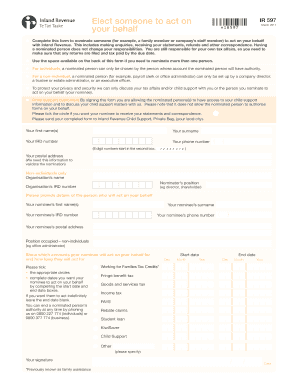

Ir597 Form

What is the ir597 Form

The ir597 form is a specific document used in the United States for tax purposes. It is essential for individuals and businesses to accurately report certain financial information to the Internal Revenue Service (IRS). This form typically pertains to specific deductions or credits that taxpayers may be eligible for, ensuring compliance with federal tax regulations. Understanding the purpose and requirements of the ir597 form is crucial for maintaining accurate tax records and fulfilling legal obligations.

How to use the ir597 Form

Using the ir597 form involves several key steps to ensure proper completion and submission. First, gather all necessary financial documents, including income statements and any relevant receipts. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is important to follow the instructions provided by the IRS, as any errors can lead to delays or penalties. Once the form is completed, it can be submitted electronically or via mail, depending on individual preferences and requirements.

Steps to complete the ir597 Form

Completing the ir597 form requires attention to detail and adherence to specific guidelines. Here are the steps to follow:

- Gather Information: Collect all relevant financial documents, including previous tax returns, income statements, and any supporting documentation.

- Fill Out the Form: Enter your information accurately, ensuring all fields are completed as required.

- Review for Accuracy: Double-check all entries to avoid mistakes that could result in penalties.

- Submit the Form: Decide whether to file electronically or by mail, and follow the appropriate submission guidelines.

Legal use of the ir597 Form

The legal use of the ir597 form is governed by IRS regulations. To be considered valid, the form must be completed accurately and submitted within the designated timeframes. It is essential to maintain copies of the submitted form and any supporting documents for record-keeping purposes. Failure to comply with IRS requirements can result in penalties, including fines or audits. Therefore, understanding the legal implications of using the ir597 form is vital for all taxpayers.

Filing Deadlines / Important Dates

Filing deadlines for the ir597 form are crucial for compliance with tax regulations. Typically, the form must be submitted by the annual tax filing deadline, which is usually April 15 for most individuals. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes in deadlines or specific requirements set by the IRS to avoid penalties.

Required Documents

To complete the ir597 form, certain documents are necessary to ensure accurate reporting. These may include:

- Income statements (W-2s, 1099s)

- Receipts for deductible expenses

- Previous tax returns for reference

- Any relevant financial records

Having these documents on hand will facilitate a smoother completion process and help ensure compliance with IRS guidelines.

Quick guide on how to complete ir597 form

Effortlessly Prepare Ir597 Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the correct format and securely save it online. airSlate SignNow provides all the resources necessary to create, edit, and eSign your documents efficiently without interruptions. Manage Ir597 Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to Edit and eSign Ir597 Form with Ease

- Locate Ir597 Form and click on Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools available from airSlate SignNow specifically designed for that function.

- Generate your eSignature using the Sign option, which takes only a few seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the concerns of lost or misfiled documents, tedious form searches, or errors that require printing new versions. airSlate SignNow meets your document management requirements in just a few clicks from your selected device. Amend and eSign Ir597 Form and ensure outstanding communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ir597 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ir597 feature in airSlate SignNow?

The ir597 feature in airSlate SignNow allows users to efficiently send and eSign documents in compliance with industry standards. This feature streamlines the document management process, making it easy for both businesses and individuals to obtain necessary signatures quickly and securely.

-

How much does airSlate SignNow cost with the ir597 integration?

airSlate SignNow offers various pricing plans based on the ir597 integration capabilities. Starting at just a competitive monthly rate, users can access powerful eSigning features along with the benefits of the ir597 integration, making it a cost-effective solution for businesses of all sizes.

-

What benefits does the ir597 feature provide for businesses?

The ir597 feature enhances business workflows by improving document turnaround times and reducing the need for physical paperwork. This not only saves time but also helps businesses reduce operational costs, thereby increasing overall efficiency.

-

Can I integrate airSlate SignNow with other software using the ir597 feature?

Yes, airSlate SignNow allows seamless integration with a variety of software applications using the ir597 feature. This flexibility enables businesses to connect their existing tools and automate workflows easily, enhancing productivity across the board.

-

How secure is the ir597 eSigning process?

The ir597 feature in airSlate SignNow prioritizes security by implementing industry-leading encryption protocols and compliance with legal standards. Users can confidently send and receive documents knowing their sensitive information is protected throughout the entire eSigning process.

-

Is there a free trial available for the ir597 feature?

Yes, airSlate SignNow offers a free trial that includes access to the ir597 feature. This allows potential customers to explore the benefits and functionalities of the service without any commitment, helping them make an informed decision.

-

What types of documents can I eSign with the ir597 feature?

With the ir597 feature, users can eSign a wide range of documents, including contracts, agreements, and forms. This versatility makes airSlate SignNow an ideal solution for various industries, as it accommodates diverse document types and formats.

Get more for Ir597 Form

Find out other Ir597 Form

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word