Fin 579 Form

What is the Fin 579 Form

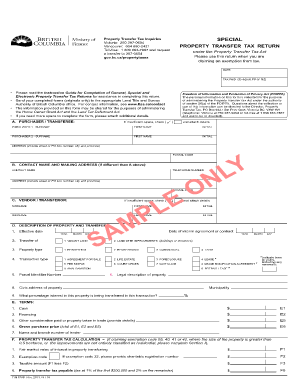

The Fin 579 form, also known as the Fin 579 property tax return, is a crucial document used in the United States for reporting property transfer taxes. This form is typically required when a property changes ownership, ensuring that the appropriate taxes are assessed and collected by local authorities. It serves as a formal declaration of the transaction and provides essential information about the property, including its value and the parties involved in the transfer.

Steps to Complete the Fin 579 Form

Completing the Fin 579 form involves several key steps to ensure accuracy and compliance with legal requirements. Begin by gathering necessary information, such as the property's legal description, the names of the buyer and seller, and the sale price. Next, accurately fill out all sections of the form, ensuring that no details are omitted. After completing the form, review it for any errors or missing information. Finally, submit the form according to your local jurisdiction's guidelines, which may include online submission, mailing, or in-person delivery.

Legal Use of the Fin 579 Form

The Fin 579 form is legally binding when filled out and submitted correctly. To ensure its validity, it must comply with relevant state laws and regulations regarding property transfers. This includes providing accurate information and adhering to deadlines for submission. The use of electronic signatures is permissible, provided that the eSignature solution meets the requirements set forth by the ESIGN and UETA acts. This legal framework ensures that digital submissions are recognized as valid and enforceable.

Required Documents

When completing the Fin 579 form, certain documents are typically required to support the information provided. These may include the property deed, proof of sale or purchase agreement, and any relevant identification for the parties involved. Additionally, if applicable, documentation related to any exemptions or deductions should be included. Ensuring that all required documents accompany the Fin 579 form can facilitate a smoother processing experience.

Form Submission Methods

The Fin 579 form can be submitted through various methods, depending on the requirements of the local jurisdiction. Common submission methods include:

- Online Submission: Many jurisdictions allow electronic filing through designated platforms.

- Mail: The form can often be printed and mailed to the appropriate tax office.

- In-Person: Some individuals may choose to submit the form directly at their local tax office.

It is essential to verify the preferred submission method with local authorities to ensure compliance with their specific procedures.

Examples of Using the Fin 579 Form

The Fin 579 form is commonly used in various scenarios involving property transfers. For instance, when a homeowner sells their property, the seller must complete the Fin 579 form to report the transfer to local tax authorities. Additionally, if a property is inherited, the heirs may need to file the Fin 579 form to document the change in ownership and assess any applicable taxes. Understanding these examples can help individuals recognize when the form is necessary.

Quick guide on how to complete fin 579 form

Complete Fin 579 Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Fin 579 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest method to modify and eSign Fin 579 Form without any hassle

- Locate Fin 579 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to confirm your changes.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Fin 579 Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fin 579 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the fin 579 form?

The fin 579 form is a crucial document used for various financial reporting and compliance purposes. It allows businesses to report specific financial information accurately, making it essential for transparency and legality. Using airSlate SignNow to eSign this document streamlines the process and ensures that submissions are timely and secure.

-

How does airSlate SignNow facilitate the completion of the fin 579 form?

airSlate SignNow provides an intuitive platform that allows users to easily fill out and eSign the fin 579 form. By utilizing templates and automation features, businesses can efficiently manage their document workflows. This not only saves time but also reduces the likelihood of errors in important financial documentation.

-

What are the pricing options for using airSlate SignNow to manage the fin 579 form?

airSlate SignNow offers various pricing plans tailored to meet different business needs, all while ensuring efficient management of documents like the fin 579 form. Plans range from basic to advanced features, providing options for teams of varying sizes. Each plan is designed to be cost-effective, ensuring you get great value for your investment.

-

Can the fin 579 form be integrated with other software through airSlate SignNow?

Yes, airSlate SignNow allows seamless integrations with various software applications, making it easy to manage the fin 579 form alongside your existing tools. This ensures that data flows smoothly between systems, enhancing overall productivity. Integration simplifies your workflow, allowing you to focus more on critical tasks rather than document management.

-

What are the benefits of using airSlate SignNow for the fin 579 form?

Using airSlate SignNow for the fin 579 form brings numerous benefits, including enhanced efficiency, improved accuracy, and secure document handling. The platform's user-friendly interface makes electronic signing and document tracking straightforward. Additionally, it helps ensure compliance with industry standards, safeguarding your business against potential legal issues.

-

Is airSlate SignNow secure for handling sensitive documents like the fin 579 form?

Absolutely. airSlate SignNow prioritizes security, utilizing advanced encryption and compliance measures to protect sensitive documents like the fin 579 form. Your data is secure throughout the signing process, ensuring that only authorized personnel have access. This gives businesses peace of mind when managing important financial information.

-

How can I track the status of my fin 579 form using airSlate SignNow?

airSlate SignNow provides excellent tracking features that allow you to monitor the status of your fin 579 form in real-time. You can see when the document is viewed, signed, or requires additional action from others. This feature offers transparency and helps you manage deadlines effectively, ensuring timely completion of necessary paperwork.

Get more for Fin 579 Form

- Capf 52 1 civil air patrol form

- Blank field trip form

- Boston mutual beneficiary change formpdf mark iii brokerage

- Science fair judging form k 2

- Science fair feedback sheet form

- Concert response form

- Scavenger hunt realidades 1 teacher pages form

- Multidimensional pain readiness to change questionnaire pdf form

Find out other Fin 579 Form

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online