Alabama Inheritance Tax Waiver Form 1999

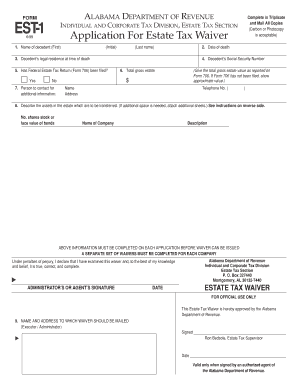

What is the Alabama Inheritance Tax Waiver Form

The Alabama inheritance tax waiver form is a legal document used to facilitate the transfer of assets from a deceased individual to their heirs without the burden of inheritance tax. This form is essential for individuals who wish to claim their inheritance while ensuring compliance with state tax laws. The waiver serves as a declaration that the heirs will not be subject to inheritance taxes, thus streamlining the process of asset distribution.

How to Use the Alabama Inheritance Tax Waiver Form

Using the Alabama inheritance tax waiver form involves several steps to ensure proper completion and submission. First, gather all necessary information about the deceased, including their full name, date of death, and details about the estate. Next, fill out the form accurately, providing all required information about the heirs and the assets involved. Once completed, the form must be signed by the relevant parties, which may include the executor of the estate and the heirs. Finally, submit the form to the appropriate state tax authority to finalize the waiver process.

Steps to Complete the Alabama Inheritance Tax Waiver Form

Completing the Alabama inheritance tax waiver form requires careful attention to detail. Begin by downloading the form from the official state website or obtaining a physical copy. Follow these steps:

- Enter the deceased's full name and date of death.

- List all heirs and their relationship to the deceased.

- Provide a detailed description of the assets being transferred.

- Ensure all required signatures are obtained.

- Review the form for accuracy before submission.

After filling out the form, it should be submitted to the appropriate tax authority, either online or via mail.

Legal Use of the Alabama Inheritance Tax Waiver Form

The legal use of the Alabama inheritance tax waiver form is crucial for ensuring that the transfer of assets complies with state laws. This form must be executed in accordance with Alabama's inheritance tax regulations. It is important to ensure that all information provided is accurate and truthful. Failing to comply with legal requirements can lead to penalties or delays in the distribution of assets. Proper legal counsel may be beneficial to navigate any complexities involved in the process.

Required Documents

To successfully complete the Alabama inheritance tax waiver form, certain documents are required. These include:

- A certified copy of the deceased's death certificate.

- Documentation of the deceased's assets, such as property deeds or bank statements.

- Identification for all heirs involved in the process.

- Any previous tax returns related to the estate, if applicable.

Having these documents ready will facilitate a smoother completion of the form and ensure compliance with state regulations.

Form Submission Methods

The Alabama inheritance tax waiver form can be submitted using various methods. Heirs may choose to submit the form online through the state tax authority's website, ensuring a quicker processing time. Alternatively, the form can be mailed to the appropriate office or delivered in person. Each method has its own processing times, so it is advisable to consider the urgency of the matter when selecting a submission method.

Quick guide on how to complete alabama inheritance tax waiver form

Accomplish Alabama Inheritance Tax Waiver Form seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-conscious alternative to conventional printed and signed documents, enabling you to locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Alabama Inheritance Tax Waiver Form on any device with airSlate SignNow Android or iOS applications and enhance any document-oriented workflow today.

The easiest method to modify and eSign Alabama Inheritance Tax Waiver Form effortlessly

- Find Alabama Inheritance Tax Waiver Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Alabama Inheritance Tax Waiver Form and guarantee outstanding communication at every step of the document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alabama inheritance tax waiver form

Create this form in 5 minutes!

How to create an eSignature for the alabama inheritance tax waiver form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the inheritance tax in Alabama?

The inheritance tax in Alabama was abolished in 2000, meaning there is no state-level inheritance tax imposed on heirs or beneficiaries. However, it's essential to stay updated on any potential changes in legislation regarding inheritance tax in Alabama. If you have specific concerns, consulting with a tax professional is recommended for personalized advice.

-

How can airSlate SignNow help with estate planning related to inheritance tax in Alabama?

AirSlate SignNow provides a user-friendly platform for creating and signing essential documents for estate planning. While there is no inheritance tax in Alabama, it's crucial to have proper documentation in place for asset transfers. Utilizing our services can streamline the process and ensure that everything is executed efficiently and without delay.

-

What features does airSlate SignNow offer for document management?

AirSlate SignNow offers a variety of features designed for efficient document management, including eSignature capabilities, templates, and secure storage. These features ensure that all documents related to inheritance planning are handled securely and can be easily accessed when needed. This makes it simpler for businesses to manage documents without worrying about inheritance tax in Alabama affecting the process.

-

Are there any costs associated with using airSlate SignNow for managing inheritance documents?

AirSlate SignNow offers a range of pricing plans, including a free trial, to accommodate various budget needs for managing documents related to inheritance planning. This cost-effective solution ensures that you can efficiently handle all necessary paperwork without the burden of extra fees related to inheritance tax in Alabama. Explore our plans to find the best fit for your requirements.

-

Can I integrate airSlate SignNow with other software tools?

Yes, airSlate SignNow can be integrated with many software tools, including CRM platforms and cloud storage services. This integration capability ensures that you can effectively manage documents associated with inheritance planning without hassle. Although inheritance tax in Alabama is not an issue, having effective integrations can simplify the management of all estate-related documents.

-

What are the benefits of using airSlate SignNow for document eSigning?

Using airSlate SignNow for document eSigning comes with several benefits, such as increased efficiency, reduced turnaround time, and enhanced security. With no inheritance tax in Alabama to contend with, you can focus on completing the signing process quickly and securely. This can be especially valuable when dealing with important estate planning documents.

-

Is airSlate SignNow legally compliant for managing estate documents?

Yes, airSlate SignNow is legally compliant with eSignature laws, ensuring that all documents, including those related to inheritance planning, are recognized as legally binding. This provides peace of mind that your documents will hold up in legal settings, without the complications of inheritance tax in Alabama to worry about. Always ensure you're using compliant practices for any type of document management.

Get more for Alabama Inheritance Tax Waiver Form

- Form 42 2014 2019

- Pag ibig members data form

- Us probation office monthly supervision report form

- Overton security com application form

- Tss application form

- Continued claim form edd

- Northern tool credit application form

- Wells fargo fha pre foreclosure sale addendum pfsa wells fargo fha pre foreclosure sale addendum pfsa form

Find out other Alabama Inheritance Tax Waiver Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT