W9 for Security Deposit Nj Form

What is the W-9 for security deposit?

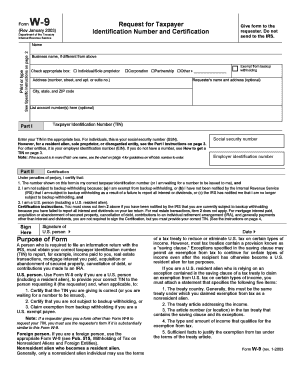

The W-9 form is an Internal Revenue Service (IRS) document used in the United States to provide taxpayer information to individuals or entities that are required to report income paid to the IRS. Specifically, when it comes to security deposits, landlords may request tenants to fill out a W-9 form to collect necessary information for tax reporting purposes. This includes the tenant's name, address, and taxpayer identification number (TIN), which can be a Social Security number or Employer Identification Number (EIN).

How to use the W-9 for security deposit?

Using the W-9 form for security deposits involves a few straightforward steps. First, the landlord provides the W-9 form to the tenant. The tenant must then complete the form accurately, ensuring all required fields are filled out, including their name, business name (if applicable), address, and TIN. Once completed, the tenant returns the signed W-9 to the landlord. This form is crucial for the landlord, as it helps in reporting any interest earned on the security deposit to the IRS.

Steps to complete the W-9 for security deposit

Completing the W-9 form for a security deposit involves several key steps:

- Obtain the Form: Access the W-9 form from the IRS website or request it from your landlord.

- Fill Out Personal Information: Provide your name, business name (if applicable), and address in the designated fields.

- Enter Taxpayer Identification Number: Include your Social Security number or Employer Identification Number.

- Certification: Sign and date the form to certify that the information provided is accurate.

- Return the Form: Submit the completed W-9 to your landlord as instructed.

Legal use of the W-9 for security deposit

The W-9 form is legally recognized as a valid document for collecting taxpayer information. Landlords use this form to ensure compliance with IRS regulations regarding income reporting. When a tenant provides a W-9, it allows the landlord to accurately report any interest accrued on the security deposit. It is important for both parties to understand that the information provided on the W-9 must be truthful and complete, as inaccuracies can lead to penalties or issues with the IRS.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the W-9 form. According to these guidelines, the form should be used when a landlord needs to report payments made to contractors or individuals, including interest on security deposits. It is essential for landlords to maintain accurate records of all W-9 forms received, as they may need to reference them during tax season. Additionally, tenants should be aware that the information on the W-9 may be shared with the IRS, making it crucial to provide accurate details.

Who fills out the W-9, landlord or tenant?

In the context of a security deposit, it is typically the tenant who fills out the W-9 form. The landlord requests this form to obtain the necessary taxpayer information from the tenant. By completing the W-9, the tenant provides the landlord with the required details to report any interest earned on the security deposit to the IRS. It is important for tenants to ensure that the information they provide is accurate and up to date.

Quick guide on how to complete w9 for security deposit nj

Accomplish W9 For Security Deposit Nj effortlessly on any device

Digital document management has become prevalent among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage W9 For Security Deposit Nj on any platform with airSlate SignNow Android or iOS applications and simplify any document-centered process today.

The simplest method to modify and electronically sign W9 For Security Deposit Nj with ease

- Find W9 For Security Deposit Nj and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow supplies specifically for that task.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tiresome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your needs in document management in a few clicks from any device of your choice. Modify and electronically sign W9 For Security Deposit Nj and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w9 for security deposit nj

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Who fills out a W9, the landlord or tenant?

In general, the tenant fills out the W9 form when they are required to provide their taxpayer information for rental purposes. The landlord typically requests this information to report the rental income to the IRS. It's vital to clarify who is responsible for completing the form to avoid confusion.

-

What is the purpose of the W9 form in rental agreements?

The W9 form is essential for providing accurate tax information. It helps landlords collect necessary details from tenants for tax reporting and ensures compliance with IRS regulations. Understanding who fills out a W9 landlord or tenant helps streamline this process.

-

How can airSlate SignNow assist in managing W9 forms?

airSlate SignNow makes it easy to manage W9 forms with its user-friendly electronic signing platform. Landlords can quickly send W9 requests to tenants, receive completed forms, and store them securely. This efficient process saves time and enhances organization.

-

What features does airSlate SignNow offer for rental documentation?

airSlate SignNow includes features like document templates, electronic signatures, and secure storage. These tools simplify the process of completing rental agreements and related forms such as W9s. Choosing the right service ensures all parties fulfill their tax responsibilities seamlessly.

-

Is airSlate SignNow cost-effective for landlords?

Yes, airSlate SignNow offers a cost-effective solution for landlords managing numerous rental agreements. With its affordable pricing plans, landlords can easily send and eSign W9 forms and other documents without breaking the bank. It’s a smart investment for streamlining rental operations.

-

Can I integrate airSlate SignNow with other platforms?

Absolutely! airSlate SignNow integrates smoothly with various platforms, enhancing its functionality for landlords and tenants. This means you can streamline your workflow by linking your favorite tools while managing who fills out a W9 landlord or tenant efficiently.

-

What are the benefits of using electronic signatures for W9 forms?

Using electronic signatures for W9 forms offers security, speed, and convenience. Both landlords and tenants can sign documents from anywhere, reducing delays in the process. Understanding who fills out a W9 landlord or tenant becomes easier with accessible and fast methods.

Get more for W9 For Security Deposit Nj

Find out other W9 For Security Deposit Nj

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed