Application for Reduced User Fee for Installment Agreements Form

What is the Application For Reduced User Fee For Installment Agreements Form

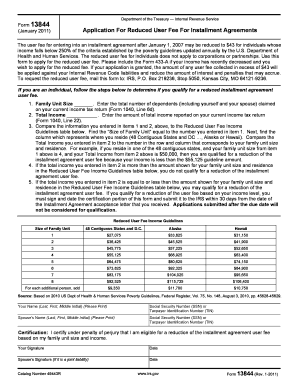

The Application For Reduced User Fee For Installment Agreements Form is a document used by individuals or businesses seeking to establish an installment agreement with the IRS while requesting a reduction in the user fee associated with that agreement. This form is particularly relevant for taxpayers who may face financial hardships and need to pay their tax liabilities over time. By submitting this application, taxpayers can potentially lower the costs associated with setting up a payment plan, making it more manageable to fulfill their tax obligations.

How to use the Application For Reduced User Fee For Installment Agreements Form

Using the Application For Reduced User Fee For Installment Agreements Form involves several steps. First, ensure that you meet the eligibility criteria for a reduced user fee. Next, complete the form accurately, providing all required information, including your personal details and financial situation. Once completed, submit the form to the IRS as part of your request for an installment agreement. It is essential to keep a copy of the submitted form for your records and follow up if you do not receive a response within a reasonable timeframe.

Steps to complete the Application For Reduced User Fee For Installment Agreements Form

Completing the Application For Reduced User Fee For Installment Agreements Form can be straightforward if you follow these steps:

- Gather necessary information, including your Social Security number, tax identification number, and details about your tax liabilities.

- Fill out the form, ensuring all sections are completed accurately. Pay special attention to your financial information, as it will be used to assess your eligibility for a reduced fee.

- Review the form for any errors or omissions before submission.

- Submit the form to the IRS, either online or by mail, depending on your preference and the instructions provided with the form.

Eligibility Criteria

To qualify for the reduced user fee for an installment agreement, taxpayers must meet specific eligibility criteria. Generally, these criteria include demonstrating financial hardship or being a low-income taxpayer. The IRS defines low-income taxpayers as those whose income is at or below a certain threshold, which may vary annually. It is important to review the IRS guidelines to ensure that you meet the necessary requirements before submitting your application.

Required Documents

When submitting the Application For Reduced User Fee For Installment Agreements Form, certain documents may be required to support your application. These documents typically include:

- Proof of income, such as recent pay stubs or tax returns.

- Documentation of any financial hardships, such as medical bills or unemployment notices.

- Any additional forms or information requested by the IRS related to your specific tax situation.

Form Submission Methods

The Application For Reduced User Fee For Installment Agreements Form can be submitted to the IRS through various methods. Taxpayers may choose to submit the form online via the IRS website, which may offer a quicker processing time. Alternatively, the form can be mailed to the appropriate IRS address listed in the form instructions. In some cases, in-person submissions may be possible at designated IRS offices, although this option may be limited based on location and availability.

Quick guide on how to complete application for reduced user fee for installment agreements form

Complete Application For Reduced User Fee For Installment Agreements Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Application For Reduced User Fee For Installment Agreements Form on any platform using airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

The easiest way to modify and eSign Application For Reduced User Fee For Installment Agreements Form without hassle

- Locate Application For Reduced User Fee For Installment Agreements Form and click on Obtain Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and holds the same legal weight as a conventional wet ink signature.

- Review all the information and click on the Finish button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form hunting, or errors that require printing new document versions. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Application For Reduced User Fee For Installment Agreements Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for reduced user fee for installment agreements form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Application For Reduced User Fee For Installment Agreements Form?

The Application For Reduced User Fee For Installment Agreements Form is a document that allows eligible individuals to request a lower user fee for setting up installment agreements with the IRS. This form helps ease financial burdens by reducing the fees associated with tax payments. Understanding how to correctly complete this form can signNowly impact your payment strategy.

-

How can airSlate SignNow assist with the Application For Reduced User Fee For Installment Agreements Form?

airSlate SignNow simplifies the process of sending and electronically signing the Application For Reduced User Fee For Installment Agreements Form. With our platform, you can easily fill out, sign, and send your application securely. Streamlining this process helps ensure that your form is submitted accurately and promptly, optimizing your chances of approval.

-

What features does airSlate SignNow offer for completing the Application For Reduced User Fee For Installment Agreements Form?

airSlate SignNow includes features such as customizable templates, secure e-signature capabilities, and mobile access, making it easier to manage the Application For Reduced User Fee For Installment Agreements Form. These tools enhance accessibility and streamline document workflows, ensuring that you can handle your forms efficiently from any device.

-

Is there a cost associated with using airSlate SignNow for the Application For Reduced User Fee For Installment Agreements Form?

Yes, there are various pricing plans available for airSlate SignNow, providing flexibility depending on your needs. Each plan includes access to features that simplify the completion of the Application For Reduced User Fee For Installment Agreements Form. Investing in our service can provide signNow time and cost savings in handling your documentation.

-

What are the benefits of using airSlate SignNow for tax-related documents like the Application For Reduced User Fee For Installment Agreements Form?

Using airSlate SignNow helps you reduce paper clutter, ensures compliance with IRS regulations, and improves turnaround time for documents such as the Application For Reduced User Fee For Installment Agreements Form. Additionally, our e-signature solution enhances security and provides users with a trail of document history for reference.

-

Can I use airSlate SignNow with other software for the Application For Reduced User Fee For Installment Agreements Form?

Absolutely! airSlate SignNow integrates seamlessly with many popular applications and platforms, enhancing your workflow when completing the Application For Reduced User Fee For Installment Agreements Form. You can easily connect with tools like Google Drive, Dropbox, and CRM systems to manage all your documents in one place.

-

How secure is my information when submitting the Application For Reduced User Fee For Installment Agreements Form via airSlate SignNow?

airSlate SignNow prioritizes the security of your documents and personal information when handling the Application For Reduced User Fee For Installment Agreements Form. Our platform employs state-of-the-art encryption and complies with industry-standard security practices to protect your data from unauthorized access.

Get more for Application For Reduced User Fee For Installment Agreements Form

- Frontenac parent teacher organization funds request form

- Get ambucs form

- Tjhsst pre arranged absence form updated tjhsst

- Policy number commercial general liability cg 20 10 07 04 this endorsement changes the policy form

- Fedex retiree discount shipping privilege request form

- Mechanical bull ride release of liability form

- Residential input form space coast page 1 of 4 listing

- Solicitud inscripcion form

Find out other Application For Reduced User Fee For Installment Agreements Form

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation