simplifies the completion and signing of the TR 25 form. You can quickly upload, fill out, and send the form for signatures, saving time and increasing productivity.

-

What are the pricing options for using airSlate SignNow for the TR 25 form?

airSlate SignNow provides flexible pricing plans tailored for various business sizes and needs. You can access features to manage the TR 25 form at competitive rates, helping you find an option that fits your budget.

-

Can I integrate airSlate SignNow with other tools for the TR 25 form process?

Yes, airSlate SignNow offers seamless integrations with popular applications, enhancing your workflow for processing the TR 25 form. You can easily connect with tools like Google Drive, Dropbox, and more to ensure your documents are always accessible.

-

What benefits does airSlate SignNow provide for the TR 25 form?

Using airSlate SignNow for the TR 25 form gives you numerous benefits, including faster turnaround times and improved team collaboration. Additionally, eSigning ensures that documents are legally binding while maintaining security.

-

Is it secure to eSign the TR 25 form with airSlate SignNow?

Absolutely! airSlate SignNow uses industry-leading security measures, including encryption, to protect your sensitive data when signing the TR 25 form. Trust that your documents are safe and comply with legal standards.

-

How can I track the status of my TR 25 form with airSlate SignNow?

AirSlate SignNow offers real-time tracking updates for your TR 25 form. You can easily monitor when it’s opened, signed, or completed, giving you peace of mind throughout the process.

Get more for Tr 25 Form

Find out other Tr 25 Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple