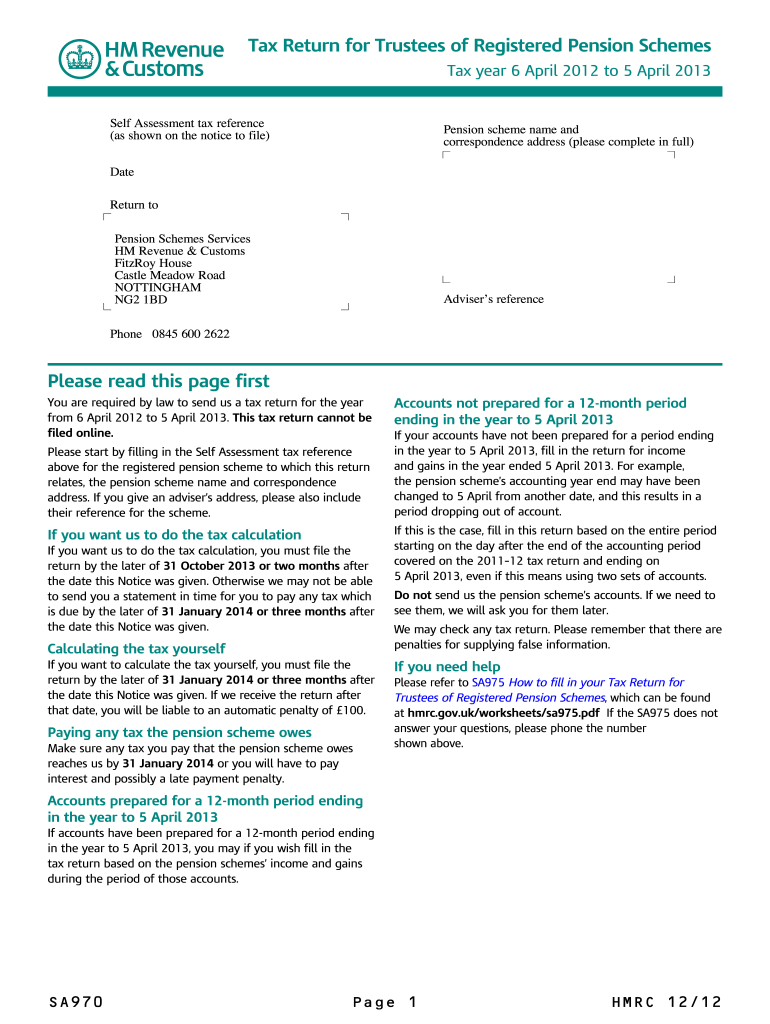

Tax Return for Trustees of Registered Pension Schemes Use Form SA970 to File Your Tax Return for the Tax Year Ende 2012

Understanding the Tax Return for Trustees of Registered Pension Schemes

The Tax Return for Trustees of Registered Pension Schemes is a specific document required for reporting income and expenses related to pension schemes. This form, known as SA970, is essential for trustees to ensure compliance with tax regulations. It captures necessary financial information, allowing the Internal Revenue Service (IRS) to assess the tax obligations of the pension scheme accurately. Understanding the purpose and requirements of this form is crucial for trustees to avoid penalties and ensure proper management of pension funds.

Steps to Complete the Tax Return Using Form SA970

Completing the Tax Return for Trustees of Registered Pension Schemes using Form SA970 involves several key steps:

- Gather all necessary financial documents, including income statements, expense reports, and prior tax returns.

- Carefully fill out each section of the form, ensuring that all information is accurate and complete.

- Double-check the entries for any errors or omissions that could lead to complications.

- Sign the form electronically or by hand, depending on your submission method.

- Submit the completed form by the designated deadline to avoid late fees or penalties.

Required Documents for Filing the Tax Return

When preparing to file the Tax Return for Trustees of Registered Pension Schemes, specific documents are essential to ensure a smooth process:

- Financial statements detailing income and expenditures related to the pension scheme.

- Documentation of any contributions made to the pension fund during the tax year.

- Records of distributions made to beneficiaries, if applicable.

- Any prior correspondence with the IRS regarding the pension scheme.

Filing Deadlines for Form SA970

Timely submission of the Tax Return for Trustees of Registered Pension Schemes is crucial. The IRS typically sets specific deadlines for filing, which may vary based on the tax year. Generally, the deadline for submitting Form SA970 aligns with the annual tax return deadline. It is advisable to check the IRS website or consult with a tax professional for the exact dates to avoid penalties.

Penalties for Non-Compliance with Tax Return Requirements

Failure to comply with the requirements for filing the Tax Return for Trustees of Registered Pension Schemes can result in significant penalties. These may include:

- Monetary fines for late submissions or inaccuracies in reported information.

- Potential audits by the IRS, leading to further scrutiny of the pension scheme's financial activities.

- Legal consequences for trustees who fail to meet their fiduciary responsibilities.

Digital Submission Methods for Form SA970

Trustees can choose from various submission methods for the Tax Return for Trustees of Registered Pension Schemes. Digital submission is often preferred due to its convenience. Options include:

- Filing electronically through the IRS e-file system, which allows for quicker processing.

- Using certified tax software that supports Form SA970 to ensure compliance and accuracy.

- Submitting a paper form via mail, although this method may take longer for processing.

Quick guide on how to complete tax return for trustees of registered pension schemes 2013 use form sa9702013 to file your tax return for the tax year ended 5

A brief manual on how to create your Tax Return For Trustees Of Registered Pension Schemes Use Form SA970 To File Your Tax Return For The Tax Year Ende

Finding the right template can be difficult when you need to submit official foreign paperwork. Even if you possess the necessary form, quickly filling it out according to all the specifications can be cumbersome if you rely on printed versions instead of handling it electronically. airSlate SignNow is the online electronic signature platform that aids you in overcoming these hurdles. It enables you to obtain your Tax Return For Trustees Of Registered Pension Schemes Use Form SA970 To File Your Tax Return For The Tax Year Ende and efficiently fill it out and sign it on-site without the need to reprint documents in case of typing errors.

Here are the procedures you should follow to create your Tax Return For Trustees Of Registered Pension Schemes Use Form SA970 To File Your Tax Return For The Tax Year Ende using airSlate SignNow:

- Press the Get Form button to bring your document into our editor instantly.

- Begin with the first empty field, enter your information, and proceed with the Next function.

- Complete the blank spaces using the Cross and Check tools from the toolbar above.

- Select the Highlight or Line options to emphasize the crucial details.

- Click on Image to upload one if your Tax Return For Trustees Of Registered Pension Schemes Use Form SA970 To File Your Tax Return For The Tax Year Ende requires it.

- Utilize the right-side panel to add additional fields for you or others to fill in if needed.

- Review your responses and confirm the form by clicking Date, Initials, and Sign.

- Sketch, type, upload your eSignature, or capture it using a camera or QR code.

- Conclude the editing process by clicking the Done button and choosing your file-sharing preferences.

Once your Tax Return For Trustees Of Registered Pension Schemes Use Form SA970 To File Your Tax Return For The Tax Year Ende is ready, you can distribute it in your preferred manner - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely store all your completed documentation in your account, neatly arranged in folders according to your liking. Don’t spend unnecessary time on manual form filling; try airSlate SignNow!

Create this form in 5 minutes or less

Find and fill out the correct tax return for trustees of registered pension schemes 2013 use form sa9702013 to file your tax return for the tax year ended 5

Create this form in 5 minutes!

How to create an eSignature for the tax return for trustees of registered pension schemes 2013 use form sa9702013 to file your tax return for the tax year ended 5

How to make an electronic signature for your Tax Return For Trustees Of Registered Pension Schemes 2013 Use Form Sa9702013 To File Your Tax Return For The Tax Year Ended 5 in the online mode

How to generate an eSignature for the Tax Return For Trustees Of Registered Pension Schemes 2013 Use Form Sa9702013 To File Your Tax Return For The Tax Year Ended 5 in Chrome

How to make an electronic signature for signing the Tax Return For Trustees Of Registered Pension Schemes 2013 Use Form Sa9702013 To File Your Tax Return For The Tax Year Ended 5 in Gmail

How to generate an eSignature for the Tax Return For Trustees Of Registered Pension Schemes 2013 Use Form Sa9702013 To File Your Tax Return For The Tax Year Ended 5 right from your smart phone

How to make an eSignature for the Tax Return For Trustees Of Registered Pension Schemes 2013 Use Form Sa9702013 To File Your Tax Return For The Tax Year Ended 5 on iOS devices

How to make an electronic signature for the Tax Return For Trustees Of Registered Pension Schemes 2013 Use Form Sa9702013 To File Your Tax Return For The Tax Year Ended 5 on Android OS

People also ask

-

What is the process for filing a Tax Return For Trustees Of Registered Pension Schemes using Form SA970?

To file a Tax Return For Trustees Of Registered Pension Schemes, you must complete Form SA970 for the tax year end. The form requires specific details about the pension scheme's income and expenditure. Once completed, you can submit it electronically or by post, ensuring all information is accurate to avoid delays.

-

How does airSlate SignNow assist in filing a Tax Return For Trustees Of Registered Pension Schemes?

airSlate SignNow simplifies the process of filing a Tax Return For Trustees Of Registered Pension Schemes by allowing you to easily eSign and send documents securely. Our platform ensures that all necessary forms, including Form SA970, are easily accessible and can be completed and signed online, saving you time and effort.

-

Are there any costs associated with using airSlate SignNow for my Tax Return For Trustees Of Registered Pension Schemes?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, making it a cost-effective solution for filing your Tax Return For Trustees Of Registered Pension Schemes. Each plan includes features that enhance document management and eSigning, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for managing my Tax Return For Trustees Of Registered Pension Schemes?

airSlate SignNow provides features such as document templates, real-time tracking, and secure storage, which are essential for managing your Tax Return For Trustees Of Registered Pension Schemes. These tools help streamline the filing process, ensuring you can complete Form SA970 efficiently and accurately.

-

Can I integrate airSlate SignNow with other software for my Tax Return For Trustees Of Registered Pension Schemes?

Absolutely! airSlate SignNow offers integrations with various accounting and financial software, allowing you to seamlessly manage your Tax Return For Trustees Of Registered Pension Schemes. This means you can easily pull in necessary data and documents, making the filing process with Form SA970 even more efficient.

-

What are the benefits of using airSlate SignNow for eSigning my Tax Return For Trustees Of Registered Pension Schemes?

Using airSlate SignNow for eSigning your Tax Return For Trustees Of Registered Pension Schemes provides unmatched convenience and security. You can sign documents from anywhere, reduce paper usage, and ensure compliance with legal standards, all while using Form SA970 for your tax return.

-

Is my information secure when filing a Tax Return For Trustees Of Registered Pension Schemes with airSlate SignNow?

Yes, your information is highly secure when using airSlate SignNow to file your Tax Return For Trustees Of Registered Pension Schemes. We implement robust security measures, including encryption and secure access protocols, to protect your sensitive data while you complete Form SA970.

Get more for Tax Return For Trustees Of Registered Pension Schemes Use Form SA970 To File Your Tax Return For The Tax Year Ende

- After receiving appropriate documentation of the cost of materials and labor form

- Yes no if yes describe judgment form

- This catalogue should be compared to the pre lease catalogue at the expiration or termination of form

- All notices required or deemed necessary by the parties shall be written and shall be deemed form

- In consideration of this guaranty lessor has agreed to grant or agreed to continue without form

- The floors skylights and windows that reflect or admit light into any place in the building shall not be covered or obstructed form

- Lease severance and amendment agreement form

- Landlord may sue assignor under the assigned lease agreement for damages including form

Find out other Tax Return For Trustees Of Registered Pension Schemes Use Form SA970 To File Your Tax Return For The Tax Year Ende

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors