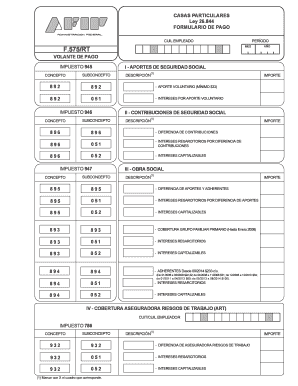

Formulario 575

What is the Formulario 575

The Formulario 575, often referred to as the F-575, is a tax form used in the United States to report specific financial information to the Internal Revenue Service (IRS). This form is essential for individuals and businesses to ensure compliance with tax regulations. It is typically associated with income reporting and may be required for various types of taxpayers, including self-employed individuals and corporations.

How to use the Formulario 575

Using the Formulario 575 involves a few straightforward steps. First, gather all necessary financial documents, including income statements and any relevant deductions. Next, accurately fill out the form, ensuring that all information is correct and complete. After completing the form, it can be submitted either electronically or via mail, depending on your preference and the specific requirements set by the IRS.

Steps to complete the Formulario 575

Completing the Formulario 575 requires careful attention to detail. Follow these steps:

- Review the form instructions to understand the requirements.

- Collect all necessary documentation, such as W-2s or 1099s.

- Fill out the form, ensuring all sections are completed accurately.

- Double-check your entries for any errors or omissions.

- Submit the form by the specified deadline, either online or by mail.

Legal use of the Formulario 575

The Formulario 575 is legally binding when completed and submitted according to IRS guidelines. To ensure its legal validity, it must be filled out accurately and submitted on time. Failure to comply with these regulations can result in penalties or delays in processing. Utilizing a reliable e-signature platform, such as signNow, can further enhance the legitimacy of your submission by providing secure and verifiable electronic signatures.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Formulario 575. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for individual taxpayers. However, if you are self-employed or filing for a business entity, different deadlines may apply. Always check the IRS website or consult a tax professional for the most current dates and any extensions that may be available.

Form Submission Methods (Online / Mail / In-Person)

The Formulario 575 can be submitted through various methods, offering flexibility for taxpayers. You can file the form online using the IRS e-file system, which is often the quickest option. Alternatively, you may choose to print the form and mail it to the appropriate IRS address. In certain cases, in-person submission may be possible at designated IRS offices, but this is less common. Ensure you choose the method that best suits your needs and complies with IRS regulations.

Quick guide on how to complete formulario 575

Prepare Formulario 575 effortlessly on any gadget

Online document administration has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, allowing you to access the necessary form and securely save it on the web. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage Formulario 575 on any device with airSlate SignNow's Android or iOS applications and enhance any document-centered operation today.

How to modify and eSign Formulario 575 without hassle

- Find Formulario 575 and click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature with the Sign tool, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to distribute your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new copies of documents. airSlate SignNow meets all your requirements in document management in just a few clicks from any device of your preference. Alter and eSign Formulario 575 and guarantee outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the formulario 575

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 575 and why is it important?

Form 575 is a crucial document used for various business operations, often related to taxation and compliance. Understanding how to efficiently manage and eSign form 575 is vital for ensuring timely submissions and avoiding penalties. airSlate SignNow offers a seamless solution for filling out and signing this important form.

-

How does airSlate SignNow simplify the signing process for form 575?

airSlate SignNow provides an intuitive platform to digitally sign and send form 575, making the process quick and hassle-free. With features like templates and automated workflows, users can manage their forms with ease. This ensures that businesses can focus on their core activities while handling form 575 efficiently.

-

What are the pricing options for using airSlate SignNow for form 575?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes looking to efficiently manage form 575. You can choose a plan that suits your budget and needs, ensuring cost-effectiveness without compromising on functionality. Visit our pricing page for detailed information.

-

Can I integrate airSlate SignNow with other applications for managing form 575?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing you to manage form 575 in conjunction with your existing workflows. Whether you use CRM tools, collaboration platforms, or cloud storage services, our integrations streamline the process. This enhances efficiency and keeps all your document management in one place.

-

What benefits does using airSlate SignNow for form 575 offer?

Using airSlate SignNow for form 575 provides numerous benefits, including reducing processing time and enhancing security with encrypted eSigning. Additionally, the platform allows for tracking and audit trails, ensuring compliance and accessibility. Overall, it’s a cost-effective solution to increasing productivity.

-

Is it easy to use airSlate SignNow for someone unfamiliar with form 575?

Absolutely! airSlate SignNow is designed to be user-friendly, even for those unfamiliar with form 575. The interface guides users through the signing and sending process with simple steps and helpful tutorials. This ensures that everyone can navigate the platform with confidence.

-

How does airSlate SignNow ensure the security of my form 575?

Security is a top priority at airSlate SignNow when handling form 575. The platform uses advanced encryption and secure cloud storage to protect sensitive information. Additionally, users benefit from multifactor authentication to further safeguard their documents.

Get more for Formulario 575

Find out other Formulario 575

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document