Irs 990 Pf Omb Form

What is the Irs 990 Pf Omb Form

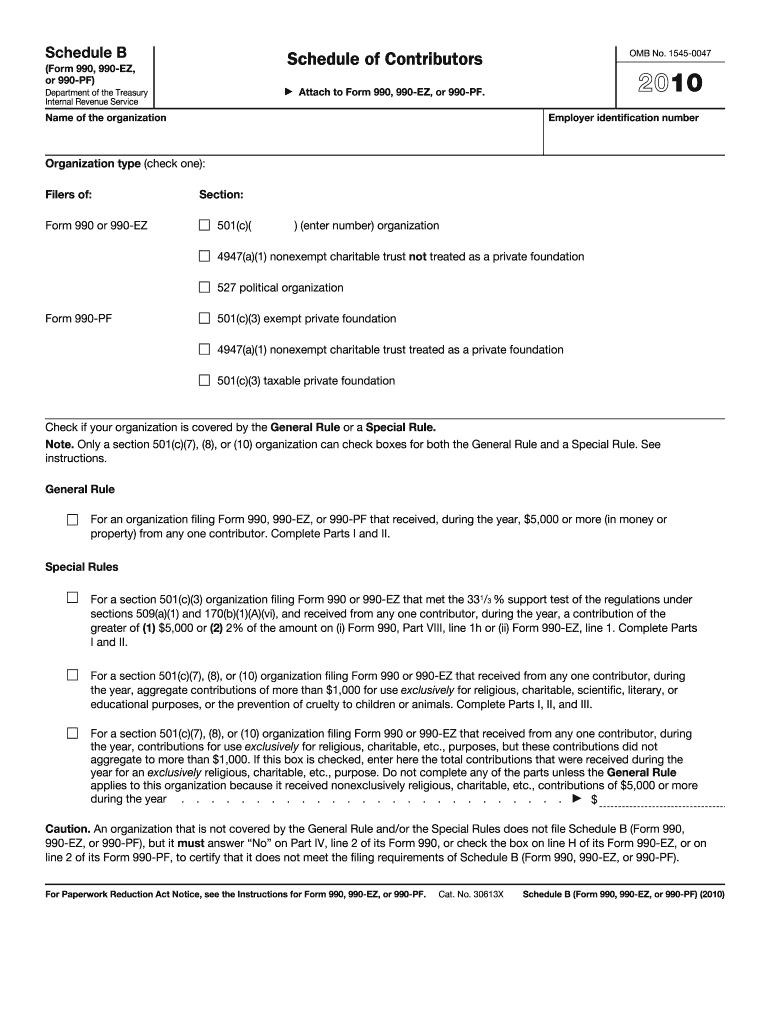

The Irs 990 Pf Omb Form is a tax document used by private foundations in the United States to report their financial activities to the Internal Revenue Service (IRS). This form provides essential information about the foundation's revenue, expenses, and charitable distributions. It is crucial for maintaining compliance with federal regulations governing private foundations. By accurately completing this form, organizations can ensure transparency and accountability in their financial dealings.

How to use the Irs 990 Pf Omb Form

Using the Irs 990 Pf Omb Form involves several key steps. First, gather all necessary financial documents, including income statements, balance sheets, and records of charitable contributions. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. It is important to follow the IRS guidelines closely to avoid any errors that could lead to penalties. Once the form is completed, it can be submitted electronically or by mail, depending on the preference of the organization.

Steps to complete the Irs 990 Pf Omb Form

Completing the Irs 990 Pf Omb Form requires a systematic approach. Start by reviewing the form's instructions to understand the requirements. Then, follow these steps:

- Gather financial records, including revenue and expenses.

- Fill in the organization’s identifying information, such as name and EIN.

- Report income, detailing contributions and investment income.

- List expenses, including administrative costs and grants made.

- Complete the sections on governance and compliance.

- Review the form for accuracy and completeness.

Finally, submit the form by the designated deadline to ensure compliance with IRS regulations.

Legal use of the Irs 990 Pf Omb Form

The Irs 990 Pf Omb Form serves a legal purpose by providing the IRS with critical information about a private foundation's financial activities. This form must be filed annually to maintain tax-exempt status and avoid potential penalties. Accurate reporting on this form helps ensure that foundations meet their legal obligations, including the distribution of a minimum percentage of their assets for charitable purposes. Failure to comply with these requirements can result in significant legal consequences.

Filing Deadlines / Important Dates

Filing deadlines for the Irs 990 Pf Omb Form are crucial for compliance. Generally, the form is due on the fifteenth day of the fifth month after the end of the foundation's fiscal year. For example, if a foundation's fiscal year ends on December 31, the form is due on May 15 of the following year. Extensions may be available, but it is essential to file for them before the original deadline. Keeping track of these dates helps avoid late fees and maintains good standing with the IRS.

Form Submission Methods (Online / Mail / In-Person)

The Irs 990 Pf Omb Form can be submitted in various ways to accommodate different organizational preferences. Organizations may choose to file electronically through the IRS e-file system, which is often faster and more efficient. Alternatively, the form can be mailed to the appropriate IRS address, ensuring that it is postmarked by the filing deadline. In-person submissions are generally not recommended, as the IRS encourages electronic and mail submissions for efficiency and tracking purposes.

Quick guide on how to complete irs 990 pf 2010 omb form

Effortlessly Prepare Irs 990 Pf Omb Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers a superb environmentally friendly option to traditional printed and signed documents, as you can access the right format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Irs 990 Pf Omb Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to Modify and Electronically Sign Irs 990 Pf Omb Form with Ease

- Find Irs 990 Pf Omb Form and click on Get Form to begin.

- Utilize the features we offer to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Alter and electronically sign Irs 990 Pf Omb Form to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What is a good way to learn how to read an IRS form 990?

You may find the instructions to prepare Form 990 at the website below: https://www.irs.gov/pub/irs-pdf/...Hope this is helpful.

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

How can I fill out my PF form when I am currently working abroad?

Try to withdraw onlineMore info comment or check contacts info

-

Is it necessary to fill out form 15G to withdraw PF?

Greeting !!!Below are basic details for Form 15G or form 15HForm 15G or form 15H is submitted to request income provider for not deducting TDS for prescribed income. In that form, declaration maker declares that his estimated taxable income for the same year is Nil.If you fulfill following conditions, submit form 15G / form 15H:1. Your estimated tax liability for the current year is NIL and2. Your interest for financial year does not exceed basic exemption limit + relief under section 87A.Only resident Indian can submit form 15G / form 15H. NRI cannot submit those forms. Also note that individual and person can submit form 15G/ H and company and firm cannot submit those forms. However, AOP and HUF can submit those forms.Consequences of wrongly submitting form 15G or form 15H:If your estimated income from all the sources is more than thebasic exemption limit ( + relief under section 87A if applicable), don’t submitform 15G or form 15H to income provider. Wrongly submission of form 15G / form15H will attract section 277 of income tax act.Be Peaceful !!!

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

Which IRS forms do US expats need to fill out?

That would depend on their personal situation, but should they actually have a full financial life in another country including investments, pensions, mortgages, insurance policies, a small business, multiple bank accounts…The reporting alone can be bankrupting, and that is before you get on to actual taxes that are punitive toward foreign finances owned by a US citizen and god help you if you make mistake because penalties appear designed to bankrupt you.US citizens globally are renouncing citizenship for good reason.This is extracted from a letter sent by the James Bopp law firm to Chairman Mark Meadows of the subcommittee of government operations regarding the difficulty faced by US citizens who try to live else where.“ FATCA is forcing Americans abroad into a set of circumstances where they must renounce their U.S. citizenship to survive.For example, suppose you have a married couple living in Washington DC. One works as a lobbyist for an NGO and has a defined benefits pensions. The other is self employed in a lobby firm, working under an LLC. According to the IRS filing requirements, it would take about 15 hours and $280 to complete their yearly filings. Should they under report income, any penalties would be a percentage of their unreported tax burden. The worst case is a 20% civil fraud penalty.Compare the same couple with one different fact. They moved to Australia because the NGO reassigned the wife to Sydney. The husband, likewise, moves his business overseas. They open a bank account, contribute to the mandatory Australian retirement fund, purchase a house with a mortgage and get a life insurance policy on both of them.These are now their new filing requirements:• Form 8938• Form 3520-A• Form 3520• Form 5471 (to be filed by the husbands new Australian corporation where he is self employed)• Form 720 Excise Tax.• FinCEN Form 114The burden that was 15 hours now goes up to• 57.2 hours for Form 720,• 54.20 hours for Form 3520,• 61.22 Hours for Form 3520-A.• 50 hours estimate for Form 5471For a total of 226.99 hours (according to the IRS’s own time estimates) not including time to file the FBAR.The penalties for innocent misfiling or non filings for the above foreign reporting forms for the couple are up to $50,000, per year. It is likely that the foreign income exclusion and foreign tax credit will negate any actual tax due to the IRS. So each year, there is a lurking $50,000 penalty for getting something technically wrong on a form, yet there would be no additional tax due to the US treasury.”

Create this form in 5 minutes!

How to create an eSignature for the irs 990 pf 2010 omb form

How to create an electronic signature for the Irs 990 Pf 2010 Omb Form in the online mode

How to make an eSignature for your Irs 990 Pf 2010 Omb Form in Chrome

How to make an eSignature for signing the Irs 990 Pf 2010 Omb Form in Gmail

How to create an electronic signature for the Irs 990 Pf 2010 Omb Form right from your mobile device

How to create an electronic signature for the Irs 990 Pf 2010 Omb Form on iOS

How to create an eSignature for the Irs 990 Pf 2010 Omb Form on Android devices

People also ask

-

What is the Irs 990 Pf Omb Form and why is it important?

The Irs 990 Pf Omb Form is a vital document for private foundations, as it provides the IRS with essential information about the foundation's financial activities, governance, and compliance. Completing this form accurately is crucial for maintaining tax-exempt status and ensuring transparency in charitable activities.

-

How can airSlate SignNow assist with the Irs 990 Pf Omb Form?

airSlate SignNow simplifies the process of preparing and signing the Irs 990 Pf Omb Form by providing an intuitive platform for document management. With features like secure e-signatures and customizable templates, you can easily gather necessary signatures and ensure that your form is completed accurately and efficiently.

-

What are the pricing options for airSlate SignNow when using the Irs 990 Pf Omb Form?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, making it easy to manage documents like the Irs 990 Pf Omb Form at an affordable rate. Pricing tiers depend on the number of users and features needed, ensuring you only pay for what you use.

-

Is airSlate SignNow compliant with IRS regulations for the Irs 990 Pf Omb Form?

Yes, airSlate SignNow is committed to compliance with all relevant laws and regulations, including those governing the Irs 990 Pf Omb Form. Our platform offers secure document signing and storage, ensuring that your sensitive information remains protected and compliant with IRS standards.

-

Can I integrate airSlate SignNow with other software for managing the Irs 990 Pf Omb Form?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, allowing you to connect tools you already use for managing the Irs 990 Pf Omb Form. This interoperability enhances your workflow and ensures that your documents are efficiently handled across platforms.

-

What features does airSlate SignNow offer to streamline the Irs 990 Pf Omb Form process?

airSlate SignNow provides a variety of features that streamline the process of managing the Irs 990 Pf Omb Form, including automated reminders, e-signature capabilities, and document tracking. These tools help ensure that your filing deadlines are met and that all necessary signatures are collected promptly.

-

How does airSlate SignNow enhance collaboration on the Irs 990 Pf Omb Form?

With airSlate SignNow, collaboration on the Irs 990 Pf Omb Form becomes effortless. You can invite team members to review and sign documents in real time, ensuring that everyone is on the same page and that your form is completed accurately and efficiently.

Get more for Irs 990 Pf Omb Form

- Smimer local quota certificate form

- Weekly sleep log form

- Parkingpermit gtaa com form

- Life ford my compensation direct deposit info form

- Dic form 81

- Learn about the irs form 656 take action now

- Release indemnity and assumption of risk young engineers form

- Irs form 14039 identity theft affidavit form

Find out other Irs 990 Pf Omb Form

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast

- eSign Iowa Car Dealer Limited Power Of Attorney Safe

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney