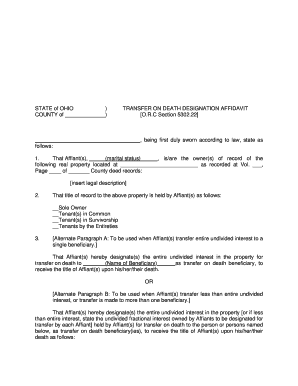

Tod Deed Images Form

What is the transfer on death deed form?

The transfer on death deed form, often referred to as a TOD deed, is a legal document that allows an individual to transfer property to a designated beneficiary upon their death. This form is particularly useful in estate planning, as it enables property owners in Texas to bypass the probate process, ensuring a smoother transition of assets. The TOD deed becomes effective only upon the death of the property owner, allowing them to retain full control of the property during their lifetime.

Key elements of the transfer on death deed form

Several critical elements must be included in the transfer on death deed form for it to be valid in Texas:

- Property Description: A clear and accurate description of the property being transferred.

- Beneficiary Designation: The name and details of the individual or entity that will receive the property upon the owner's death.

- Signature of the Owner: The property owner must sign the document in the presence of a notary public.

- Date of Execution: The date when the deed is signed and notarized.

Steps to complete the transfer on death deed form

Completing the transfer on death deed form involves several steps to ensure it is executed correctly:

- Obtain the Form: Download the state of Texas transfer on death deed form from a reliable source.

- Fill Out the Form: Provide all necessary information, including property details and beneficiary information.

- Sign the Form: Sign the document in front of a notary public to validate it.

- File the Form: Submit the completed form to the county clerk’s office where the property is located.

Legal use of the transfer on death deed form

The transfer on death deed form is legally binding in Texas, provided it meets all statutory requirements. It is essential to ensure that the form is properly executed and recorded to avoid any disputes regarding the transfer of property after the owner's death. The form must be filed with the county clerk's office to be effective, and it cannot be revoked or altered once it has been recorded without following specific legal procedures.

Who issues the transfer on death deed form?

The transfer on death deed form is not issued by a specific agency but is a standardized document that can be obtained from various legal resources, including state government websites, legal aid organizations, and estate planning professionals. It is important to ensure that the version used complies with Texas state laws and regulations.

Examples of using the transfer on death deed form

Common scenarios for utilizing a transfer on death deed form include:

- Transferring a family home to children upon the parent's death.

- Designating a partner as the beneficiary of a jointly owned property.

- Ensuring that a business property passes directly to a specified heir without going through probate.

Required documents for the transfer on death deed form

To complete the transfer on death deed form, the following documents may be required:

- Proof of ownership of the property, such as a deed or title.

- Identification for the property owner and the beneficiary.

- Any existing wills or estate planning documents that may affect the transfer.

Quick guide on how to complete tod deed images

Easily prepare Tod Deed Images on any device

Internet document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly solution to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to quickly create, modify, and eSign your documents without delays. Manage Tod Deed Images on any platform using airSlate SignNow apps for Android or iOS, and enhance any document-related process today.

The easiest method to modify and eSign Tod Deed Images effortlessly

- Locate Tod Deed Images and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight relevant sections of your documents or obscure sensitive information with tools specially provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all information and click the Done button to confirm your modifications.

- Select your delivery method for the form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from your chosen device. Modify and eSign Tod Deed Images and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tod deed images

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a printable transfer on death deed form Texas?

A printable transfer on death deed form Texas is a legal document that allows a property owner to designate a beneficiary who will inherit the property upon their death, avoiding probate. This form is essential for property owners seeking a simple and effective way to transfer their assets and ensure that their loved ones receive their property without complications.

-

Where can I obtain a printable transfer on death deed form Texas?

You can easily obtain a printable transfer on death deed form Texas through our airSlate SignNow platform, which provides user-friendly legal document templates. Additionally, this form can usually be found on state government websites or legal resources that specialize in estate planning documentation.

-

How much does a printable transfer on death deed form Texas cost?

The cost of obtaining a printable transfer on death deed form Texas through airSlate SignNow is budget-friendly and designed to provide value with our subscription plans. You may also find free downloadable versions online, but ensure they meet Texas legal standards for validity.

-

Can I customize a printable transfer on death deed form Texas?

Yes, you can customize a printable transfer on death deed form Texas using airSlate SignNow's online tools. Our platform allows you to fill in specific details and make necessary adjustments to the form, ensuring it fits your unique estate planning needs.

-

What are the benefits of using a printable transfer on death deed form Texas?

Using a printable transfer on death deed form Texas simplifies the inheritance process, allows for easy asset transfer without probate, and helps ensure that your wishes are followed after your passing. It's a straightforward solution that can save time and legal expenses for your beneficiaries.

-

Is the printable transfer on death deed form Texas legally binding?

Yes, when completed correctly and filed according to Texas law, a printable transfer on death deed form Texas is legally binding. It must be recorded with the county clerk's office where the property is located, which ensures the document is recognized by the state.

-

Can I eSign my printable transfer on death deed form Texas?

Absolutely! With airSlate SignNow, you can easily eSign your printable transfer on death deed form Texas. This feature ensures that your document is signed securely and efficiently, allowing you to complete the process digitally from anywhere.

Get more for Tod Deed Images

- Publication 3598 rev 11 what you should know about the audit reconsideration process form

- Annual income tax returns form 1120 pol

- Publication 5354 rev 3 criminal tax bulletin form

- Schedule k 1 form 8865 partners share of income iucat

- Instructions for form 945 internal revenue service

- Form schedule r f 990 schedule r f 990 related

- What to know about form 4562 depreciation and

- R6140 823credit utilization formpursuant to th

Find out other Tod Deed Images

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form