Form 14196 2010-2026

What is the Form 14196

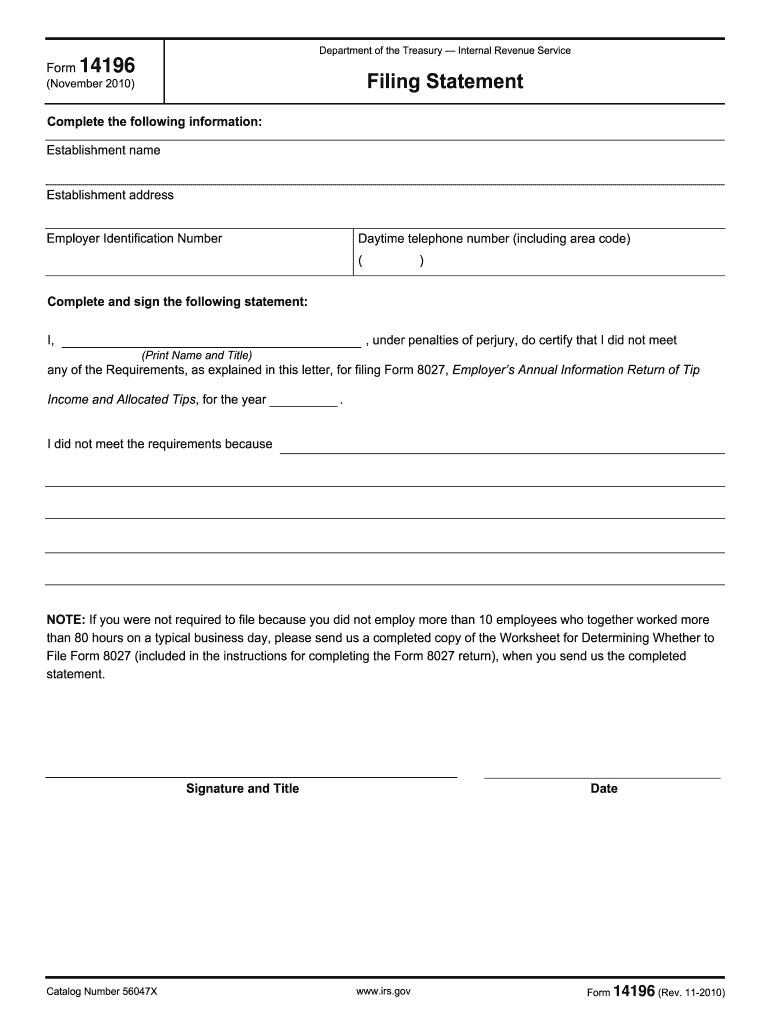

The IRS 14196 form, also known as the 14196 statement, is a document used primarily for tax purposes. It is often associated with the executive order 14196, which outlines specific guidelines for reporting and compliance. This form is essential for individuals and businesses to ensure they meet their tax obligations accurately and timely. Understanding the purpose and requirements of the 14196 form is crucial for maintaining compliance with IRS regulations.

How to use the Form 14196

Utilizing the IRS 14196 form involves several steps to ensure proper completion and submission. First, assess the specific requirements outlined by the IRS for your situation. Gather all necessary information and documentation that may be needed to complete the form accurately. Once you have the required data, fill out the form, ensuring that all fields are completed as instructed. After completing the form, review it for accuracy before submission to avoid delays or penalties.

Steps to complete the Form 14196

Completing the IRS 14196 form requires a systematic approach to ensure all information is accurately provided. Follow these steps:

- Review the form instructions carefully to understand the requirements.

- Gather all necessary documents and information needed to fill out the form.

- Complete each section of the form, paying attention to detail.

- Double-check all entries for accuracy and completeness.

- Submit the form according to the specified submission methods.

Legal use of the Form 14196

The legal use of the IRS 14196 form is critical for ensuring compliance with federal tax laws. To use the form legally, it must be filled out with accurate and truthful information. Submitting outdated or incorrect forms can lead to penalties or legal repercussions. It is important to stay informed about any changes in regulations that may affect the use of this form and to ensure that you are using the most current version available.

Form Submission Methods

Submitting the IRS 14196 form can be done through various methods, depending on the guidelines provided by the IRS. Common submission methods include:

- Online submission: If allowed, this method provides a quick and efficient way to submit your form.

- Mail: You can send the completed form via postal service to the designated IRS address.

- In-person: Some individuals may opt to submit the form in person at an IRS office, ensuring immediate confirmation of receipt.

Filing Deadlines / Important Dates

Filing deadlines for the IRS 14196 form are crucial to avoid penalties. It is important to be aware of the specific dates relevant to your tax situation. Generally, forms must be submitted by the designated tax deadlines, which can vary based on individual circumstances. Keeping track of these dates ensures timely compliance and helps avoid unnecessary complications with the IRS.

Quick guide on how to complete form 14196 11 2010 filling statement

Unveil the simplest method to complete and authorize your Form 14196

Are you still squandering time generating your official documents on paper instead of online? airSlate SignNow offers a superior alternative to complete and authorize your Form 14196 and associated forms for public services. Our intelligent electronic signature solution equips you with everything required to manage documentation swiftly and in alignment with official standards - robust PDF editing, management, protection, signing, and sharing tools are all available within a user-friendly interface.

Only a few steps are necessary to finalize and authorize your Form 14196:

- Load the fillable template into the editor via the Get Form button.

- Determine what details you need to input in your Form 14196.

- Move between the fields using the Next option to ensure nothing is overlooked.

- Employ Text, Check, and Cross tools to complete the fields with your information.

- Update the content with Text boxes or Images from the top toolbar.

- Emphasize what is essential or Blackout areas that are no longer relevant.

- Click on Sign to create a legally binding electronic signature using any method you prefer.

- Add the Date next to your signature and conclude your task with the Done button.

Store your completed Form 14196 in the Documents folder within your account, download it, or transfer it to your preferred cloud storage. Our solution also offers adaptable file sharing. There’s no need to print your forms when you need to submit them to the relevant public office - accomplish it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Experience it today!

Create this form in 5 minutes or less

FAQs

-

How do I fill out the P.11 form for UNDP?

How to Fill in Personal History Form

-

How do I fill out the form for PU class 11 in Jawahar Navodaya?

Visit your nearest navodaya and enquire about the available vacancies and apply there itself. Form isn't available online

-

What percent is required in class 11 to fill out the NEET application form?

For eligibility in neet the criteria for marks:The candidate must have passed in the subjects of Physics, Chemistry, Biology/Bio-technology and English individually and must have obtained a minimum of 50% marks taken together in Physics, Chemistry and Biology/ Bio-technology at the qualifying examination.In respect of candidates belonging to Scheduled Caste/Scheduled Tribes or Other Backward Classes, the marks obtained in Physics, Chemistry and Biology/Bio-technology taken together in qualifying examination be 40% instead of 50% for General Candidates.Further, for persons for locomotory disability of lower limbs, the minimum of 45% marks for General-PH and 40% marks for SC-PH/ST-PH/OBC-PH are requiredThis is regarding your 12th boards. So the 11th marks do not count for neet application form or eligibility.Coming to your question the minimum marks would be the passing marks set by your school/college to be promoted to 12thGood luck!

-

What are the documents required to fill out the AMU Class 11 form?

HOW TO OBTAIN AND FILL THE APPLICATION FORMThe prescribed Application Forms and the Guide to Admissions containing details of courses areavailable on the following website:-amucontrollerexams.comThe application Form is to be filled ONLINE, i.e. the candidates have to fill the Application Formdirectly on the website.(a)Before filling up the Application Form, candidates are required to read instructions carefullygiven in every step as available in the online portal.(b)Candidates have to fill the Application Form directly on the website and make onlinepayment. (There is no need to submit the physical copy of the Application Form)(c) Details of Admission Test Fee / Processing Charges: Details about the TestFee/Processing charges is available on the relevant pages in this Guide, Only Onlinepayment mode is available for depositing the Test Fee/Processing charges. The onlinepayment detail will automatically be posted in the respective column of the Application form.The Physically Challenged candidates having 40% disability are exempted from theProcessing Charges / Test Fee, however the candidates will have to produce relevantdocuments in support of their claim else their candidature may be rejected at any time.BASIC STEPS TO BE FOLLOWED IN ONLINE SUBMISSION OF APPLICATION FORMRegistering as a new user:1. The candidate should register online and provide his / her correct and functional emailbecause the username and password etc. will be sent on this email.2. Please note every candidate will register separately and will get his/her username andpassword to access his/her Dashboard for filling as well as tracking the form(s).3. Only Single Registration is sufficient for applying to the multiple courses by a candidate.S. No. . Registration1 Username Choose a username2 Password Enter your password3 Re-Enter Password Re-enter your password4 Email Enter your valid & functional email address5 Name of theCandidateEnter the full name of the candidate in capital lettersexactly as mentioned in his/her High School / SecondarySchool Certificate. Do not use Mr / Master / Ms / Miss etc.before the name.Signing in to a registered account:1. The candidate shall login using his/her username and password. Dashboard of thecandidate will be available to him/her for filling the form.2. In case the candidate has lost/forgot his/her password, Forgot Password link should beused to get the same on the registered email.Updating Profile of the Candidate:1. The candidate should fill his/her Profile carefully. Fields marked with asterisk aremandatory.2. After saving the Profile, the candidate will be asked to review and confirm that theparticulars entered are correct.3. Candidate will not be able to Edit/Update his/her Profile after confirmation.4. If a candidate finds any mistake in his/her Profile after confirmation, then he/she will have tore-register with different Username and Password to complete all the entries afresh.Sr. No. Profile1 Username* Prefilled as given at the time of registration2 Email* Prefilled as given at the time of registration3 Name of the Candidate* Prefilled as given at the time of registration4 Alternate Email Specify an alternate email of the candidate5 Aadhaar No Specify the AADHAAR number of the candidate6 Mother's Name* Write the full name of candidate’s mother as mentionedin the High School/ Secondary School Certificate. Donot use Mrs / Dr / Smt etc. before the name.7 Father's Name* Write the full name of candidate’s father as mentionedin the High School/ Secondary School Certificate. Donot use Mr / Dr / Shri etc. before the name.8 Date of Birth* Specify the date of birth of the candidate (in ChristianEra) as recorded in the High School/ SecondarySchool Certificate/ Birth Certificate.9 Gender* Select the gender of the candidate (Male or Female).10 Mobile No.* Specify the valid mobile number of the candidate11 Alternate Mobile No. Specify the alternate mobile number of the candidate12 CorrespondenceAddress*Specify the complete mailing address of the candidateincluding Pin Code.13 Permanent Address* Specify the complete permanent address of thecandidate including Pin Code.14 Nationality* Specify the nationality of the candidate.15 Religion* Specify the religion of the candidate (for statisticalpurposes only)16 Hostel Accommodationrequired*Write ‘Yes’ if hostel accommodation is required,otherwise write ‘No’Updating Educational Qualification of the candidate:1. Candidate should fill details of his/her educational qualifications by providing the name of allexaminations passed, including qualifying examination, year of passing, Examination RollNo., University/Board from where passed, and the percentage/CGPA obtained.2. If the result of examination (including qualifying examination) is awaited, fill in all thecolumns except marks column and write "RA" in Results columnUploading Photo, Signature & Thumb Impression of the candidate:1. Candidate should have scanned copy of his/her latest front facing good quality coloredPhoto with white background, signature & Thumb Impression (Left Thumb Impression only)in JPG/JPEG format ONLY for uploading on the website.2. Canddate should not upload the photo, signature or thumb impression of any other personas any mismatch may result in cancellation of his/her Application/Admission at any stage,even if he/she qualified for admission. (Note: Signature establishes the identity of thecandidate. Hence, the candidate should not merely write his/her name in capital letters.This may lead to rejection of his/her application.)3. Please note that file extension names such as filename.BMP, filename.PNG, orfilename.TIFF are not acceptable. Candidates are advised not to rename files withBMP/PNG/TIFF/etc. to JPG/JPEG. If file is not in JPG or JPEG format convert them toJPG/JPEG format using appropriate software (e.g, Paint) instead of just renaming the fileextension.4. The size of each image must be between 20 KB and 200 KB.5. Candidate will ensure to keep 10 copies of the uploaded photo with him/her as the samewill be needed at the time of admission, if the candidate is selected.Special categories claimed by the candidate:1. Eligible candidate may select any applicable special category if he/she wishes to beconsidered for admission/nomination under that category. For details refer to Table-III2. The candidate should follow the step-wise instruction as they appear in the selection ofcategories upto a maximum of 3 categories per Application Form.3. Candidate will have no right to be considered for admission/nomination under a specialcategory if the same is not claimed in the Application Form.4. It is mandatory to select "NO" if the candidate does not belong to any Special Category.5. It is to be noted that all such candidates will be required to produce necessary documentaryproof in support of special categories claimed, if offered admission.Documents to be uploaded by the candidate:1. Scanned copy of date of birth certificate/High School Certificate of the candidate.2. Scanned copy of Marks-sheet / grade-sheet of qualifying examination. (If the Marks-sheet /grade-sheet of qualifying examination is not available, the Marks-sheet / grade-sheetpassed in the preceding year should be uploaded)3. Scanned copy of documents in support of claim under special category, if any.4. Scanned copy of valid GATE Score Card (applicable only for candidates applying foradmission to M.Tech. courses in the Faculty of Engineering & Technology).5. Scanned copy of documents in support of Professional Experience, if any (applicable onlyfor candidates applying for admission to B.E course in the Faculty of Engineering &Technology).6. Scanned copy of No Objection Certificate from the employer, if employed at present.Note: It is to be ensured that all documents should be uploaded in JPG/JPEG format onlyand their individual size should lie between 200KB to 2MB.Applying for a course/class and making payment:1. This step has two components- Application & Payment: (i) Filling specific Application detailsfor respective course and (ii) Payment of Test fee/Processing charges online. It is to benoted that both components of this Step must be completed in one go otherwise theapplication will stand incomplete and applicants will have to re-apply this Step.2. Candidate must ensure that he/she is eligible to apply for the Course of study forwhich application is being submitted as the Test Fee/Processing charges are non-refundable.3. Test fee/Processing fee is to be paid ONLINE only. The candidate should keep readyhis/her Net Banking/Debit Card/Credit Card details and follow the instructions available onthe website to make payment. It is to be ensured that correct amount of processing chargesis displayed on the generated PDF. If not, then follow Refresh Payment by visiting theDashboard/Home menu and generate the PDF again with correct amount.4. No corrections are allowed after submission of online forms. In case corrections isnecessary such candidates may create new user login and fill the form again and pay theprocessing charges as usual.For better information contact /whatsapp9811797572 Naseem Ahmad

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

What are the good ways to fill out 1120 form if my business is inactive?

While you might not have been “active” throughout the year, by filing a “no activity” return you may be throwing away potential deductions! Most businesses (even unprofitable ones) will have some form of expenses – think tax prep fees, taxes, filing fees, home office, phone, etc. Don’t miss out on your chance to preserve these valuable deductions. You can carry these forward to more profitable years by using the Net Operating Loss Carry-forward rules. But you must report them to take advantage of this break. If you honestly did not have any expenses or income during the tax year, simply file form 1120 by the due date (no later than 2 and one half months after the close of the business tax year – March 15 for calendar year businesses). Complete sections A-E on the front page of the return and make sure you sign the bottom – that’s it!

-

Do I need to fill out a financial statement form if I get a full tuition waiver and RA/TA?

If that is necessary, the university or the faculty will inform you of that. These things can vary from university to university. Your best option would be to check your university website, financial services office or the Bursar office in your university.

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

Create this form in 5 minutes!

How to create an eSignature for the form 14196 11 2010 filling statement

How to create an eSignature for your Form 14196 11 2010 Filling Statement in the online mode

How to generate an electronic signature for the Form 14196 11 2010 Filling Statement in Chrome

How to generate an eSignature for signing the Form 14196 11 2010 Filling Statement in Gmail

How to create an electronic signature for the Form 14196 11 2010 Filling Statement straight from your smartphone

How to generate an electronic signature for the Form 14196 11 2010 Filling Statement on iOS devices

How to generate an eSignature for the Form 14196 11 2010 Filling Statement on Android OS

People also ask

-

What is the IRS 14196 form and how can airSlate SignNow help with it?

The IRS 14196 form, also known as the 'Application for the Filing of Returns,' is essential for certain tax-related processes. airSlate SignNow simplifies the process of filling out, signing, and submitting the IRS 14196 form, ensuring that businesses can manage their tax documents seamlessly and securely.

-

Is airSlate SignNow affordable for small businesses needing the IRS 14196 form?

Yes, airSlate SignNow offers cost-effective pricing plans tailored for small businesses. By providing a user-friendly platform to manage documents like the IRS 14196 form, businesses can save both time and money while ensuring compliance with IRS regulations.

-

Can I edit the IRS 14196 form using airSlate SignNow?

Absolutely! With airSlate SignNow, you can easily edit the IRS 14196 form before sending it for eSignature. The platform allows users to customize fields, add text, and ensure all necessary information is accurately captured, making it ideal for tax-related submissions.

-

How does airSlate SignNow ensure the security of my IRS 14196 form submissions?

airSlate SignNow employs advanced security measures to protect your IRS 14196 form submissions. With end-to-end encryption, secure cloud storage, and compliance with industry standards, your sensitive documents remain safe throughout the signing process.

-

Are there any integrations available with airSlate SignNow for managing the IRS 14196 form?

Yes, airSlate SignNow integrates with various applications, facilitating efficient document management for the IRS 14196 form. This means you can streamline your workflow by connecting with tools you already use, enhancing productivity and collaboration.

-

What features does airSlate SignNow offer for the IRS 14196 form?

airSlate SignNow provides a range of features specifically designed for managing the IRS 14196 form, including eSigning, document tracking, and automated reminders. These tools help ensure timely submission and comprehensive oversight of your tax documents.

-

How can airSlate SignNow help me track the status of my IRS 14196 form?

With airSlate SignNow, you can easily track the status of your IRS 14196 form throughout the signing process. Our platform provides real-time updates and notifications, ensuring you are informed at every step until the document is finalized.

Get more for Form 14196

- 1040 u s individual income tax return filing status exemptions irs form

- Draft form lpk berusia 16 tahun atau lebih dicetak via sf205

- Class reunion registration form template word

- Serbia visa application for citizens of ghana serbia visa application for citizens of ghana form

- Demande de divorce formulaire a imprimer fill online

- Flow sheet template 207156704 form

- Brazoria county homestead exemption form

- Babysitting agreement template form

Find out other Form 14196

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple