18 Iscrizioni Per Via Franco Zorzi 36 Bellinzona Search Ch 2021-2026

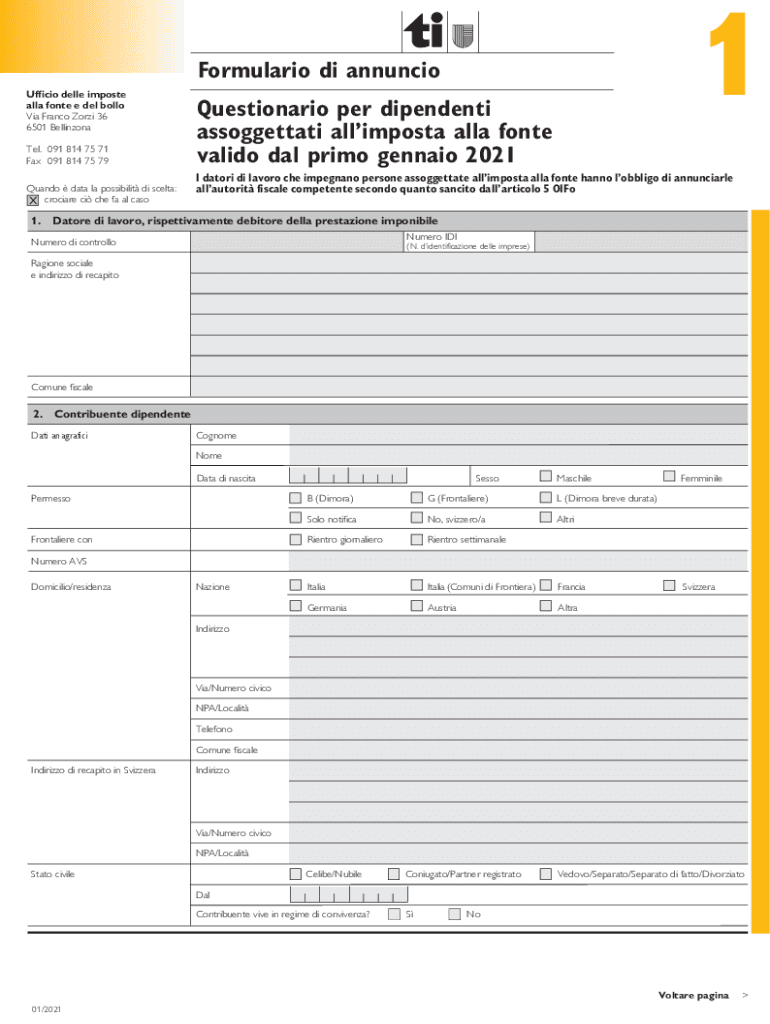

Understanding the questionario per dipendenti assoggettati all'imposta alla fonte

The questionario per dipendenti assoggettati all'imposta alla fonte is a crucial document for employees subject to withholding tax. This form collects essential information regarding an employee's tax status, ensuring that the correct amount of tax is withheld from their earnings. Proper completion of this form is vital for both the employer and the employee to comply with tax regulations.

Steps to complete the questionario per dipendenti assoggettati all'imposta alla fonte

Completing the questionario requires careful attention to detail. Follow these steps for accurate submission:

- Gather necessary personal information, including your Social Security number and employment details.

- Review the specific tax withholding requirements applicable to your situation.

- Fill out the form with accurate data, ensuring all sections are completed.

- Review the completed form for any errors or omissions.

- Submit the form to your employer, either electronically or in paper format, as per their guidelines.

Legal use of the questionario per dipendenti assoggettati all'imposta alla fonte

This form must be used in compliance with U.S. tax laws. It serves as a legal document that outlines the employee's tax withholding preferences and obligations. Ensuring that the form is filled out correctly is essential to avoid potential legal issues, such as under-withholding or over-withholding of taxes.

IRS Guidelines for the questionario per dipendenti assoggettati all'imposta alla fonte

The Internal Revenue Service (IRS) provides specific guidelines regarding the completion and submission of this form. It is important for employees to familiarize themselves with these guidelines to ensure compliance. The IRS outlines the necessary information required, deadlines for submission, and the consequences of non-compliance.

Required documents for the questionario per dipendenti assoggettati all'imposta alla fonte

To complete the questionario, employees typically need the following documents:

- Social Security card or number

- Proof of residency

- Previous year’s tax return, if applicable

- Any additional documentation required by the employer

Penalties for non-compliance with the questionario per dipendenti assoggettati all'imposta alla fonte

Failure to complete and submit the questionario accurately can lead to penalties. The IRS may impose fines for under-withholding, and employees may face unexpected tax liabilities during tax filing season. Employers also have a responsibility to ensure that they are withholding the correct amounts based on the information provided in this form.

Quick guide on how to complete 18 iscrizioni per via franco zorzi 36 bellinzona search ch

Complete 18 Iscrizioni Per Via Franco Zorzi 36 Bellinzona Search ch effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle 18 Iscrizioni Per Via Franco Zorzi 36 Bellinzona Search ch on any device using airSlate SignNow Android or iOS applications and simplify any document-centric procedure today.

How to alter and eSign 18 Iscrizioni Per Via Franco Zorzi 36 Bellinzona Search ch without hassle

- Locate 18 Iscrizioni Per Via Franco Zorzi 36 Bellinzona Search ch and select Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require printing new document versions. airSlate SignNow meets all your document management needs in just a few clicks from any chosen device. Alter and eSign 18 Iscrizioni Per Via Franco Zorzi 36 Bellinzona Search ch and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 18 iscrizioni per via franco zorzi 36 bellinzona search ch

Create this form in 5 minutes!

How to create an eSignature for the 18 iscrizioni per via franco zorzi 36 bellinzona search ch

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the formulario imposte alla fonte 2024?

The formulario imposte alla fonte 2024 is a tax form used in Italy for the withholding tax on certain incomes. It simplifies the tax reporting process for individuals and businesses, making it easier to comply with tax regulations. Understanding this form is crucial for anyone involved in financial transactions in Italy.

-

How can airSlate SignNow help with the formulario imposte alla fonte 2024?

airSlate SignNow provides an efficient platform for completing and eSigning the formulario imposte alla fonte 2024. Our solution automates the document workflow, allowing you to prepare, share, and sign tax forms quickly and securely. This eliminates delays and ensures compliance with tax-related deadlines.

-

What are the pricing options for airSlate SignNow's services related to the formulario imposte alla fonte 2024?

airSlate SignNow offers flexible pricing plans tailored to different business needs, which include options for individuals and teams. The pricing is competitive, ensuring you receive a cost-effective solution for managing forms like the formulario imposte alla fonte 2024. You can choose a plan that allows you to optimize your document processes without excessive costs.

-

What features does airSlate SignNow offer for managing the formulario imposte alla fonte 2024?

Our platform includes features such as customizable templates, automated reminders, and secure eSigning capabilities. These features enhance your efficiency when completing the formulario imposte alla fonte 2024, ensuring you meet your tax obligations with ease. Additionally, you can track document statuses in real-time.

-

Can I integrate airSlate SignNow with other software for formulario imposte alla fonte 2024 processing?

Yes, airSlate SignNow offers integrations with various business applications that streamline the process of handling the formulario imposte alla fonte 2024. This allows you to connect with CRM systems, cloud storage, and other tools, enhancing productivity. You can easily import and export data to simplify your tax documentation.

-

What benefits does using airSlate SignNow provide for completing the formulario imposte alla fonte 2024?

Using airSlate SignNow to complete the formulario imposte alla fonte 2024 offers several benefits, including increased accuracy, reduced processing time, and enhanced security. With our solution, you can avoid common errors that arise from manual entries and ensure your tax documents are securely stored and easily accessible. This means less stress when tax season arrives.

-

Is there customer support available for help with the formulario imposte alla fonte 2024?

Absolutely! airSlate SignNow provides comprehensive customer support to assist you with any questions related to the formulario imposte alla fonte 2024. Our team is knowledgeable and ready to help you navigate any issues, ensuring you can efficiently manage your documents and eSign when needed.

Get more for 18 Iscrizioni Per Via Franco Zorzi 36 Bellinzona Search ch

Find out other 18 Iscrizioni Per Via Franco Zorzi 36 Bellinzona Search ch

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple