Oregon Lodging Tax Quarterly Return 3rd Quarter 150 604 002 3 Oregon Form

What is the Oregon Lodging Tax Quarterly Return 3rd Quarter 150 604 002 3 Oregon

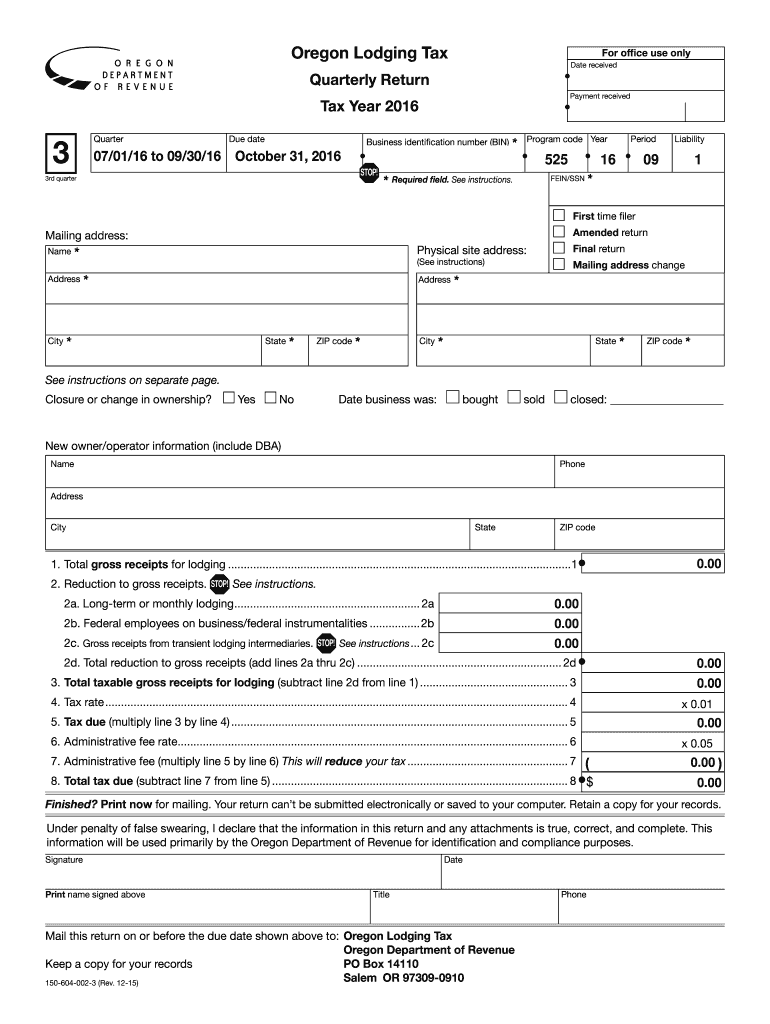

The Oregon Lodging Tax Quarterly Return 3rd Quarter 150 604 002 3 Oregon is a tax form that lodging providers in Oregon must complete to report and remit lodging taxes collected during the third quarter of the year. This form is essential for compliance with state tax regulations, ensuring that businesses contribute their fair share to local and state revenues. The form captures details about the total lodging revenue, the amount of tax collected, and any deductions that may apply. Accurate completion of this form is crucial for avoiding penalties and ensuring that the funds are properly allocated to local services.

Steps to complete the Oregon Lodging Tax Quarterly Return 3rd Quarter 150 604 002 3 Oregon

Completing the Oregon Lodging Tax Quarterly Return involves several key steps:

- Gather all relevant financial records, including receipts and sales reports for the third quarter.

- Calculate the total lodging revenue for the quarter.

- Determine the amount of lodging tax collected based on the applicable tax rate.

- Fill out the form accurately, ensuring all sections are completed, including any required signatures.

- Review the completed form for accuracy before submission.

Following these steps helps ensure compliance and reduces the risk of errors that could lead to penalties.

Legal use of the Oregon Lodging Tax Quarterly Return 3rd Quarter 150 604 002 3 Oregon

The Oregon Lodging Tax Quarterly Return is legally recognized as a valid document for tax reporting purposes. To be considered legally binding, the form must be filled out correctly and submitted by the deadline established by the state. Electronic signatures may be used, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant regulations. It is essential for lodging providers to maintain records of submitted forms and any correspondence with tax authorities to support their compliance efforts.

Filing Deadlines / Important Dates

Timely submission of the Oregon Lodging Tax Quarterly Return is crucial for compliance. The filing deadline for the third quarter typically falls on the last day of the month following the end of the quarter. For example, the deadline for the third quarter, which covers July through September, is usually October 31. It is important to stay informed about any changes to deadlines or requirements that may arise, as these can vary from year to year.

Form Submission Methods (Online / Mail / In-Person)

The Oregon Lodging Tax Quarterly Return can be submitted through various methods, providing flexibility for lodging providers. Options typically include:

- Online submission through the Oregon Department of Revenue’s secure portal.

- Mailing a paper copy of the completed form to the appropriate tax authority address.

- In-person submission at designated tax offices, if applicable.

Choosing the right submission method can help ensure that your form is processed efficiently and securely.

Penalties for Non-Compliance

Failure to file the Oregon Lodging Tax Quarterly Return on time or inaccuracies in the form can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for lodging providers to understand the implications of non-compliance and to take proactive steps to ensure timely and accurate submissions. Regularly reviewing tax obligations and maintaining organized records can help mitigate these risks.

Quick guide on how to complete oregon lodging tax quarterly return 3rd quarter 150 604 002 3 oregon

Complete Oregon Lodging Tax Quarterly Return 3rd Quarter 150 604 002 3 Oregon effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and store it securely online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without any delays. Manage Oregon Lodging Tax Quarterly Return 3rd Quarter 150 604 002 3 Oregon on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign Oregon Lodging Tax Quarterly Return 3rd Quarter 150 604 002 3 Oregon with ease

- Obtain Oregon Lodging Tax Quarterly Return 3rd Quarter 150 604 002 3 Oregon and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal authority as a traditional wet ink signature.

- Review all the information and click on the Done button to save your updates.

- Select how you'd like to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Stop worrying about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Oregon Lodging Tax Quarterly Return 3rd Quarter 150 604 002 3 Oregon and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oregon lodging tax quarterly return 3rd quarter 150 604 002 3 oregon

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oregon Lodging Tax Quarterly Return 3rd Quarter 150 604 002 3 Oregon?

The Oregon Lodging Tax Quarterly Return 3rd Quarter 150 604 002 3 Oregon is a specific tax form required by the state for lodging providers to report lodging taxes collected for the third quarter. This form ensures compliance with state regulations and facilitates accurate tax reporting. Understanding this form is crucial for business owners in the lodging industry in Oregon.

-

How can airSlate SignNow help with filing the Oregon Lodging Tax Quarterly Return 3rd Quarter 150 604 002 3 Oregon?

airSlate SignNow simplifies the process of preparing and submitting the Oregon Lodging Tax Quarterly Return 3rd Quarter 150 604 002 3 Oregon by allowing users to eSign and send documents securely. With our platform, you can manage your tax forms efficiently, ensuring timely submissions without hassle. This helps prevent potential fines due to late or incorrect filings.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow provides features such as eSignature capabilities, document templates, and secure cloud storage, making it ideal for managing documents like the Oregon Lodging Tax Quarterly Return 3rd Quarter 150 604 002 3 Oregon. These tools enhance efficiency and accuracy while ensuring compliance. Additionally, our user-friendly interface makes document handling straightforward for all users.

-

Is there a cost associated with using airSlate SignNow for the Oregon Lodging Tax Quarterly Return 3rd Quarter 150 604 002 3 Oregon?

Yes, airSlate SignNow offers a variety of pricing plans tailored to different needs. Our solutions are cost-effective and designed to help businesses efficiently handle documents like the Oregon Lodging Tax Quarterly Return 3rd Quarter 150 604 002 3 Oregon. By utilizing our platform, you can save time and resources compared to traditional methods.

-

Can I integrate airSlate SignNow with other software for my Oregon Lodging Tax Quarterly Return 3rd Quarter 150 604 002 3 Oregon?

Absolutely! airSlate SignNow offers integrations with various accounting and management software, making it easier to streamline your processes. This allows for better alignment when preparing the Oregon Lodging Tax Quarterly Return 3rd Quarter 150 604 002 3 Oregon and managing financial records. Integration can enhance workflow efficiency and reduce errors.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management offers several benefits, including enhanced security, ease of use, and efficient workflow. Specifically for the Oregon Lodging Tax Quarterly Return 3rd Quarter 150 604 002 3 Oregon, you will experience faster preparation and submission times. Furthermore, our platform is designed to help you stay organized and compliant with tax regulations.

-

How does airSlate SignNow ensure the security of my Oregon Lodging Tax Quarterly Return 3rd Quarter 150 604 002 3 Oregon documents?

airSlate SignNow employs robust security measures, including encryption and secure cloud storage, to protect documents like the Oregon Lodging Tax Quarterly Return 3rd Quarter 150 604 002 3 Oregon. Our commitment to protecting your sensitive data means you can confidently manage your tax documents with us. Security protocols ensure that your information is accessible only to authorized individuals.

Get more for Oregon Lodging Tax Quarterly Return 3rd Quarter 150 604 002 3 Oregon

Find out other Oregon Lodging Tax Quarterly Return 3rd Quarter 150 604 002 3 Oregon

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template