E 595e Fillable Form

What is the E 595e Fillable Form

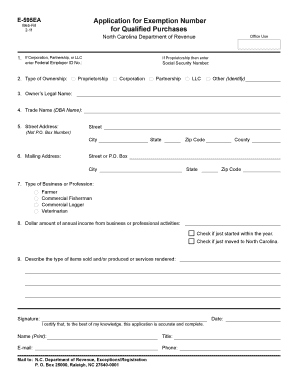

The E 595e fillable form is a crucial document used in the United States for tax-exempt purchases. This form allows buyers to certify their eligibility for exemption from sales tax on specific purchases, typically related to resale or manufacturing. By completing the E 595e, individuals and businesses can streamline their purchasing processes while ensuring compliance with state tax regulations.

How to use the E 595e Fillable Form

Using the E 595e fillable form involves several straightforward steps. First, ensure you have the latest version of the form, which can be obtained online. Next, fill out the required fields, providing accurate information about your business and the nature of the tax-exempt purchase. Once completed, the form must be signed and dated. It is essential to keep a copy for your records and provide the original to the seller at the time of purchase to validate the tax exemption.

Steps to complete the E 595e Fillable Form

Completing the E 595e fillable form requires careful attention to detail. Follow these steps:

- Download the E 595e form from a reliable source.

- Fill in your business name, address, and tax identification number.

- Indicate the type of exemption you are claiming.

- Provide a description of the items being purchased tax-exempt.

- Sign and date the form to affirm its accuracy.

After completing the form, present it to the vendor to ensure the tax exemption is honored.

Legal use of the E 595e Fillable Form

The E 595e fillable form is legally binding when filled out correctly and used in accordance with state regulations. It is essential to ensure that the information provided is truthful and that the purchases made under this exemption are eligible. Misuse of the form can result in penalties, including back taxes and fines, so it is crucial to understand the legal implications of using this document.

Who Issues the Form

The E 595e form is issued by the state tax authority in the United States. Each state may have its own version of the form, tailored to its specific tax laws and regulations. It is important to use the correct form for your state to ensure compliance and validity of the tax exemption claimed.

Form Submission Methods

The E 595e fillable form can be submitted in various ways, depending on the vendor's requirements. Typically, it is presented in person at the point of sale. Some vendors may allow the form to be sent via email or fax. Always confirm with the seller the preferred method of submission to ensure the tax exemption is applied correctly.

Examples of using the E 595e Fillable Form

Common scenarios for using the E 595e fillable form include:

- Retail businesses purchasing inventory for resale.

- Manufacturers acquiring raw materials used in production.

- Wholesalers buying goods to sell to retailers.

In each case, the form serves to validate the tax-exempt status of the purchase, ensuring compliance with state tax laws.

Quick guide on how to complete e 595e fillable form

Prepare E 595e Fillable Form seamlessly on any device

Online document management has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage E 595e Fillable Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign E 595e Fillable Form effortlessly

- Obtain E 595e Fillable Form and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize crucial sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature with the Sign feature, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Edit and eSign E 595e Fillable Form and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the e 595e fillable form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the e 595e certification and why is it important?

The e 595e certification is crucial for businesses as it ensures compliance with electronic signatures and document management regulations. This certification allows companies to adopt airSlate SignNow for secure and legally binding electronic signatures, making document handling efficient and trustworthy.

-

How does airSlate SignNow support the e 595e standards?

airSlate SignNow is designed with the e 595e requirements in mind, ensuring that users can send and eSign documents that meet legal standards. This support helps businesses maintain compliance while enjoying a streamlined eSigning experience.

-

What are the main features of airSlate SignNow related to e 595e?

Key features of airSlate SignNow that align with the e 595e certification include multi-user access, document tracking, and customizable templates. These features streamline the eSigning process, making it easy for businesses to manage and sign documents securely.

-

Is airSlate SignNow cost-effective for businesses needing e 595e certification?

Yes, airSlate SignNow provides a cost-effective solution for businesses seeking e 595e certification. With flexible pricing plans and a variety of features included, companies can find an option that fits their budget while ensuring compliance with electronic signature regulations.

-

What integrations does airSlate SignNow offer with regard to e 595e?

airSlate SignNow offers integrations with various software platforms to enhance the e 595e compliance process. By integrating with CRMs, cloud storage services, and other business tools, users can efficiently manage documents while adhering to certification standards.

-

How can businesses benefit from using airSlate SignNow for e 595e?

By using airSlate SignNow, businesses benefit from a fast and secure way to eSign documents necessary for e 595e certification. The platform simplifies workflows, increases productivity, and ensures that all documentation remains legally binding and compliant.

-

Can I try airSlate SignNow for e 595e certification before committing?

Absolutely! airSlate SignNow offers a free trial that allows potential users to explore its features and see how it meets e 595e certification needs. This trial period is an excellent way to assess the tool's effectiveness for your business.

Get more for E 595e Fillable Form

- Autorisation de communiquer des renseignements contenus au internet crditedmtl form

- Lsw 22cw pc lsw 22ww pc westgate mfg inc form

- Express checkout bformb santa clara university scu

- Pfms generated payment form

- Snysa physical form hometeamsonline

- Carrier profile sheet form

- Transit order t1ncts porath customs agents form

- Plate tectonics earthquakes volcanoes review packet berkleyschools form

Find out other E 595e Fillable Form

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now