M1pr Form

What is the M1PR Form

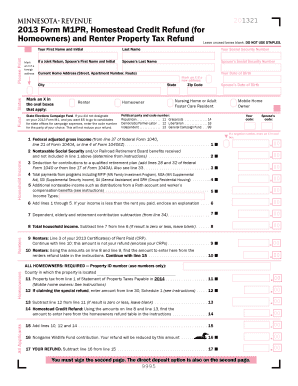

The M1PR form is a Minnesota state tax form specifically designed for individuals claiming a property tax refund. This form is essential for residents who have paid property taxes on their homestead and meet certain income eligibility criteria. The M1PR form allows taxpayers to report their income and property tax information to determine the refund amount they may be entitled to receive.

How to Use the M1PR Form

Using the M1PR form involves several steps to ensure accurate completion and submission. First, gather all necessary documents, including your property tax statement and income information. Next, fill out the form by providing your personal details, property information, and income details. It is crucial to follow the instructions carefully to avoid errors that could delay your refund. Once completed, you can submit the form either online or by mail, depending on your preference.

Steps to Complete the M1PR Form

Completing the M1PR form requires careful attention to detail. Here are the steps to follow:

- Obtain the M1PR form from the Minnesota Department of Revenue website or a local tax office.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about your property, including the address and the amount of property taxes paid.

- Report your total income from all sources for the year.

- Calculate your property tax refund using the provided tables and instructions.

- Review the form for accuracy before submission.

Legal Use of the M1PR Form

The M1PR form is legally binding when completed correctly and submitted in accordance with Minnesota tax laws. To ensure its validity, taxpayers must provide accurate information and adhere to the filing deadlines. The form must be signed and dated by the taxpayer, confirming that the information provided is true and complete. Failure to comply with these legal requirements may result in penalties or denial of the refund.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the M1PR form to ensure timely processing of your property tax refund. Generally, the deadline for submitting the M1PR form is August 15 of the year following the tax year in question. For example, for property taxes paid in 2022, the form must be submitted by August 15, 2023. Taxpayers should also keep an eye on any updates or changes to deadlines announced by the Minnesota Department of Revenue.

Form Submission Methods

The M1PR form can be submitted through various methods, providing flexibility for taxpayers. You can choose to file online through the Minnesota Department of Revenue’s e-Services portal, which offers a convenient and efficient way to submit your form. Alternatively, you can print the completed form and mail it to the appropriate address provided in the instructions. In-person submissions may also be possible at local tax offices, depending on their policies.

Quick guide on how to complete m1pr form 31556747

Complete M1pr Form effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage M1pr Form on any device using the airSlate SignNow Android or iOS apps and enhance any document-based workflow today.

How to modify and eSign M1pr Form with ease

- Locate M1pr Form and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow has specifically designed for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign M1pr Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the m1pr form 31556747

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the m1pr form and how is it used?

The m1pr form is a specific document used for reporting various financial activities. In the context of airSlate SignNow, users can easily create, send, and eSign this form, ensuring compliance and record-keeping. It's designed to streamline the documentation process and make your reporting more efficient.

-

How can airSlate SignNow help manage the m1pr form electronically?

AirSlate SignNow provides a user-friendly platform to manage the m1pr form electronically. You can complete, send, and track this form electronically, reducing paperwork and improving turnaround time. The eSigning process ensures that all parties can sign securely from anywhere.

-

Is there a cost associated with using the m1pr form through airSlate SignNow?

Yes, there are affordable pricing plans on airSlate SignNow that include the use of the m1pr form. Various subscription options cater to different business needs, ensuring that you can find a plan that fits your budget. This cost-effective solution helps businesses save on both time and resources.

-

What features are available for the m1pr form on airSlate SignNow?

AirSlate SignNow offers various features for managing the m1pr form, including customizable templates, secure eSigning, and automated workflows. Users can easily create forms, collaborate with others, and track the status of submissions. These features signNowly enhance productivity and document management.

-

Can I integrate airSlate SignNow with other applications for the m1pr form?

Absolutely! AirSlate SignNow allows seamless integration with numerous applications which can streamline the usage of the m1pr form. Integrations with platforms like Google Drive, Salesforce, and others enable efficient data transfer and workflow automation, enhancing your overall productivity.

-

What are the benefits of using the m1pr form with airSlate SignNow?

Using the m1pr form with airSlate SignNow offers numerous benefits, including enhanced security, improved efficiency, and reduced processing time. The electronic format ensures compliance and easy access to important documents, while eSigning capabilities simplify the approval process. Overall, it empowers businesses to manage their forms more effectively.

-

How secure is my data when using the m1pr form on airSlate SignNow?

Data security is a top priority at airSlate SignNow, especially when handling sensitive documents like the m1pr form. The platform employs advanced encryption protocols and complies with industry standards to keep your information safe. You can trust that your data is secure throughout its lifecycle.

Get more for M1pr Form

- Certified payroll report pdf office of the nevada labor form

- Nevada state contractors board of address form

- Secured hazard information form nevada division of minerals minerals state nv

- Suggested form nevada division of minerals nevada affidavit minerals state nv

- Ir 016 affidavit for release of estates under 20000 form

- Nevada form self certification

- Pre sentencing report template form

- Ndot form 725 right of way occupancy permit form

Find out other M1pr Form

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple