Ir330 2018

What is the IR330?

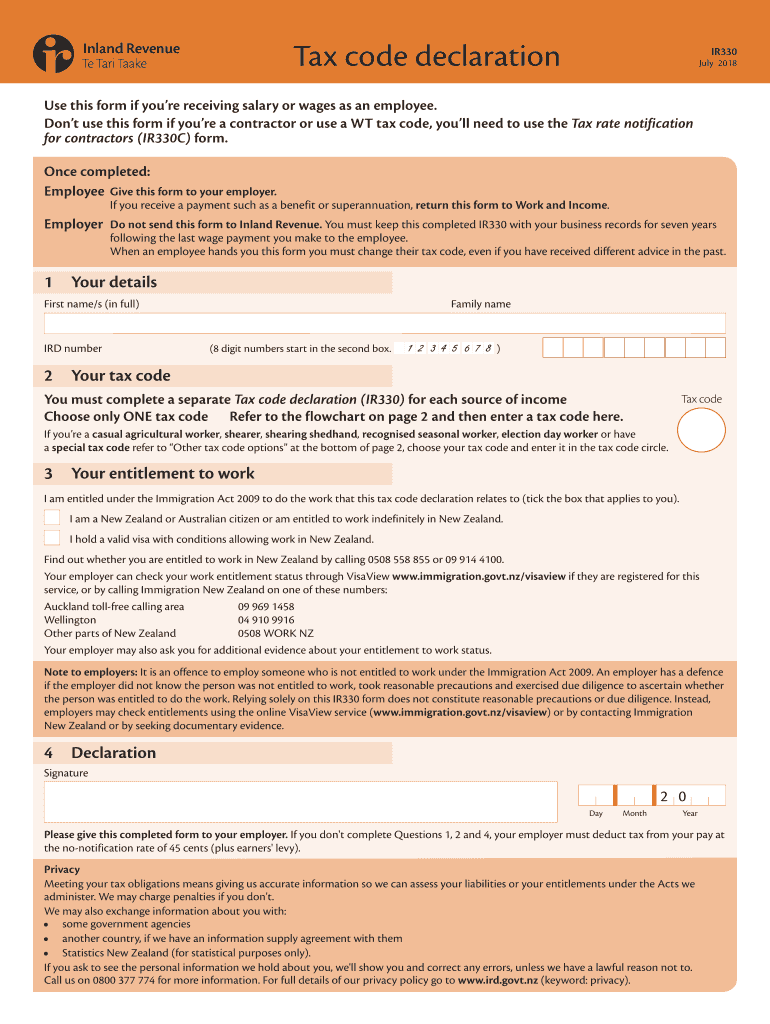

The IR330 is a tax code declaration form used in New Zealand, primarily for employees to declare their tax code to their employer. This form helps determine the correct amount of tax to withhold from an employee's wages or salary. By accurately completing the IR330, individuals ensure that their tax obligations are met, thereby avoiding potential overpayment or underpayment of taxes. This form is essential for maintaining compliance with tax regulations and is recognized by the Inland Revenue Department (IRD).

How to use the IR330

Using the IR330 involves a straightforward process. First, individuals must obtain the form, which can typically be downloaded from the IRD website or obtained from their employer. Next, complete the form by providing personal details, including name, address, and IRD number. It is crucial to select the appropriate tax code that reflects your income situation, such as whether you are a full-time employee, part-time worker, or self-employed. Once completed, submit the form to your employer, who will then use it to calculate the correct tax deductions from your pay.

Steps to complete the IR330

Completing the IR330 requires careful attention to detail. Follow these steps:

- Download the IR330 form from the IRD website or request it from your employer.

- Fill in your personal information, including your full name, address, and IRD number.

- Choose the correct tax code based on your employment status and income level.

- Review the form for accuracy, ensuring all required fields are completed.

- Submit the completed form to your employer for processing.

Legal use of the IR330

The IR330 is legally binding when completed accurately and submitted to an employer. It is essential for compliance with New Zealand tax laws, as it ensures that the correct amount of tax is withheld from an employee's earnings. Providing false information on the IR330 can lead to penalties, including fines or legal action. Therefore, it is important to fill out the form truthfully and to update it promptly if any personal circumstances change.

Key elements of the IR330

Several key elements are critical to the IR330 form:

- Personal Information: This includes your full name, address, and IRD number.

- Tax Code Selection: Selecting the appropriate tax code is crucial for accurate tax withholding.

- Signature: Signing the form confirms that the information provided is true and correct.

- Submission Instructions: Clear guidance on how to submit the form to your employer.

Who Issues the Form

The IR330 form is issued by the Inland Revenue Department (IRD) of New Zealand. The IRD is responsible for managing the country's tax system, including the distribution and regulation of tax forms. Employers and employees can access the IR330 through the IRD's official website, ensuring that they are using the most current version of the form.

Quick guide on how to complete ir330 2018 2019 form

A brief guide on how to set up your Ir330

Locating the right template can be a challenge when you need to submit official international documents. Even if you possess the necessary form, it can be tedious to quickly complete it according to all the specifications if you're using printed copies instead of handling everything digitally. airSlate SignNow is the online electronic signature platform that enables you to tackle all of that. It allows you to obtain your Ir330 and promptly fill out and sign it on-site without having to reprint papers if you make an error.

Here are the actions you need to take to prepare your Ir330 using airSlate SignNow:

- Click the Get Form button to instantly upload your document to our editor.

- Begin with the first blank field, enter your information, and proceed with the Next feature.

- Complete the empty sections using the Cross and Check tools from the toolbar above.

- Choose the Highlight or Line options to emphasize the most important details.

- Click on Image and upload one if your Ir330 necessitates it.

- Utilize the right-side panel to add additional fields for yourself or others to fill in if necessary.

- Review your responses and confirm the form by clicking Date, Initials, and Sign.

- Create, type, upload your eSignature, or capture it with a camera or QR code.

- Conclude editing by clicking the Done button and choosing your file-sharing preferences.

After your Ir330 is finalized, you can share it in your preferred manner - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely store all your completed documents in your account, organized into folders according to your choices. Don’t waste time on manual form filling; give airSlate SignNow a try!

Create this form in 5 minutes or less

Find and fill out the correct ir330 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

Create this form in 5 minutes!

How to create an eSignature for the ir330 2018 2019 form

How to make an eSignature for your Ir330 2018 2019 Form in the online mode

How to generate an electronic signature for the Ir330 2018 2019 Form in Google Chrome

How to make an electronic signature for putting it on the Ir330 2018 2019 Form in Gmail

How to make an eSignature for the Ir330 2018 2019 Form straight from your smart phone

How to make an electronic signature for the Ir330 2018 2019 Form on iOS devices

How to generate an electronic signature for the Ir330 2018 2019 Form on Android devices

People also ask

-

What is the Ir330 and how does it relate to airSlate SignNow?

The Ir330 is a specific form used in the New Zealand tax system, often requiring electronic signatures for submission. With airSlate SignNow, businesses can seamlessly eSign the Ir330 form, ensuring compliance and efficiency in their document workflows. Our platform simplifies the process, making it easy to manage tax documents securely.

-

How does airSlate SignNow facilitate the signing of the Ir330 form?

airSlate SignNow offers a user-friendly interface that allows businesses to upload, send, and eSign the Ir330 form quickly. Signers can complete the process from anywhere, on any device, which signNowly speeds up tax submissions. This convenience ensures that users can focus on their business rather than paperwork.

-

Is there a cost associated with using airSlate SignNow for the Ir330 form?

Yes, airSlate SignNow operates on a subscription model with various pricing plans tailored to different business needs. Users can choose a plan that fits their budget while gaining access to features that streamline the signing of documents like the Ir330. Check our pricing page for detailed information on plans.

-

What features does airSlate SignNow provide for managing the Ir330 form?

With airSlate SignNow, you can easily manage the Ir330 form through features such as templates, reminders, and real-time tracking. These tools help you streamline the signing process and ensure that all necessary parties are kept informed. Additionally, our platform offers secure cloud storage for easy access to your signed documents.

-

Can I integrate airSlate SignNow with other applications for the Ir330 process?

Absolutely! airSlate SignNow integrates with various third-party applications such as CRM systems, cloud storage services, and project management tools. This integration capability allows users to streamline the workflow for signing the Ir330 form and other documents, making it a versatile solution for businesses.

-

What are the benefits of using airSlate SignNow for the Ir330 form?

Using airSlate SignNow for the Ir330 form provides numerous benefits, including improved efficiency, reduced paper waste, and enhanced security. Businesses can save time by automating the signing process, which helps in meeting deadlines. Furthermore, electronic signatures are legally binding, ensuring compliance with regulations.

-

Is airSlate SignNow compliant with legal standards for the Ir330?

Yes, airSlate SignNow is compliant with legal standards for electronic signatures, including those required for the Ir330 form. Our platform adheres to industry regulations that validate eSignatures, ensuring that your signed documents hold up in legal proceedings. This compliance gives users peace of mind when handling sensitive tax documents.

Get more for Ir330

- Please download and complete our release form galway downs

- Ppampk entry form and release of liability nfl ppampk

- Printable chargemaster forms

- Narrative observation template 429740022 form

- Ics 231 form

- Colonoscopy prep instructions pdf 475232299 form

- The official website of platte county wyoming planning form

- Self reporting form

Find out other Ir330

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement