Ca1887 Hmrc Form

What is the CA1887 HMRC?

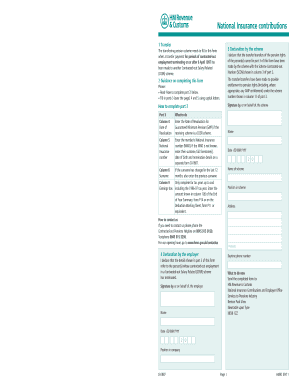

The CA1887 HMRC form is a specific document used in the United Kingdom for tax purposes, particularly related to the reporting of certain financial activities. Although primarily associated with UK tax regulations, understanding its implications is essential for businesses and individuals who engage in cross-border transactions or have ties to the UK financial system. The form serves as a means of ensuring compliance with tax obligations and providing necessary information to the relevant authorities.

How to Use the CA1887 HMRC

Using the CA1887 HMRC form involves several key steps. First, gather all necessary financial documents and information that pertain to the reporting period. This may include income statements, expense reports, and any other relevant financial data. Next, accurately fill out the form, ensuring that all sections are completed as required. It is crucial to double-check the information for accuracy to avoid potential issues with tax authorities. Once completed, the form should be submitted according to the specified guidelines, which may include online submission or mailing it to the appropriate office.

Steps to Complete the CA1887 HMRC

Completing the CA1887 HMRC form requires careful attention to detail. Follow these steps for a smooth process:

- Gather necessary documents: Collect all financial records relevant to the reporting period.

- Fill out the form: Complete each section of the CA1887 HMRC form, ensuring all information is accurate and complete.

- Review your entries: Double-check for any errors or omissions that could lead to complications.

- Submit the form: Follow the instructions for submission, whether online or by mail, ensuring it reaches the correct authority.

Legal Use of the CA1887 HMRC

The legal use of the CA1887 HMRC form is defined by compliance with tax regulations in the UK. When used correctly, this form helps individuals and businesses fulfill their tax obligations, thereby avoiding penalties or legal issues. It is important to understand the legal framework surrounding the form, including deadlines and requirements for submission, to ensure that all filings are compliant with the law.

Key Elements of the CA1887 HMRC

Several key elements characterize the CA1887 HMRC form. These include:

- Identification Information: Details about the individual or business submitting the form.

- Financial Data: Accurate reporting of income, expenses, and other financial activities relevant to the tax year.

- Signature: A declaration that the information provided is true and complete, often requiring a signature from the responsible party.

Filing Deadlines / Important Dates

Filing deadlines for the CA1887 HMRC form are critical to ensure compliance and avoid penalties. Typically, forms must be submitted by specific dates that align with the tax year. It is essential to stay informed about these deadlines to ensure timely submission. Failure to file by the due date can result in fines and additional scrutiny from tax authorities.

Quick guide on how to complete ca1887 hmrc

Effortlessly Prepare Ca1887 Hmrc on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Manage Ca1887 Hmrc across any platform with the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

How to Modify and Electronically Sign Ca1887 Hmrc with Ease

- Find Ca1887 Hmrc and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method of sending your form—via email, SMS, invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Ca1887 Hmrc and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ca1887 hmrc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ca1887 on airSlate SignNow?

ca1887 is a specific feature within airSlate SignNow that streamlines the process of sending and signing documents electronically. It enables users to create, manage, and track documents effortlessly, ensuring that you don't miss important signatures or deadlines.

-

How much does airSlate SignNow cost with the ca1887 feature?

The pricing for airSlate SignNow, including the ca1887 feature, varies based on the subscription plan chosen. The plans are structured to accommodate different business sizes and needs, providing a cost-effective solution without compromising on functionality.

-

What benefits does ca1887 offer to businesses?

The ca1887 feature enhances operational efficiency by reducing the time spent on manual paperwork. With the user-friendly interface of airSlate SignNow, businesses can improve productivity, minimize errors, and accelerate the signing process, which ultimately boosts customer satisfaction.

-

Can I integrate ca1887 with other applications?

Yes, ca1887 on airSlate SignNow can seamlessly integrate with various applications such as CRM systems, cloud storage solutions, and project management tools. This compatibility allows for a more cohesive workflow, enabling businesses to manage documents within their preferred platforms.

-

Is ca1887 secure for sensitive documents?

Absolutely, ca1887 features robust security measures to protect sensitive documents. airSlate SignNow uses encryption and complies with industry standards, ensuring that your documents are safe from unauthorized access and providing peace of mind for your business operations.

-

How does ca1887 improve the signing experience?

ca1887 simplifies the signing experience by providing an intuitive interface that guides users through the signing process. This is designed to minimize confusion and streamline communication, making it easier for clients and partners to complete their signatures swiftly.

-

What types of documents can I use ca1887 with?

With ca1887, you can use a wide range of document types, including contracts, agreements, forms, and more. This feature is versatile enough to accommodate various business needs, ensuring that all your important documents are handled efficiently.

Get more for Ca1887 Hmrc

Find out other Ca1887 Hmrc

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile