Ca Loan Brokerage Agreement Form

What is the CA Loan Brokerage Agreement

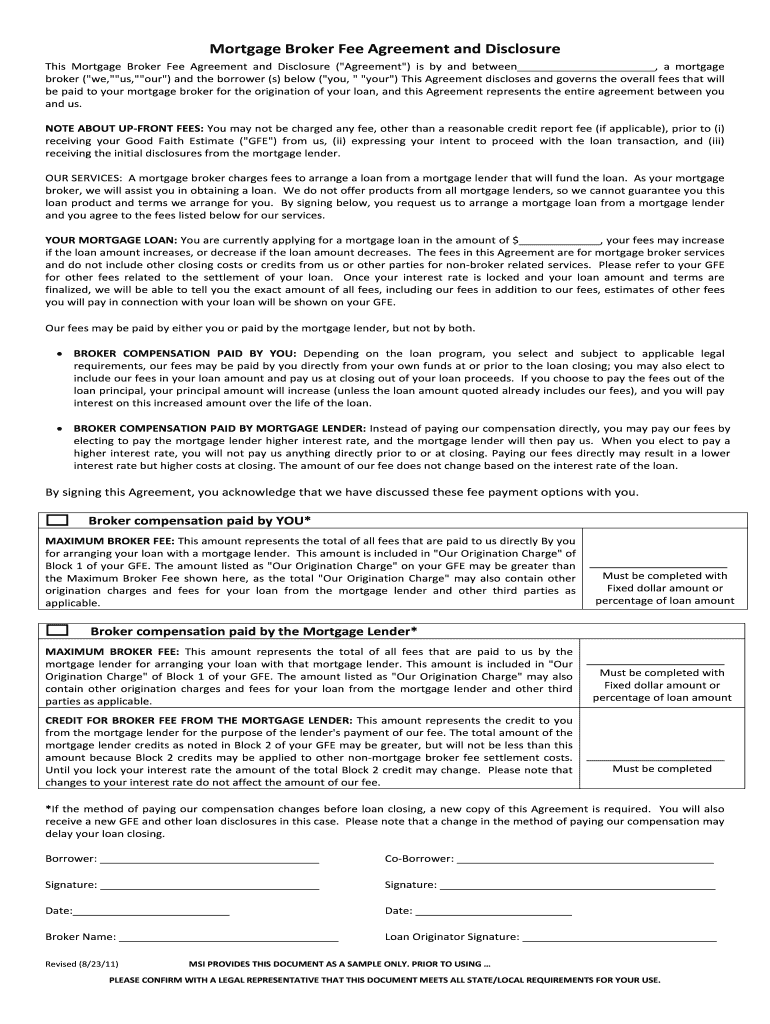

The CA loan brokerage agreement is a legal document that outlines the terms and conditions under which a loan broker operates in California. This agreement serves as a contract between the broker and the borrower, detailing the broker's responsibilities, fees, and the services provided. It is essential for establishing a clear understanding of the relationship between the parties involved, ensuring compliance with state regulations, and protecting the interests of both the borrower and the broker.

Key Elements of the CA Loan Brokerage Agreement

A comprehensive CA loan brokerage agreement typically includes several critical components:

- Broker Information: Details about the loan broker, including name, address, and licensing information.

- Borrower Information: Identification of the borrower, including personal details and financial background.

- Terms of Service: A clear outline of the services the broker will provide, such as loan sourcing, negotiation, and application assistance.

- Fees and Compensation: Information regarding the broker's fees, including how and when they are paid, as well as any potential additional costs.

- Duration of Agreement: The time frame during which the agreement is valid and the conditions for termination.

- Compliance Clauses: Statements ensuring adherence to relevant laws and regulations governing loan brokerage in California.

Steps to Complete the CA Loan Brokerage Agreement

Completing the CA loan brokerage agreement involves several steps to ensure accuracy and compliance:

- Gather Necessary Information: Collect all required personal and financial information from both the borrower and the broker.

- Draft the Agreement: Use a template or legal guidance to draft the agreement, ensuring all key elements are included.

- Review the Document: Both parties should review the agreement thoroughly to ensure clarity and understanding of all terms.

- Sign the Agreement: Utilize a secure eSignature platform to sign the document digitally, ensuring it meets legal standards.

- Distribute Copies: Provide copies of the signed agreement to all parties involved for their records.

Legal Use of the CA Loan Brokerage Agreement

The CA loan brokerage agreement is legally binding when executed correctly. To ensure its legality, it must meet specific requirements:

- Proper Signatures: Signatures must be obtained from all parties involved, preferably using a secure eSignature solution.

- Compliance with State Laws: The agreement must adhere to California state regulations governing loan brokerage practices.

- Clear Terms: All terms and conditions should be clearly defined to avoid misunderstandings and disputes.

How to Use the CA Loan Brokerage Agreement

The CA loan brokerage agreement is used primarily in the context of securing loans. Here’s how it can be effectively utilized:

- Loan Application Process: The agreement outlines the broker's role in assisting the borrower through the application process.

- Negotiation of Terms: It provides a framework for the broker to negotiate loan terms on behalf of the borrower.

- Fee Structure Transparency: The agreement clarifies the fee structure, ensuring borrowers understand the costs involved.

Obtaining the CA Loan Brokerage Agreement

To obtain a CA loan brokerage agreement, individuals can follow these steps:

- Consult Legal Resources: Seek legal advice or use templates available through reputable legal websites.

- Contact a Loan Broker: Engage with a licensed loan broker who can provide a customized agreement based on specific needs.

- Utilize Digital Tools: Consider using digital platforms that offer templates and eSigning capabilities to streamline the process.

Quick guide on how to complete ca loan brokerage agreement

Complete Ca Loan Brokerage Agreement effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can obtain the correct format and securely store it online. airSlate SignNow provides all the tools you require to generate, modify, and eSign your documents swiftly and without hindrances. Handle Ca Loan Brokerage Agreement on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

The simplest method to modify and eSign Ca Loan Brokerage Agreement with ease

- Locate Ca Loan Brokerage Agreement and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information using features that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign tool, which only takes moments and carries the same legal validity as a traditional handwritten signature.

- Review all the information carefully and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to missing or lost files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Ca Loan Brokerage Agreement while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ca loan brokerage agreement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CA loan brokerage agreement?

A CA loan brokerage agreement is a legal document that outlines the relationship between a loan broker and their clients in California. This agreement specifies the services provided, fees, and the rights and responsibilities of both parties regarding the loan process.

-

Why do I need a CA loan brokerage agreement?

Having a CA loan brokerage agreement is crucial as it protects your interests during the loan brokerage process. It establishes clear terms and conditions, ensuring transparency and accountability from the broker while guiding you through securing the best loan options available.

-

How much does a CA loan brokerage agreement cost?

The cost of a CA loan brokerage agreement can vary depending on the broker and specific services provided. Typically, fees could be a flat rate or a percentage of the loan amount, so it’s important to review the agreement thoroughly to understand all associated costs.

-

What features should I look for in a CA loan brokerage agreement?

When reviewing a CA loan brokerage agreement, look for features such as detailed terms of service, transparency in fees, representations about the broker's qualifications, and clear outlines of the loan process. These elements ensure you are well-informed and protected throughout your lending journey.

-

What are the benefits of using a CA loan brokerage agreement with airSlate SignNow?

Using airSlate SignNow for your CA loan brokerage agreement offers benefits like streamlined document management and secure electronic signing. This simplifies the process, reduces the time required for transactions, and keeps your agreements organized and easily accessible.

-

Can I customize my CA loan brokerage agreement?

Yes, you can customize your CA loan brokerage agreement to fit your specific needs. It's advisable to work with a legal professional to ensure that all crucial aspects are covered while ensuring the agreement complies with California regulations.

-

Is airSlate SignNow compatible with other tools for managing a CA loan brokerage agreement?

airSlate SignNow integrates seamlessly with various business tools, enhancing the management of your CA loan brokerage agreement. Whether you use CRM systems or cloud storage solutions, these integrations ensure that all aspects of your agreement are synchronized and easily manageable.

Get more for Ca Loan Brokerage Agreement

Find out other Ca Loan Brokerage Agreement

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement