Alabama St Ex A1 Form

What is the Alabama St Ex A1

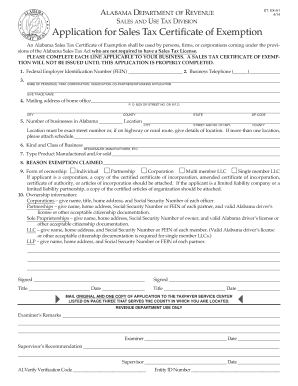

The Alabama St Ex A1 form is a sales tax exemption certificate used by businesses and individuals in Alabama to claim exemption from sales tax on certain purchases. This form is particularly relevant for organizations that qualify for tax-exempt status, such as non-profits, educational institutions, and government entities. By submitting the St Ex A1, the purchaser certifies that the items or services acquired are intended for a tax-exempt purpose, thereby avoiding sales tax charges.

How to use the Alabama St Ex A1

To effectively use the Alabama St Ex A1 form, the user must complete it accurately and provide the necessary information. This includes the name and address of the purchaser, the seller's information, and a detailed description of the items being purchased. After filling out the form, it should be presented to the seller at the time of purchase. The seller retains the form for their records, ensuring compliance with Alabama tax regulations.

Steps to complete the Alabama St Ex A1

Completing the Alabama St Ex A1 involves several straightforward steps:

- Begin by entering the purchaser's name and address in the designated fields.

- Provide the seller's name and address to establish the transaction context.

- Clearly describe the items or services being purchased, ensuring they qualify for tax exemption.

- Indicate the reason for the exemption, which must align with acceptable categories under Alabama law.

- Sign and date the form to validate the information provided.

Legal use of the Alabama St Ex A1

The legal use of the Alabama St Ex A1 form is governed by state tax laws. To be valid, the form must be completed in accordance with Alabama's sales tax exemption criteria. This includes ensuring that the purchaser is indeed eligible for tax exemption and that the items purchased fall under the exempt categories. Misuse of the form can result in penalties, including fines and retroactive tax assessments.

Key elements of the Alabama St Ex A1

Several key elements are essential for the Alabama St Ex A1 form to be considered valid:

- Purchaser Information: Accurate details about the purchaser, including their legal name and address.

- Seller Information: The name and address of the seller involved in the transaction.

- Description of Goods: A thorough description of the items or services being purchased, which must qualify for exemption.

- Exemption Reason: A clear indication of the reason for claiming the exemption, aligned with state regulations.

- Signature: The form must be signed by an authorized representative of the purchaser.

Examples of using the Alabama St Ex A1

Common scenarios for using the Alabama St Ex A1 include:

- A non-profit organization purchasing supplies for an event.

- A school acquiring educational materials for classroom use.

- A government agency procuring equipment for public services.

In each case, the purchaser must ensure that the items or services meet the criteria for tax exemption as outlined by Alabama law.

Quick guide on how to complete alabama st ex a1

Prepare Alabama St Ex A1 effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers a perfect environmentally-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Handle Alabama St Ex A1 on any system with the airSlate SignNow apps for Android or iOS, and simplify any document-related task today.

How to modify and eSign Alabama St Ex A1 effortlessly

- Find Alabama St Ex A1 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which only takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your updates.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, frustrating form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Alabama St Ex A1 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the alabama st ex a1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is st ex a1 se and how does it relate to airSlate SignNow?

St ex a1 se refers to a unique electronic signature method enabled by airSlate SignNow. This feature allows businesses to sign documents securely and efficiently, ensuring compliance with legal standards. By incorporating st ex a1 se, users can streamline their workflows and improve document turnaround times.

-

How much does airSlate SignNow cost for st ex a1 se services?

The pricing for airSlate SignNow varies depending on the plan chosen, but it offers competitive rates for st ex a1 se services. Users can select from monthly or annual subscriptions, making it accessible for businesses of all sizes. Each plan includes essential features, ensuring value while leveraging the st ex a1 se capabilities.

-

What features does airSlate SignNow offer with st ex a1 se?

AirSlate SignNow provides a range of features with st ex a1 se, including customizable templates, in-person signing, and advanced security measures. The platform also supports integration with popular applications, enhancing its functionality. Users can easily manage their documents and signatures all in one place.

-

How does the st ex a1 se benefit my business's document workflow?

Implementing st ex a1 se through airSlate SignNow signNowly accelerates your document workflow. The eSigning process is quick and secure, allowing for real-time tracking and management. This leads to faster approvals and ultimately enhances productivity within your team.

-

Are there any integrations available for st ex a1 se in airSlate SignNow?

Yes, airSlate SignNow offers numerous integrations for st ex a1 se with popular tools and platforms like Google Workspace, Salesforce, and Microsoft Office. This allows users to seamlessly connect their existing workflows and enhance document management. Integrations contribute to a more cohesive user experience.

-

Is airSlate SignNow compliant with electronic signature laws using st ex a1 se?

Absolutely! airSlate SignNow ensures that all st ex a1 se processes comply with electronic signature laws such as E-Sign and UETA. This compliance gives businesses the confidence to use electronic signatures legally and securely. All signed documents maintain integrity and can be used in legal contexts.

-

Can I customize my documents with st ex a1 se in airSlate SignNow?

Yes, one of the key advantages of using airSlate SignNow with st ex a1 se is the ability to customize documents. Users can add fields, logos, and instructions to fit their branding. This level of customization helps in creating a professional presentation for every document.

Get more for Alabama St Ex A1

Find out other Alabama St Ex A1

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement