Auditor Horry County GovernmentAuditor Horry County GovernmentAuditor Horry County GovernmentHorry County Government Home 2021

Understanding Horry County Personal Property Tax

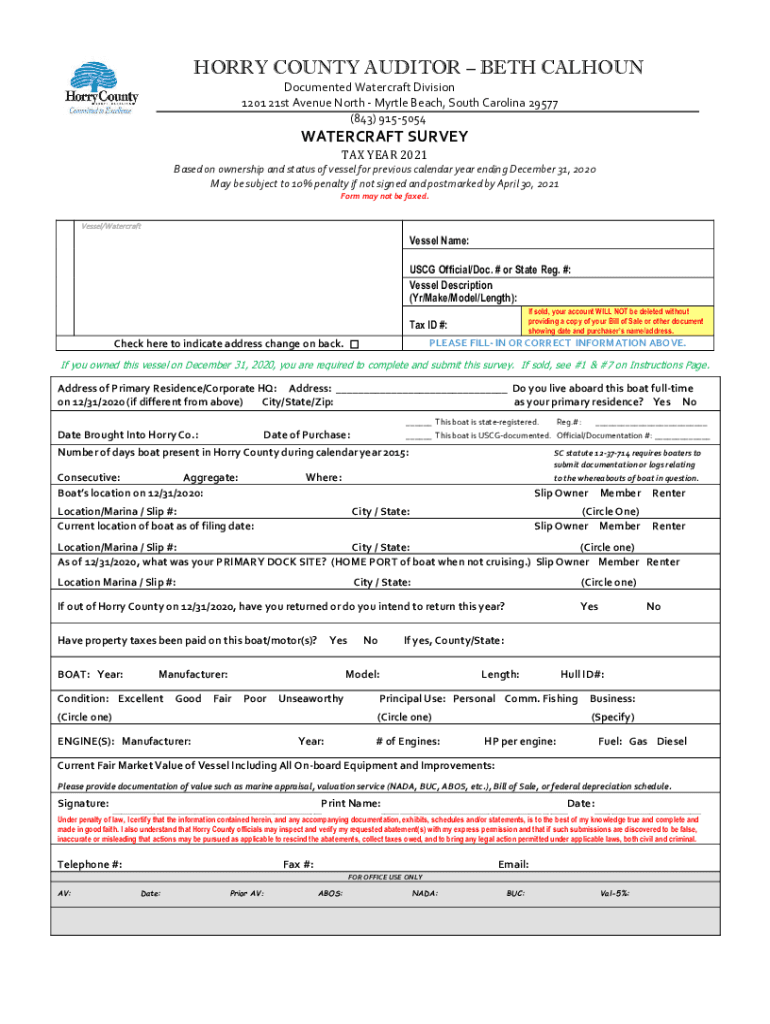

The Horry County personal property tax applies to tangible personal property owned by individuals and businesses. This tax is levied on items such as vehicles, boats, and business equipment. The Horry County Assessor's Office is responsible for assessing the value of these items and determining the tax owed. Understanding the specifics of this tax can help property owners ensure compliance and avoid penalties.

Steps to Complete the Horry County Personal Property Return

Filing the Horry County personal property return involves several key steps:

- Gather necessary documentation, including proof of ownership and any previous tax records.

- Obtain the Horry County personal property return form from the Assessor's Office or their official website.

- Complete the form accurately, listing all applicable personal property items.

- Submit the completed form by the designated deadline, either online or by mail.

Required Documents for Filing

When filing the Horry County personal property return, certain documents are essential:

- Proof of ownership for each item listed, such as titles or purchase receipts.

- Previous year's tax return, if applicable, to provide a reference for valuation.

- Any additional documentation requested by the Horry County Assessor's Office.

Penalties for Non-Compliance

Failing to file the Horry County personal property return or submitting inaccurate information can result in penalties. These may include:

- Fines imposed by the county for late submissions.

- Increased tax assessments if property is not reported accurately.

- Potential legal action for persistent non-compliance.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines for the Horry County personal property tax. Typically, the deadline for submission is April 30 of each year. Late filings may incur penalties, so marking this date on your calendar can help ensure timely compliance.

Digital vs. Paper Version of the Horry County Personal Property Return

Property owners have the option to file their Horry County personal property return digitally or via paper forms. The digital version offers convenience and faster processing times, while paper forms may be preferred by those who are more comfortable with traditional methods. Regardless of the method chosen, ensuring accuracy and completeness is essential for compliance.

Quick guide on how to complete auditor horry county governmentauditor horry county governmentauditor horry county governmenthorry county government home

Finalize Auditor Horry County GovernmentAuditor Horry County GovernmentAuditor Horry County GovernmentHorry County Government Home effortlessly on any device

Digital document management has grown increasingly favored by businesses and individuals alike. It offers an ideal environmentally-friendly substitute for conventional printed and signed paperwork, allowing you to easily find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly and without delays. Handle Auditor Horry County GovernmentAuditor Horry County GovernmentAuditor Horry County GovernmentHorry County Government Home on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The most efficient method to modify and electronically sign Auditor Horry County GovernmentAuditor Horry County GovernmentAuditor Horry County GovernmentHorry County Government Home with ease

- Find Auditor Horry County GovernmentAuditor Horry County GovernmentAuditor Horry County GovernmentHorry County Government Home and click Get Form to begin.

- Use the tools available to complete your document.

- Emphasize important sections of your documents or obscure sensitive data with the tools that airSlate SignNow provides specifically for this purpose.

- Formulate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all information thoroughly and click on the Done button to save your modifications.

- Choose how you want to send your form: via email, SMS, invitation link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Auditor Horry County GovernmentAuditor Horry County GovernmentAuditor Horry County GovernmentHorry County Government Home while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct auditor horry county governmentauditor horry county governmentauditor horry county governmenthorry county government home

Create this form in 5 minutes!

How to create an eSignature for the auditor horry county governmentauditor horry county governmentauditor horry county governmenthorry county government home

How to generate an electronic signature for your PDF document in the online mode

How to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your mobile device

How to make an electronic signature for a PDF document on iOS devices

How to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the process for paying Horry County personal property tax with airSlate SignNow?

Paying your Horry County personal property tax with airSlate SignNow is straightforward. Simply upload your tax documents, fill in the required fields, and use our eSignature feature to authorize the payment. This process ensures that your documentation is secure and legally binding.

-

Are there any fees associated with using airSlate SignNow for Horry County personal property tax?

While airSlate SignNow offers a cost-effective solution, there may be fees associated with specific transactions or features. It's essential to review our pricing plans to choose one that best suits your needs for handling Horry County personal property tax documents.

-

What features does airSlate SignNow offer for Horry County personal property tax processing?

airSlate SignNow provides features like document templates, eSigning, and secure cloud storage, all designed to streamline the Horry County personal property tax process. Additionally, you can track the status of your documents in real-time to ensure timely submission.

-

Is airSlate SignNow compliant with Horry County regulations for personal property tax documents?

Yes, airSlate SignNow is designed to comply with Horry County regulations for personal property tax documents. Our platform ensures that all signatures and forms meet state requirements, giving you peace of mind when filing your tax documents.

-

Can I integrate airSlate SignNow with other tools for managing Horry County personal property tax?

Absolutely! airSlate SignNow integrates seamlessly with various tools and software that facilitate efficient management of Horry County personal property tax, such as accounting software and CRM systems. This integration helps streamline your workflow and keeps all your data organized.

-

How does airSlate SignNow enhance the efficiency of managing Horry County personal property tax?

airSlate SignNow enhances efficiency by allowing you to handle Horry County personal property tax documents digitally. This reduces the need for physical paperwork, speeds up the approval process, and minimizes the risk of errors, ensuring that you meet all deadlines smoothly.

-

Is customer support available for questions about Horry County personal property tax?

Yes, airSlate SignNow offers dedicated customer support to assist you with any inquiries related to Horry County personal property tax. Our team is available to provide guidance and help you resolve any issues you might encounter while using our services.

Get more for Auditor Horry County GovernmentAuditor Horry County GovernmentAuditor Horry County GovernmentHorry County Government Home

- California objection 497299220 form

- California guardianship 497299221 form

- Guardianship pamphlet california 497299222 form

- Cillero de la tutela a las garantasderecho penal form

- California termination form

- Ca jurisdiction form

- Visitation attachment parent legal guardian indian custodian other important person california form

- California visitation form

Find out other Auditor Horry County GovernmentAuditor Horry County GovernmentAuditor Horry County GovernmentHorry County Government Home

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template