Horry County Pt 100 2022

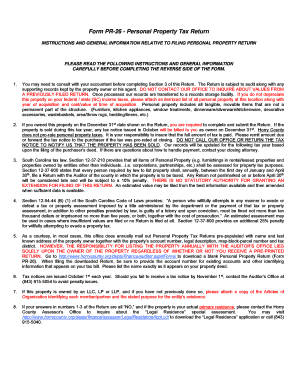

What is the Horry County Personal Property Return?

The Horry County Personal Property Return is a crucial document used by residents and businesses in Horry County, South Carolina, to report their personal property for tax purposes. This return is essential for the accurate assessment of personal property taxes, which are levied on items such as vehicles, boats, and business equipment. Filing this return helps ensure compliance with local tax laws and contributes to the funding of essential public services in the community.

Steps to Complete the Horry County Personal Property Return

Completing the Horry County Personal Property Return involves several key steps to ensure accuracy and compliance. First, gather all necessary information about the personal property you own, including descriptions, values, and acquisition dates. Next, access the appropriate form, typically available through the Horry County Auditor's office. Fill out the form carefully, making sure to list all relevant items. Finally, review your entries for accuracy before submitting the completed return by the designated deadline.

Required Documents for Filing

When filing the Horry County Personal Property Return, certain documents are typically required to support your claims. These may include:

- Proof of ownership for each item listed, such as titles or bills of sale.

- Previous year's tax returns, if applicable.

- Any relevant business licenses or registrations for commercial property.

Having these documents on hand can streamline the filing process and help prevent delays.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the Horry County Personal Property Return to avoid penalties. Generally, the return must be filed by a specific date each year, often falling in the spring. Missing this deadline can result in additional fees or penalties, so it is advisable to mark the date on your calendar and prepare your documents in advance.

Form Submission Methods

The Horry County Personal Property Return can typically be submitted through various methods to accommodate different preferences. These methods may include:

- Online submission through the Horry County Auditor's website.

- Mailing the completed form to the Auditor's office.

- In-person submission at designated county offices.

Choosing the right submission method can enhance convenience and ensure timely processing of your return.

Penalties for Non-Compliance

Failure to file the Horry County Personal Property Return on time can result in penalties that may increase the overall tax liability. These penalties can include fines or interest on unpaid taxes. Understanding the implications of non-compliance is vital for residents and business owners to avoid unnecessary financial burdens.

Quick guide on how to complete horry county pt 100

Effortlessly Prepare Horry County Pt 100 on Any Device

Web-based document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without hassle. Manage Horry County Pt 100 on any device using airSlate SignNow's Android or iOS applications and streamline any document-focused process today.

How to Modify and Electronically Sign Horry County Pt 100 Effortlessly

- Find Horry County Pt 100 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal standing as a conventional handwritten signature.

- Review the details and click the Done button to confirm your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, invite link, or download it to your computer.

Put an end to lost or mislaid files, exhausting form hunts, or mistakes that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Horry County Pt 100 and ensure seamless communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct horry county pt 100

Create this form in 5 minutes!

How to create an eSignature for the horry county pt 100

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Horry County personal property return?

An Horry County personal property return is a document that residents must file to report personal property for tax purposes. This form allows local authorities to assess the value of personal assets owned by individuals and businesses within Horry County. Completing this return accurately is crucial for compliance with local tax regulations.

-

How can airSlate SignNow help with my Horry County personal property return?

airSlate SignNow provides a streamlined solution for electronically signing and managing your Horry County personal property return. With our intuitive platform, you can quickly fill out, eSign, and submit your return, saving you time and ensuring your documents are organized. This makes the process of preparing and submitting your return much more efficient.

-

What features does airSlate SignNow offer for managing tax documents like the Horry County personal property return?

airSlate SignNow includes features such as customizable templates, cloud storage, and automated workflows, which can greatly benefit users dealing with tax documents like the Horry County personal property return. These features allow you to simplify the preparation and submission process while ensuring accuracy and compliance with local regulations.

-

Is there a cost associated with using airSlate SignNow for my Horry County personal property return?

Yes, there is a subscription fee for using airSlate SignNow, which varies based on the chosen plan and features. However, considering the time and effort saved throughout the process, many users find it to be a cost-effective solution for managing their Horry County personal property return and other important documents.

-

Can I integrate airSlate SignNow with other software for filing my Horry County personal property return?

Absolutely! airSlate SignNow offers various integrations with popular software systems that can help you manage your Horry County personal property return seamlessly. By connecting with your existing tools, you can enhance workflow efficiency and ensure that all your necessary information is readily available.

-

What are the benefits of using airSlate SignNow over traditional methods for submitting my Horry County personal property return?

Using airSlate SignNow provides several advantages over traditional paper methods, such as reduced submission time, increased accuracy, and the ability to track document status in real-time. This means that you can file your Horry County personal property return more efficiently while ensuring that you meet all deadlines without hassle.

-

How secure is my information when using airSlate SignNow for my Horry County personal property return?

airSlate SignNow prioritizes the security of its users' information with robust encryption and compliance with industry standards. When submitting your Horry County personal property return through our platform, you can trust that your personal data is safe and protected from unauthorized access.

Get more for Horry County Pt 100

- Traditional ira withdrawal instruction form 2306t americas uecu

- Ktenskapscertifikat anskan och frskran skv 7881 skatteverket form

- Wedding ceremony request form rockdale county rockdalecounty

- Attendance form for troopgroup meetings girl scouts of west future girlscouts

- Affidavit of chlorination 03132015pdf city of cape coral capecoral form

- Transcript request form pdf 29kb durham college

- To download the pretrial statement franklin county court of drj fccourts form

- Ptax 342 r 2015 2019 form

Find out other Horry County Pt 100

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form