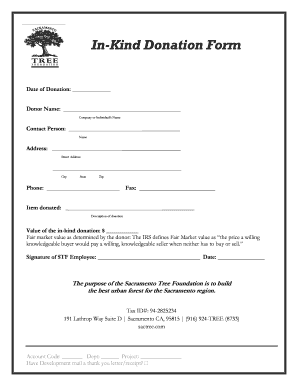

In Kind Donation Form

What is the In Kind Donation Form

The in kind donation form is a document used to record non-cash contributions made to a charitable organization. These contributions can include goods, services, or other tangible items that hold value. This form serves as a formal acknowledgment of the donation, detailing what was given, its estimated value, and the donor's information. By completing this form, donors can ensure that their contributions are recognized for tax purposes and that the receiving organization can properly account for the donation.

How to use the In Kind Donation Form

Using the in kind donation form involves several steps to ensure that all necessary information is accurately captured. First, the donor must fill out their personal details, including name, address, and contact information. Next, the form requires a description of the donated items or services, along with their estimated value. Donors should also include the date of the donation and any relevant signatures. Once completed, the form can be submitted to the organization receiving the donation, providing them with the necessary documentation for their records.

Steps to complete the In Kind Donation Form

Completing the in kind donation form involves the following steps:

- Gather necessary information, including donor details and item descriptions.

- Estimate the fair market value of the donated items or services.

- Fill out the form with accurate and complete information.

- Sign and date the form to validate the donation.

- Submit the form to the receiving organization, either online or in person.

Legal use of the In Kind Donation Form

The in kind donation form is legally binding when it meets specific criteria. For it to be recognized in the United States, it must include accurate details about the donation and be signed by both the donor and the recipient organization. Compliance with IRS guidelines is essential for tax deduction purposes. Additionally, the form should be retained by both parties for record-keeping and potential audits. This ensures that the donation is documented properly and can be verified if necessary.

Key elements of the In Kind Donation Form

Several key elements must be included in the in kind donation form to ensure its effectiveness and legality:

- Donor Information: Name, address, and contact details of the donor.

- Recipient Organization: Name and address of the organization receiving the donation.

- Description of Items: Detailed description of the donated goods or services.

- Estimated Value: Fair market value of the items being donated.

- Date of Donation: The date on which the donation is made.

- Signatures: Signatures of both the donor and an authorized representative of the organization.

IRS Guidelines

The IRS provides specific guidelines regarding in kind donations, which are essential for donors seeking tax deductions. Donors must ensure that the value of the donated items is accurately assessed, as this will impact their tax filings. For donations exceeding a certain value, the IRS may require additional documentation, such as an appraisal. It is important for donors to keep a copy of the in kind donation form for their records, as this will serve as proof of the contribution when filing taxes.

Quick guide on how to complete in kind donation form

Complete In Kind Donation Form with ease on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can acquire the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without any hold-ups. Handle In Kind Donation Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to adjust and eSign In Kind Donation Form effortlessly

- Find In Kind Donation Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with features that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which only takes a few seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, monotonous form browsing, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device. Update and eSign In Kind Donation Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the in kind donation form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an in kind donation form template?

An in kind donation form template is a document that allows organizations to formally acknowledge and record non-monetary contributions. This template helps streamline the donation process by providing a clear structure for detailing the items or services donated. By using an in kind donation form template, businesses can ensure proper documentation and facilitate transparency in their donation records.

-

How do I use an in kind donation form template with airSlate SignNow?

Using an in kind donation form template with airSlate SignNow is straightforward. You can easily customize the template to fit your organization’s needs, add it to your documents, and send it for eSigning. This allows for a seamless and efficient process for both the donor and recipient.

-

Is the in kind donation form template customizable?

Yes, the in kind donation form template is highly customizable. With airSlate SignNow, you can edit fields, add your logo, and modify text to align with your organization's branding and specific requirements. This ensures that the template meets your needs while maintaining a professional appearance.

-

What are the benefits of using an in kind donation form template?

Using an in kind donation form template streamlines the documentation process and ensures that all necessary information is captured. It promotes better organization and record-keeping, which can be beneficial during audits or for tax purposes. Additionally, it enhances the professionalism of your organization in the eyes of donors.

-

Can I integrate the in kind donation form template with other tools?

Absolutely! airSlate SignNow allows for seamless integrations with various business tools and platforms. You can easily connect your in kind donation form template to CRM systems, accounting software, and more, facilitating a smooth workflow and data management for your organization.

-

Is there a cost associated with using the in kind donation form template?

airSlate SignNow offers competitive pricing plans that include access to customizable templates, including the in kind donation form template. Depending on your organization's needs, you can choose a plan that suits your budget while enjoying all the features and benefits provided by the service.

-

Can multiple users access the in kind donation form template?

Yes, airSlate SignNow supports multi-user access, allowing different members of your organization to utilize the in kind donation form template. This feature enhances collaboration, enabling teams to work together in managing donations effectively and efficiently.

Get more for In Kind Donation Form

- Delegation authority form

- Disability verification for students with psychiatric conditions formdocx ecological economics 69 2010 2060 2068

- Calorie counter pdf form

- Community service submission form log for ongoing volunteer westga

- Georgia tb skin test form

- Planning form blank

- Crowne plaza credit card authorization form

- Uw oshkosh transcript request form

Find out other In Kind Donation Form

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy