Questionario Per Dipendenti Assoggettati All'imposta Alla Fonte 2014

What is the Questionario Per Dipendenti Assoggettati All'imposta Alla Fonte

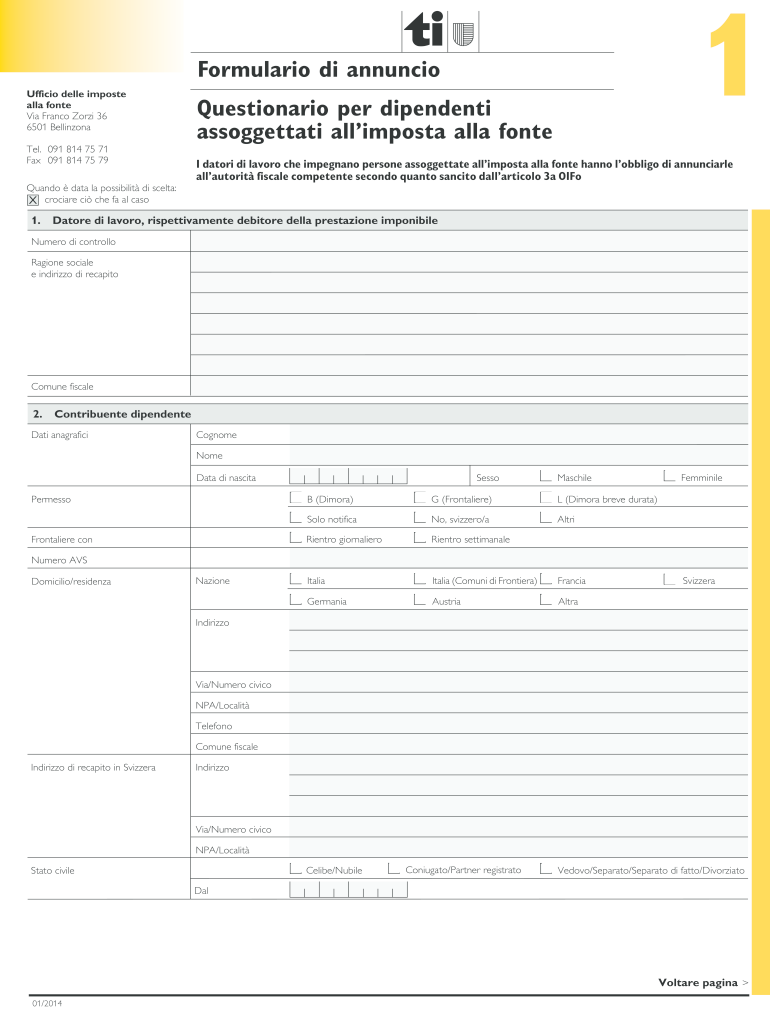

The Questionario per dipendenti assoggettati all'imposta alla fonte is a form used to gather essential information from employees who are subject to withholding tax. This questionnaire helps employers determine the appropriate tax withholding amounts based on various factors, including income level and applicable deductions. It is crucial for ensuring compliance with tax regulations and for accurately calculating the withholdings necessary for federal and state tax obligations.

Steps to Complete the Questionario Per Dipendenti Assoggettati All'imposta Alla Fonte

Completing the Questionario per dipendenti assoggettati all'imposta alla fonte involves several key steps:

- Gather necessary personal information, including your full name, address, and Social Security number.

- Provide details regarding your employment status and any additional sources of income.

- Indicate any applicable deductions or exemptions that may affect your tax withholding.

- Review the completed questionnaire for accuracy before submission.

Following these steps ensures that the form is filled out correctly, which is essential for proper tax withholding.

Legal Use of the Questionario Per Dipendenti Assoggettati All'imposta Alla Fonte

The legal use of the Questionario per dipendenti assoggettati all'imposta alla fonte is governed by federal and state tax laws. This form must be completed accurately to comply with Internal Revenue Service (IRS) requirements. Failure to provide correct information can lead to penalties, including under-withholding or over-withholding of taxes. Employers are responsible for ensuring that the information provided is up-to-date and reflects the employee's current financial situation.

Required Documents

To complete the Questionario per dipendenti assoggettati all'imposta alla fonte, you may need the following documents:

- Proof of identity, such as a driver's license or passport.

- Social Security card or number.

- Recent pay stubs or tax returns to verify income.

- Any documentation related to deductions or exemptions you intend to claim.

Having these documents on hand will facilitate a smoother completion process and ensure that all necessary information is accurately reported.

Form Submission Methods

The Questionario per dipendenti assoggettati all'imposta alla fonte can typically be submitted through various methods:

- Online submission via the employer's payroll system.

- Mailing a physical copy to the payroll department or HR.

- In-person delivery to the HR department for immediate processing.

Employers should specify the preferred submission method to ensure timely processing of the information.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of the Questionario per dipendenti assoggettati all'imposta alla fonte. It is essential to follow these guidelines to ensure compliance with federal tax laws. This includes understanding the requirements for withholding allowances and ensuring that the form is updated whenever there are changes in employment status or personal circumstances that could affect tax withholding.

Quick guide on how to complete questionario per dipendenti assoggettati allimposta alla fonte

Effortlessly Prepare Questionario Per Dipendenti Assoggettati All'imposta Alla Fonte on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the necessary format and securely save it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Questionario Per Dipendenti Assoggettati All'imposta Alla Fonte on any device with the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

Easy Methods to Edit and eSign Questionario Per Dipendenti Assoggettati All'imposta Alla Fonte with Ease

- Locate Questionario Per Dipendenti Assoggettati All'imposta Alla Fonte and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Edit and eSign Questionario Per Dipendenti Assoggettati All'imposta Alla Fonte and guarantee excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct questionario per dipendenti assoggettati allimposta alla fonte

Create this form in 5 minutes!

How to create an eSignature for the questionario per dipendenti assoggettati allimposta alla fonte

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 'questionario per dipendenti assoggettati all'imposta alla fonte'?

A 'questionario per dipendenti assoggettati all'imposta alla fonte' is a document that collects essential information from employees who are subject to withholding tax. This questionnaire helps employers comply with tax regulations and streamline payroll processes. Utilizing airSlate SignNow can greatly simplify the distribution and collection of this questionnaire.

-

How can airSlate SignNow help with the 'questionario per dipendenti assoggettati all'imposta alla fonte'?

airSlate SignNow provides an easy-to-use platform for sending and eSigning documents, including the 'questionario per dipendenti assoggettati all'imposta alla fonte'. The solution allows organizations to create, manage, and securely store these questionnaires, reducing administrative burdens and improving efficiency.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers a range of pricing plans tailored to fit different business needs. Whether you are a small team requiring basic features or a larger organization in need of advanced functionalities for the 'questionario per dipendenti assoggettati all'imposta alla fonte', there is a suitable plan available. You can choose a monthly or annual subscription for convenience.

-

Is airSlate SignNow compliant with tax regulations for the 'questionario per dipendenti assoggettati all'imposta alla fonte'?

Yes, airSlate SignNow is compliant with various tax regulations, making it a reliable choice for handling the 'questionario per dipendenti assoggettati all'imposta alla fonte'. The platform ensures that data is securely transmitted and stored, adhering to legal standards necessary for handling sensitive employee information.

-

What features does airSlate SignNow offer for document management?

AirSlate SignNow provides a variety of features for efficient document management, including eSigning, customizable templates, and automated workflows. These features enhance the process of handling the 'questionario per dipendenti assoggettati all'imposta alla fonte', allowing for quick and efficient responses from employees.

-

How can I integrate airSlate SignNow with other tools?

AirSlate SignNow offers integration capabilities with a range of business tools, including CRMs, cloud storage solutions, and productivity applications. This allows for a seamless workflow that includes the 'questionario per dipendenti assoggettati all'imposta alla fonte' and makes data management easier across platforms.

-

Can I track responses to the 'questionario per dipendenti assoggettati all'imposta alla fonte' in airSlate SignNow?

Absolutely! With airSlate SignNow, you can easily track responses to your 'questionario per dipendenti assoggettati all'imposta alla fonte'. The platform provides real-time updates and notifications, ensuring that you are always informed about the status of the questionnaires sent to your employees.

Get more for Questionario Per Dipendenti Assoggettati All'imposta Alla Fonte

Find out other Questionario Per Dipendenti Assoggettati All'imposta Alla Fonte

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe