CT MLS MULTI FAMILY Listing Input Form Filesusmrecom

Understanding the CT MLS Multi Family Listing Input Form

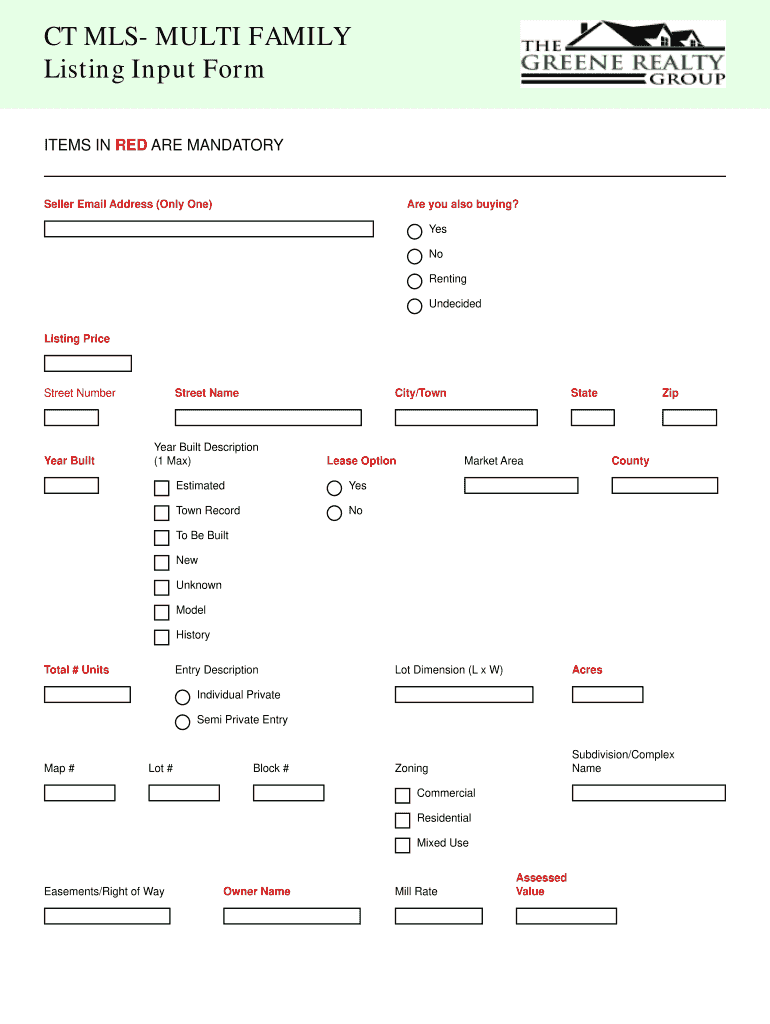

The CT MLS Multi Family Listing Input Form is a specialized document used by real estate professionals in Connecticut to list multi-family properties. This form captures essential details about the property, including its location, number of units, amenities, and pricing. Proper completion of this form is crucial for ensuring that listings are accurate and comply with local regulations.

Steps to Complete the CT MLS Multi Family Listing Input Form

Filling out the CT MLS Multi Family Listing Input Form involves several key steps:

- Gather all necessary property information, including the address, number of units, and property features.

- Access the form through the CT MLS website or authorized platforms.

- Fill in the required fields accurately, ensuring that all information is current and complete.

- Review the form for any errors or omissions before submission.

- Submit the form electronically or as instructed by the CT MLS guidelines.

Legal Use of the CT MLS Multi Family Listing Input Form

Using the CT MLS Multi Family Listing Input Form legally requires adherence to specific regulations governing real estate transactions in Connecticut. This includes ensuring that all provided information is truthful and that the form is submitted in compliance with state laws. Misrepresentation or failure to comply with these regulations can lead to penalties or legal action.

Key Elements of the CT MLS Multi Family Listing Input Form

The form includes several critical components that must be filled out:

- Property Address: The complete address of the multi-family property.

- Unit Details: Information about the number of units and their features.

- Amenities: Details about any additional amenities available to tenants.

- Pricing Information: Listing price and rental rates for each unit.

- Contact Information: Details of the listing agent or agency responsible for the property.

Obtaining the CT MLS Multi Family Listing Input Form

The CT MLS Multi Family Listing Input Form can be obtained through the Connecticut Multiple Listing Service website. Real estate agents and brokers must have an active membership to access the form. It is also available through various real estate platforms that integrate with CT MLS, ensuring that users have the most up-to-date version of the form.

Examples of Using the CT MLS Multi Family Listing Input Form

Real estate professionals utilize the CT MLS Multi Family Listing Input Form in various scenarios, such as:

- Listing a newly acquired multi-family property for sale.

- Updating an existing listing with new information or changes in pricing.

- Submitting a property for rental listings to attract potential tenants.

Quick guide on how to complete ct mls multi family listing input form filesusmrecom

The optimal approach to obtain and endorse CT MLS MULTI FAMILY Listing Input Form Filesusmrecom

On the scale of your complete organization, ineffective procedures surrounding paper authorization can consume substantial working hours. Endorsing documents like CT MLS MULTI FAMILY Listing Input Form Filesusmrecom is an inherent part of operations in any organization, which is why the effectiveness of every agreement’s lifecycle signNowly impacts the overall performance of the company. With airSlate SignNow, endorsing your CT MLS MULTI FAMILY Listing Input Form Filesusmrecom can be as simple and rapid as possible. You will discover on this platform the latest version of almost any form. Even better, you can endorse it right away without the necessity of installing external applications on your computer or printing anything out as physical documents.

How to obtain and endorse your CT MLS MULTI FAMILY Listing Input Form Filesusmrecom

- Explore our collection by category or utilize the search box to find the form you require.

- Examine the form preview by clicking Learn more to confirm it is the right one.

- Press Get form to begin editing immediately.

- Fill out your form and include any necessary information using the toolbar.

- When completed, click the Sign tool to endorse your CT MLS MULTI FAMILY Listing Input Form Filesusmrecom.

- Select the signature method that is most suitable for you: Draw, Generate initials, or upload an image of your handwritten signature.

- Click Done to finalize editing and move on to document-sharing options if needed.

With airSlate SignNow, you possess everything required to handle your documentation efficiently. You can find, fill out, edit, and even send your CT MLS MULTI FAMILY Listing Input Form Filesusmrecom in a single tab without any complications. Optimize your procedures by utilizing a unified, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How can you get your family doctor to fill out a disability form?

Definitely ask for a psychologist referral! You want someone on your side who can understand your issues and be willing and eager to advocate for you with the beancounters because disability can be rather hard to get some places, like just south of the border in America.Having a psychologist means you have a more qualified specialist filling out your papers (which is a positive for you and for the government), and it means you can be seeing someone who can get to know your issues in greater depth and expertise for further government and non-profit organization provided aid.If seeing a psychologist on a regular basis is still too difficult for you, start with your initial appointment and then perhaps build up a rapport with a good therapist through distanced appointments (like via telephone, if that is easier) until you can be going into a physical office. It would probably look good on the form if your psychologist can truthfully state that you are currently seeking regular treatment for your disorders because of how serious and debilitating they are.I don't know how disability in Canada works, but I have gone through the process in the US, and specifically for anxiety and depression, like you. Don't settle for a reluctant or wishywashy doctor or psychologist, especially when it comes to obtaining the resources for basic survival. I also advise doing some internet searches on how to persuasively file for disability in Canada. Be prepared to fight for your case through an appeal, if it should come to that, and understand the requirements and processes involved in applying for disability by reading government literature and reviewing success stories on discussion websites.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

How can we track our visitors conversion/drop off when the visitor actually fills out fields on a form page outside of our site domain (Visitor finds listing in SERPS, hits our site, jumps to client site to complete form)?

The short answer: You can't unless the client site allows you to do so. A typical way to accomplish measuring external conversions is to use a postback pixels. You can easily google how they work - in short you would require your client to send a http request to your tracking software on the form submit. A good way to do this in practice is to provide an embedable form to your clients that already includes this feature and sends along a clientID with the request, so that you can easily see which client generates how many filled out forms.

-

How do I get admission to TU if I have qualified for the JEE Mains? I am from Assam, and I want to do so under the state quota. Will there be any state rank list to be released, or do I have fill out any form?

If you haven't filled up any form then I am not sure if you are gonna get any chance now….This is the procedure they follow--- after you have qualified in JEE-MAINS. You have to fill up a form through which they come to know that you have qualified. Then they give a list of student according to their ranks (both AIR & state ranks). Then according to that there's three list A,B & C in which there's all the quota and all. And they relaese one list in general. According to that list theu release a date of your counselling .Note- The form fillup is must.

Create this form in 5 minutes!

How to create an eSignature for the ct mls multi family listing input form filesusmrecom

How to generate an electronic signature for the Ct Mls Multi Family Listing Input Form Filesusmrecom in the online mode

How to generate an eSignature for the Ct Mls Multi Family Listing Input Form Filesusmrecom in Chrome

How to create an eSignature for signing the Ct Mls Multi Family Listing Input Form Filesusmrecom in Gmail

How to create an eSignature for the Ct Mls Multi Family Listing Input Form Filesusmrecom from your smart phone

How to make an electronic signature for the Ct Mls Multi Family Listing Input Form Filesusmrecom on iOS devices

How to make an electronic signature for the Ct Mls Multi Family Listing Input Form Filesusmrecom on Android OS

People also ask

-

What is ctmls and how does it relate to airSlate SignNow?

CTMLS, or 'Cloud Transacted Multi-Layer Signing', is a technology used by airSlate SignNow to enhance the signing experience. It allows for secure and efficient electronic signatures that facilitate document transactions. With ctmls, users can ensure compliance and streamline their workflows.

-

How does airSlate SignNow's pricing compare for ctmls features?

AirSlate SignNow offers competitive pricing plans that include essential ctmls features. These plans are designed to suit different business sizes and needs, providing both affordability and scalability. By using ctmls, businesses can maximize their investment in e-signature solutions.

-

What are the key benefits of using airSlate SignNow with ctmls?

By leveraging ctmls, airSlate SignNow provides numerous benefits including enhanced security and reliability in document signing. Users can manage and track their signing processes seamlessly, reducing turnaround times. This results in improved efficiency and customer satisfaction across various business operations.

-

Can airSlate SignNow integrate with other software when using ctmls?

Yes, airSlate SignNow can be integrated with various software applications while utilizing ctmls. Popular integrations include CRM systems, document management tools, and workflow automation platforms. This interoperability allows businesses to enhance their document processes effectively.

-

Is airSlate SignNow suitable for international use with ctmls?

Absolutely! AirSlate SignNow and its ctmls capabilities are designed for global use. The platform supports multiple languages and complies with international e-signature laws, making it an ideal choice for businesses operating across borders.

-

How secure is the ctmls technology in airSlate SignNow?

CTMLS security within airSlate SignNow is top-notch, employing robust encryption and advanced security protocols. This ensures that your signed documents remain confidential and tamper-proof. Users can have peace of mind knowing that their data is protected at all times.

-

What types of documents can be signed using ctmls on airSlate SignNow?

AirSlate SignNow allows users to sign a wide variety of documents through its ctmls technology. This includes contracts, agreements, and forms across different industries. It provides the flexibility needed for any business to handle their signing requirements efficiently.

Get more for CT MLS MULTI FAMILY Listing Input Form Filesusmrecom

Find out other CT MLS MULTI FAMILY Listing Input Form Filesusmrecom

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors