Pa 40 C Form

What is the PA 40 C?

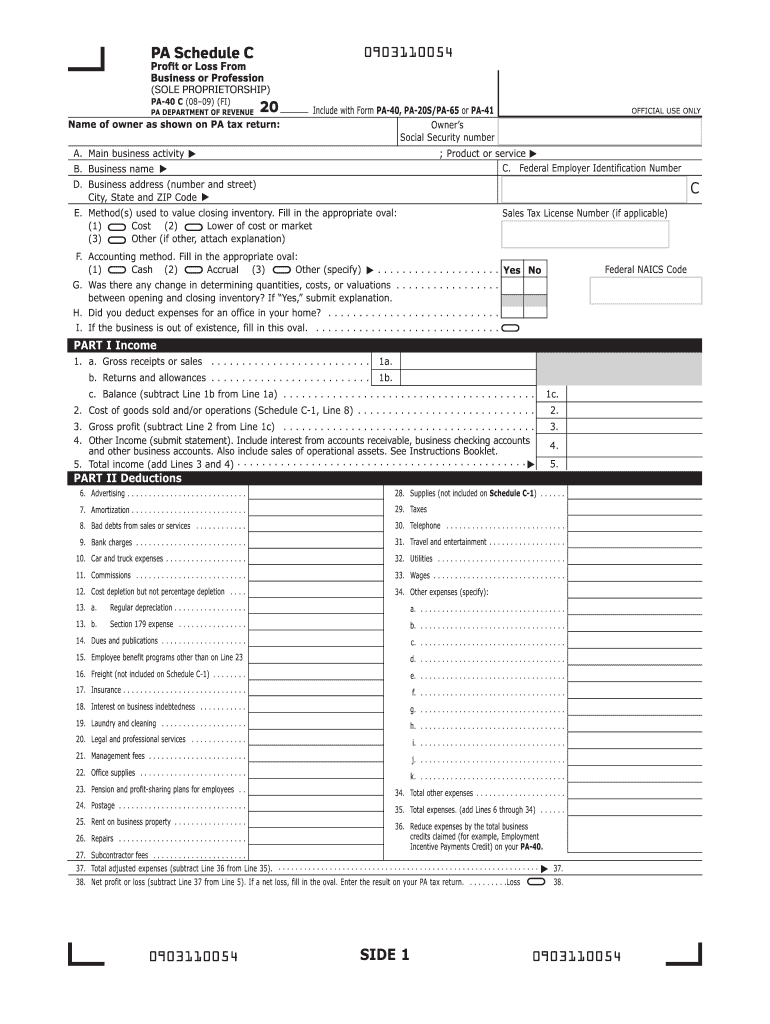

The PA 40 C, also known as the Pennsylvania Schedule C, is a tax form used by individuals to report income or loss from a business operated as a sole proprietorship. This form is essential for self-employed individuals, freelancers, and independent contractors in Pennsylvania. It captures various details about the business's financial performance, including gross income, expenses, and net profit or loss. Completing the PA 40 C accurately is crucial for ensuring compliance with state tax regulations.

How to Use the PA 40 C

Using the PA 40 C involves several steps to ensure that all necessary information is reported correctly. First, gather all relevant financial documents, including income statements, receipts for expenses, and any other records that reflect your business activities. Next, fill out the form by entering your business income and categorizing your expenses. It is important to maintain accurate records to support the figures reported on the form. Once completed, the PA 40 C should be submitted along with your PA 40 tax return to the Pennsylvania Department of Revenue.

Steps to Complete the PA 40 C

Completing the PA 40 C requires careful attention to detail. Follow these steps to ensure accuracy:

- Begin by entering your business name and address at the top of the form.

- Report your gross receipts or sales from your business activities.

- List all allowable business expenses, such as advertising, supplies, and utilities.

- Calculate your net profit or loss by subtracting total expenses from gross income.

- Sign and date the form to certify that the information provided is accurate and complete.

Legal Use of the PA 40 C

The PA 40 C is legally binding when completed and submitted according to Pennsylvania tax laws. It is essential to ensure that the information provided is truthful and accurate, as any discrepancies could lead to penalties or audits by the Pennsylvania Department of Revenue. The form must be filed by the designated deadline to avoid late fees. Understanding the legal implications of the PA 40 C helps ensure that taxpayers remain compliant with state regulations.

Required Documents

When preparing to complete the PA 40 C, certain documents are necessary to support your claims and ensure accuracy:

- Income statements detailing all revenue generated from your business.

- Receipts for business-related expenses.

- Bank statements that reflect business transactions.

- Any prior year tax returns that may provide context for your current filing.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the PA 40 C to avoid penalties. Typically, the PA 40 C must be filed by April 15 of each year, aligning with the federal tax return deadline. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Keeping track of these important dates ensures timely compliance with state tax obligations.

Quick guide on how to complete pa 40 c

Complete Pa 40 C effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the essentials to create, edit, and eSign your documents quickly and without delays. Handle Pa 40 C on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to edit and eSign Pa 40 C with ease

- Obtain Pa 40 C and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Put aside worries about lost or misplaced documents, tedious form searching, or mistakes that require new document printouts. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Pa 40 C and ensure exceptional communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa 40 c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a fillable PA 40 form?

The fillable PA 40 form is the Pennsylvania Personal Income Tax Return that allows residents to report their income and claim various deductions. Utilizing airSlate SignNow makes it easy to create, fill out, and eSign the fillable PA 40 form electronically, streamlining your tax filing process.

-

How can I create a fillable PA 40 using airSlate SignNow?

Creating a fillable PA 40 form on airSlate SignNow is simple. You can either upload a blank form and make it fillable or use our template library to find a pre-made fillable PA 40 template that suits your needs, enabling you to customize it before sending.

-

Is there a cost associated with using airSlate SignNow for a fillable PA 40?

airSlate SignNow offers a range of pricing plans to accommodate various needs, including free trials. Depending on the plan you select, you will have access to features for managing your fillable PA 40 and other document types at a competitive price.

-

Can I save and share my fillable PA 40 form with others?

Yes, airSlate SignNow allows you to save your fillable PA 40 form both locally and on the cloud. You can easily share it with others for collaboration or eSigning purposes, making it a convenient tool for tax season.

-

What features does airSlate SignNow offer for fillable PA 40 forms?

With airSlate SignNow, you gain access to features like customizable fields, progress tracking, and automated reminders for signing the fillable PA 40 form. These features enhance productivity and ensure that your tax documents are signed on time.

-

Are there integration options available with airSlate SignNow for fillable PA 40?

Absolutely! airSlate SignNow offers integrations with various platforms like Google Workspace, Salesforce, and Microsoft apps, allowing you to streamline the process of managing your fillable PA 40 and related documents within your existing workflow.

-

What are the benefits of using airSlate SignNow for my fillable PA 40?

Using airSlate SignNow for your fillable PA 40 simplifies document management with its intuitive interface, ensuring that you can fill, send, and eSign your tax forms efficiently. Additionally, it enhances data security and compliance, making it a reliable choice for sensitive documents.

Get more for Pa 40 C

Find out other Pa 40 C

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word