Dtf 406 Form

What is the Dtf 406

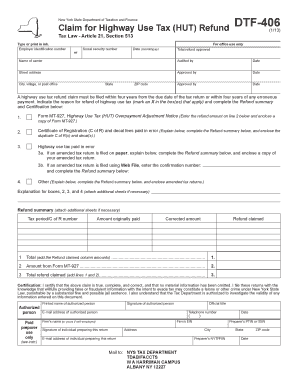

The Dtf 406 form is a crucial document used in the state of New York for tax purposes. Specifically, it is utilized for claiming a refund of New York State income tax withheld from wages or other payments. This form is essential for individuals who believe they have overpaid their state income taxes and seek to recover those funds. Understanding the Dtf 406 is vital for ensuring compliance with state tax regulations and for facilitating the refund process.

How to use the Dtf 406

Using the Dtf 406 involves several straightforward steps. First, you need to accurately fill out the form with your personal information, including your name, address, and Social Security number. Next, provide details about the income from which the tax was withheld. It is important to include the exact amount of tax withheld, as this will determine the refund amount you are eligible to receive. After completing the form, you can submit it to the appropriate tax authority for processing.

Steps to complete the Dtf 406

Completing the Dtf 406 requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather all necessary documents, including your W-2 forms and any other relevant tax statements.

- Fill in your personal information at the top of the form, ensuring it matches your identification documents.

- Report the total amount of New York State income tax withheld from your income.

- Double-check all entries for accuracy to avoid delays in processing your refund.

- Sign and date the form before submission.

Legal use of the Dtf 406

The Dtf 406 is legally binding when completed correctly and submitted in accordance with New York State tax laws. It is essential that all information provided is truthful and accurate to avoid penalties or legal issues. The form must be submitted within the designated time frame to ensure that your claim for a refund is considered valid. Compliance with all state regulations will protect your rights as a taxpayer and facilitate a smoother refund process.

Who Issues the Form

The Dtf 406 form is issued by the New York State Department of Taxation and Finance. This governmental agency is responsible for overseeing tax collection and ensuring compliance with state tax laws. The department provides resources and guidance for taxpayers to help them understand their obligations and rights regarding state income tax. For any inquiries or assistance regarding the Dtf 406, contacting the Department of Taxation and Finance is recommended.

Filing Deadlines / Important Dates

Filing deadlines for the Dtf 406 are crucial to ensure that your refund claim is processed timely. Typically, the form must be filed within three years from the date the tax was withheld. It is important to keep track of these deadlines to avoid missing out on your refund. Additionally, being aware of any changes in tax laws or filing requirements can help you stay compliant and informed.

Quick guide on how to complete dtf 406

Effortlessly Prepare Dtf 406 on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-conscious alternative to traditional printed and signed papers, allowing you to obtain the correct form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Dtf 406 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and Electronically Sign Dtf 406 Stress-Free

- Find Dtf 406 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and press the Done button to save your modifications.

- Choose how you wish to send your form: via email, text (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes requiring new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Dtf 406 to ensure excellent communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dtf 406

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is DTF 406?

DTF 406 refers to a specific model in the airSlate SignNow platform that enhances document eSigning capabilities. It is designed to simplify the signing process, making it more efficient for businesses. Understanding DTF 406 is crucial for leveraging its features effectively.

-

How does DTF 406 improve document signing?

DTF 406 streamlines the document signing process by allowing users to send, sign, and manage documents seamlessly. This model integrates user-friendly features that reduce the time and effort needed for collecting signatures. Businesses can signNowly enhance their workflow with DTF 406.

-

What are the pricing options for DTF 406?

DTF 406 offers competitive pricing plans designed to accommodate various business needs. Each plan includes a range of features to ensure optimal use of the platform. For specific pricing details related to DTF 406, it's best to visit the airSlate SignNow pricing page.

-

Can DTF 406 integrate with other applications?

Yes, DTF 406 supports integrations with numerous applications and tools. This flexibility allows businesses to connect their existing systems easily, enhancing productivity. Discover how DTF 406 can fit into your current operational framework.

-

What benefits does DTF 406 offer for businesses?

DTF 406 provides a range of benefits, including reduced turnaround times for document approvals and increased security in the signing process. Businesses can save time and resources by employing this effective eSigning solution. Embracing DTF 406 is a smart move for any organization.

-

Is DTF 406 suitable for small businesses?

Absolutely! DTF 406 is designed to cater to businesses of all sizes, including small enterprises. Its cost-effective nature and user-friendly interface make it an ideal choice for those new to eSigning, allowing them to scale with ease.

-

How secure is DTF 406 for signing documents?

DTF 406 prioritizes security, utilizing industry-leading encryption and authentication methods to protect documents. Users can feel confident knowing their sensitive information is safe while using airSlate SignNow. Trust in DTF 406 for secure document management solutions.

Get more for Dtf 406

- Emergency preparedness handbook bmormonsharebbcomb form

- Cr 110 2018 2019 form

- Mississippi llc certificate of formation step by step llc university

- Notification document for transboundary movementsshipments of waste form

- 2017 2018 club excellence award application form

- Appraisal report land form

- Cornell notes template roosevelt middle school form

- Dic 24 peace officer dwi statutory warning form

Find out other Dtf 406

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online