Form 01 922

What is the Form 01 922

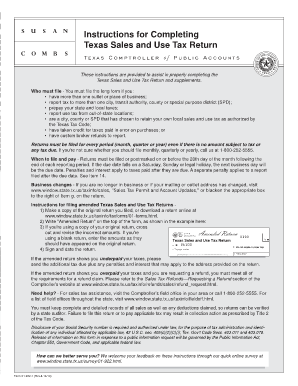

The Form 01 922 is the Texas Sales and Use Tax Return form, which businesses in Texas use to report and pay sales and use taxes. This form is essential for compliance with state tax regulations, enabling businesses to accurately report their taxable sales and purchases. The form captures various details, including total sales, exempt sales, and the amount of tax owed. Understanding this form is crucial for any business operating in Texas to ensure proper tax reporting and avoid penalties.

How to use the Form 01 922

Using the Form 01 922 involves several steps to ensure accurate completion and submission. First, gather all necessary sales records, including invoices and receipts, to accurately report taxable and exempt sales. Next, fill out the form by entering the total sales amount, any exempt sales, and calculating the tax due based on the current tax rate. After completing the form, review it for accuracy before submission. The form can be filed electronically or submitted by mail, depending on the preference of the business.

Steps to complete the Form 01 922

Completing the Form 01 922 requires attention to detail. Follow these steps for accurate completion:

- Gather all relevant sales data, including total sales and exempt sales.

- Enter the total sales amount in the designated section of the form.

- Report any exempt sales separately to ensure compliance.

- Calculate the total tax owed based on the applicable sales tax rate.

- Review all entries for accuracy and completeness.

- Submit the form electronically through the Texas Comptroller's website or mail it to the appropriate address.

Legal use of the Form 01 922

The legal use of the Form 01 922 is governed by Texas state tax laws. Businesses must ensure that the information provided on the form is truthful and accurate to avoid legal repercussions. Filing the form correctly and on time is essential, as inaccuracies or late submissions can result in penalties. Additionally, businesses must retain copies of the form and supporting documents for record-keeping and potential audits.

Filing Deadlines / Important Dates

Filing deadlines for the Form 01 922 are crucial for maintaining compliance with Texas tax regulations. Generally, the form is due on the 20th day of the month following the reporting period. For example, for sales made in January, the form must be filed by February 20. Businesses should mark their calendars for these deadlines to avoid late fees and penalties associated with non-compliance.

Form Submission Methods (Online / Mail / In-Person)

The Form 01 922 can be submitted through various methods, providing flexibility for businesses. The primary submission methods include:

- Online: Businesses can file the form electronically through the Texas Comptroller's website, which is often the fastest and most efficient method.

- Mail: The completed form can be printed and mailed to the appropriate address provided by the Texas Comptroller.

- In-Person: Some businesses may choose to submit the form in person at local Comptroller offices, although this method is less common.

Quick guide on how to complete form 01 922 100263524

Complete Form 01 922 effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow offers you all the tools you need to create, edit, and eSign your documents quickly and without delays. Manage Form 01 922 on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign Form 01 922 with ease

- Obtain Form 01 922 and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your updates.

- Choose how you want to send your form, either by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 01 922 to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 01 922 100263524

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 922 and how can airSlate SignNow help with it?

Form 922 is a document used for specific administrative processes. airSlate SignNow streamlines the management of form 922 by allowing users to easily create, send, and eSign the document electronically, ensuring compliance and efficiency.

-

How does pricing for airSlate SignNow work if I need to manage form 922?

airSlate SignNow offers various pricing plans that fit different business needs. Pricing typically includes features to manage documents like form 922 effectively, ensuring you only pay for the functionality you require.

-

Are there any advanced features in airSlate SignNow for managing form 922?

Yes, airSlate SignNow includes advanced features such as document templates, automated workflows, and secure cloud storage specifically for managing form 922. These features enhance productivity and ensure that your documents are always accessible and ready for signature.

-

Can I integrate airSlate SignNow with other tools while working with form 922?

Absolutely! airSlate SignNow supports integration with various tools and platforms, allowing you to manage form 922 seamlessly within your existing workflow. This integration enhances collaboration and document management for better efficiency.

-

What benefits does airSlate SignNow offer when using form 922?

Using airSlate SignNow for form 922 offers numerous benefits, including reduced turnaround time, improved accuracy, and enhanced security. The platform helps ensure that your documents are signed quickly and securely, so you can focus on your core business activities.

-

Is airSlate SignNow user-friendly for completing form 922?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to complete form 922. The intuitive interface guides users through the process of creating and eSigning documents, even for those who may not be tech-savvy.

-

What types of businesses can benefit from using form 922 with airSlate SignNow?

Various types of businesses, from small startups to large corporations, can benefit from using form 922 with airSlate SignNow. Its versatility and efficiency make it an ideal solution for any organization that needs to manage important documents.

Get more for Form 01 922

- Methods in eye research form

- Securing applications zenk security form

- Trihealth pavilion membership cost form

- Accentra credit union direct deposit form

- Attached supplier self certification form alcon

- Deed contract template form

- Deferred payment contract template form

- Deed of termination contract template form

Find out other Form 01 922

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself