Nyc 1127 Instructions for Form

What is the NYC 1127 Instructions for Form

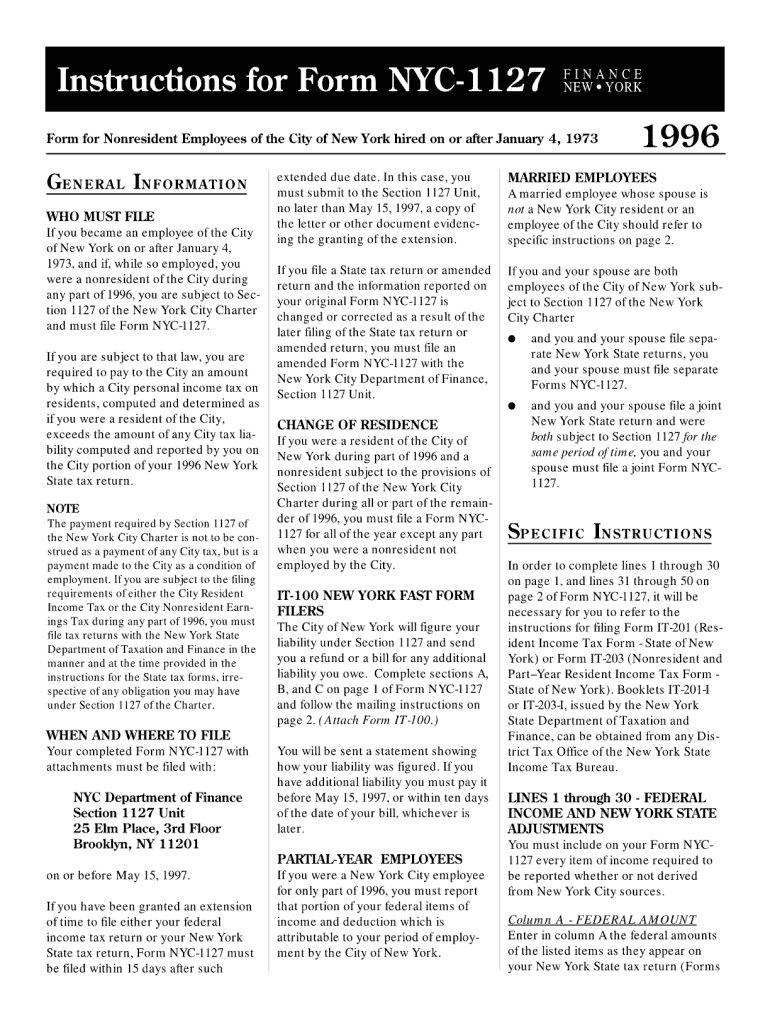

The NYC 1127 Instructions for Form provide essential guidance for individuals and businesses in New York City regarding specific tax obligations. This form is primarily used to report certain financial information relevant to local taxes. Understanding the instructions is crucial for ensuring compliance with city regulations and avoiding potential penalties. The form outlines the necessary steps for accurate completion, including required information and any supporting documentation needed.

Steps to Complete the NYC 1127 Instructions for Form

Completing the NYC 1127 Instructions for Form involves several key steps:

- Gather all necessary documentation, such as income statements and identification numbers.

- Carefully read the instructions to understand the information required.

- Fill out the form accurately, ensuring all fields are completed as per the guidelines.

- Review the form for any errors or omissions before submission.

- Submit the completed form through the designated method, whether online or by mail.

Legal Use of the NYC 1127 Instructions for Form

The NYC 1127 Instructions for Form are legally binding when completed according to the specified guidelines. It is important to ensure that all information provided is truthful and accurate, as any discrepancies may lead to legal repercussions. Compliance with these instructions not only fulfills legal obligations but also helps maintain the integrity of the reporting process.

Who Issues the NYC 1127 Form

The NYC 1127 Form is issued by the New York City Department of Finance. This department is responsible for overseeing the collection of taxes and ensuring compliance with local tax laws. The issuance of this form signifies the city's commitment to transparency and accountability in its tax collection processes.

Required Documents for the NYC 1127 Instructions for Form

To complete the NYC 1127 Instructions for Form, several documents may be required. These typically include:

- Proof of income, such as pay stubs or tax returns.

- Identification numbers, including Social Security or Employer Identification Numbers.

- Any relevant financial statements that support the information reported on the form.

Filing Deadlines / Important Dates for the NYC 1127 Form

Filing deadlines for the NYC 1127 Form are critical to ensure compliance and avoid penalties. Typically, forms must be submitted by the specified due date, which is usually aligned with the end of the tax year. It is important to check for any updates or changes to these deadlines annually to ensure timely submission.

Quick guide on how to complete nyc 1127 instructions for form

Complete Nyc 1127 Instructions For Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely save it online. airSlate SignNow provides you with all the necessary tools to generate, modify, and eSign your documents rapidly without delays. Handle Nyc 1127 Instructions For Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-based task today.

How to edit and eSign Nyc 1127 Instructions For Form effortlessly

- Obtain Nyc 1127 Instructions For Form and click Get Form to get started.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Edit and eSign Nyc 1127 Instructions For Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nyc 1127 instructions for form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to nyc 1127?

airSlate SignNow is a powerful tool that empowers businesses to send and eSign documents efficiently. For users in the nyc 1127 area, this means easy access to a cost-effective solution that streamlines document workflows and enhances productivity.

-

What features does airSlate SignNow offer for users in nyc 1127?

airSlate SignNow provides a variety of features tailored to meet the needs of users in nyc 1127, including customizable templates, secure eSignature options, and real-time document tracking. These features work together to simplify the signing process and ensure compliance with legal standards.

-

How much does airSlate SignNow cost for businesses in nyc 1127?

The pricing for airSlate SignNow is competitive and designed to accommodate businesses of all sizes in nyc 1127. You can choose from various subscription plans that offer flexible options to suit your specific needs and budget, ensuring you get great value.

-

Is airSlate SignNow secure for users in nyc 1127?

Yes, airSlate SignNow prioritizes security for all users, including those in nyc 1127. Our platform employs advanced encryption and compliance measures to protect sensitive information, ensuring that your documents remain safe during the eSigning process.

-

Can airSlate SignNow integrate with other software solutions used in nyc 1127?

Absolutely! airSlate SignNow offers seamless integrations with numerous software solutions commonly used by businesses in nyc 1127, such as CRM systems, file storage platforms, and more. This allows you to streamline your workflows and improve efficiency across your operations.

-

What benefits can businesses in nyc 1127 gain from using airSlate SignNow?

By using airSlate SignNow, businesses in nyc 1127 can benefit from improved speed and efficiency in document handling. The platform allows for quick eSigning, reducing turnaround time on contracts and agreements, and ultimately enhancing business productivity.

-

How can I get started with airSlate SignNow in nyc 1127?

Getting started with airSlate SignNow in nyc 1127 is easy. Simply sign up for an account on our website, choose the plan that fits your needs, and you can start sending and signing documents right away. Our user-friendly interface ensures a smooth onboarding experience.

Get more for Nyc 1127 Instructions For Form

- Aoc cr 300 the north carolina court system nccourts form

- Florida supreme court approved family law form 12990c2 final judgment of dissolution of marriage with property but no dependent

- Law student practice form court of appeals 2nd circuit ca2 uscourts

- Form 05 75 civil small claims courts oregon

- Anarab radio tear sheet for computerized billing rabcom form

- Anarab radio tear sheet for manual billing rabcom form

- Vs115 ltpgt report of death vital statistics 25 tac sec 1812a the funeral director or person acting as such who assumes custody form

- Dss form 27151 south carolina department of social services dss sc

Find out other Nyc 1127 Instructions For Form

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online

- eSign Utah Rental lease contract Free

- eSign Tennessee Rental lease agreement template Online

- eSign Tennessee Rental lease agreement template Myself

- eSign West Virginia Rental lease agreement template Safe

- How To eSign California Residential lease agreement form

- How To eSign Rhode Island Residential lease agreement form

- Can I eSign Pennsylvania Residential lease agreement form

- eSign Texas Residential lease agreement form Easy

- eSign Florida Residential lease agreement Easy

- eSign Hawaii Residential lease agreement Online

- Can I eSign Hawaii Residential lease agreement