Alabama Inheritance Tax Waiver Form 2014

What is the Alabama Inheritance Tax Waiver Form

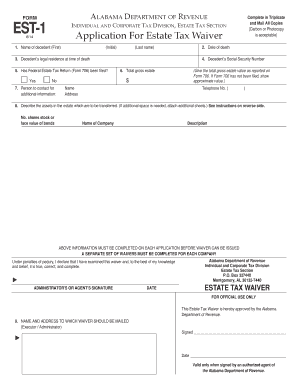

The Alabama inheritance tax waiver form is a legal document that allows heirs or beneficiaries to waive their right to inherit property or assets subject to Alabama's inheritance tax. This form is essential for individuals who wish to simplify the estate settlement process and ensure that the estate can be distributed without the burden of inheritance tax obligations. It serves as an official declaration that the signer understands the implications of waiving their inheritance rights and agrees to the terms set forth in the document.

How to use the Alabama Inheritance Tax Waiver Form

Using the Alabama inheritance tax waiver form involves several key steps. First, it is crucial to fill out the form accurately, ensuring that all required information is provided. This includes details about the deceased, the heirs, and the specific assets being waived. Once completed, the form must be signed and dated by the heirs involved. It is advisable to consult with a legal professional to confirm that the form meets all necessary legal requirements and to understand any potential tax implications associated with waiving inheritance.

Steps to complete the Alabama Inheritance Tax Waiver Form

Completing the Alabama inheritance tax waiver form requires careful attention to detail. Here are the steps to follow:

- Obtain the latest version of the Alabama inheritance tax waiver form from a reliable source.

- Fill in the personal information of the deceased, including their full name and date of death.

- List the names and addresses of all heirs or beneficiaries who are waiving their rights.

- Clearly specify the assets or property being waived.

- Each heir must sign and date the form to validate their consent.

- Review the completed form for accuracy before submission.

Key elements of the Alabama Inheritance Tax Waiver Form

The Alabama inheritance tax waiver form includes several key elements that must be addressed for it to be valid. These elements typically include:

- Identification of the deceased: Full name, date of death, and any relevant estate identification numbers.

- Heir information: Names and addresses of all heirs waiving their inheritance rights.

- Asset description: Detailed information about the property or assets being waived.

- Signatures: Required signatures of all heirs, indicating their agreement to waive their rights.

- Date: The date on which the form is signed, which is crucial for legal documentation.

Legal use of the Alabama Inheritance Tax Waiver Form

The legal use of the Alabama inheritance tax waiver form is critical for ensuring compliance with state laws regarding inheritance tax. This form must be executed properly to be considered valid in the eyes of the law. It is important to follow all state-specific regulations when using this form, including ensuring that it is signed by all necessary parties and submitted to the appropriate authorities. Failure to comply with these legal requirements may result in complications in the estate settlement process.

Filing Deadlines / Important Dates

Filing deadlines for the Alabama inheritance tax waiver form are crucial for timely estate administration. Generally, the form should be filed as soon as possible after the death of the individual to ensure that the estate can be settled without unnecessary delays. Specific deadlines may vary based on the circumstances of the estate and any applicable state laws. It is advisable to consult with a legal professional to determine the exact deadlines relevant to your situation and ensure compliance.

Quick guide on how to complete alabama inheritance tax waiver form 397739915

Prepare Alabama Inheritance Tax Waiver Form effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly option to conventional printed and signed documents, allowing you to access the right format and securely keep it online. airSlate SignNow equips you with the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Alabama Inheritance Tax Waiver Form on any device using the airSlate SignNow applications for Android or iOS and enhance any document-focused process today.

The easiest method to modify and electronically sign Alabama Inheritance Tax Waiver Form effortlessly

- Find Alabama Inheritance Tax Waiver Form and click on Get Form to initiate the process.

- Utilize the features we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, monotonous form navigation, or mistakes that necessitate printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Alabama Inheritance Tax Waiver Form to ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alabama inheritance tax waiver form 397739915

Create this form in 5 minutes!

How to create an eSignature for the alabama inheritance tax waiver form 397739915

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Alabama inheritance tax waiver form?

The Alabama inheritance tax waiver form is a document required to release a decedent's estate from potential inheritance tax liabilities. It must be completed and filed to prove that inheritance taxes have either been paid or are not applicable. Understanding this form is essential for the proper administration of an estate in Alabama.

-

How can I obtain the Alabama inheritance tax waiver form?

You can obtain the Alabama inheritance tax waiver form through the Alabama Department of Revenue's website or your local probate court. Additionally, airSlate SignNow simplifies this process by allowing you to easily eSign and send the completed form online, streamlining your estate management.

-

What are the benefits of using airSlate SignNow for the Alabama inheritance tax waiver form?

Using airSlate SignNow for the Alabama inheritance tax waiver form allows for a quicker and more efficient document signing experience. You can securely eSign the form within minutes, track its status, and ensure that your documents are processed timely. This not only saves you time but also provides peace of mind knowing your forms are handled securely.

-

Are there any fees associated with using airSlate SignNow for the Alabama inheritance tax waiver form?

Yes, there may be fees associated with using airSlate SignNow, which offers various pricing plans depending on your needs. However, the costs are generally affordable compared to traditional methods of document handling. Investing in a digital solution can save you time and enhance your efficiency when managing the Alabama inheritance tax waiver form.

-

Can I integrate airSlate SignNow with other applications while handling the Alabama inheritance tax waiver form?

Absolutely! airSlate SignNow offers a range of integrations with popular applications, enhancing your workflow when working with the Alabama inheritance tax waiver form. Whether you're using document management systems or CRM tools, these integrations can optimize your document processes and improve overall productivity.

-

What features does airSlate SignNow provide for managing the Alabama inheritance tax waiver form?

airSlate SignNow provides features such as eSigning, document templates, automated workflows, and secure storage that are ideal for managing the Alabama inheritance tax waiver form. These tools ensure that your documents are completed efficiently and securely. Additionally, the platform offers real-time collaboration, making it easy to involve multiple parties when necessary.

-

Is airSlate SignNow secure for handling sensitive documents like the Alabama inheritance tax waiver form?

Yes, airSlate SignNow prioritizes security by employing advanced encryption protocols and strict compliance with industry standards. This ensures that sensitive documents, including the Alabama inheritance tax waiver form, are protected from unauthorized access. You can confidently manage your estate documents knowing they are secure.

Get more for Alabama Inheritance Tax Waiver Form

Find out other Alabama Inheritance Tax Waiver Form

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself