Form 8965 2014

What is the Form 8965

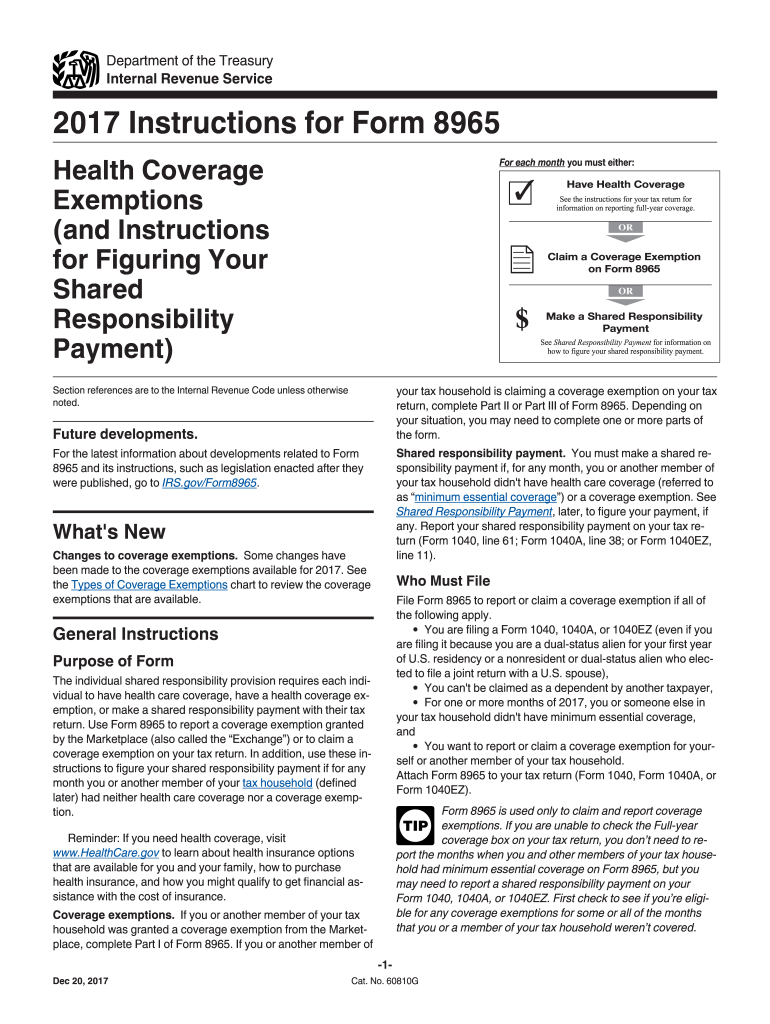

The Form 8965 is a tax form used in the United States to claim a health coverage exemption under the Affordable Care Act (ACA). This form is essential for individuals who may not have been able to obtain health insurance coverage during the tax year due to various qualifying circumstances. The purpose of the form is to inform the IRS that you are exempt from the individual shared responsibility payment, which is a penalty for not having health insurance. Understanding the specifics of this form can help taxpayers navigate their obligations and rights regarding health coverage.

How to use the Form 8965

Using the Form 8965 involves several steps to ensure accurate completion and submission. First, determine if you qualify for an exemption based on the criteria set by the IRS. Common exemptions include financial hardship, religious objections, or being a member of certain groups. After confirming eligibility, fill out the form by providing necessary personal information and details about the exemption. Once completed, the form should be attached to your federal income tax return. It is crucial to keep a copy for your records in case of inquiries from the IRS.

Steps to complete the Form 8965

Completing the Form 8965 requires careful attention to detail. Start by entering your personal information, including your name, address, and Social Security number. Next, identify the specific exemption type you are claiming. The form includes sections where you can provide additional information about your exemption circumstances. After filling out all required fields, review the form for accuracy. Finally, ensure that it is signed and dated before submitting it with your tax return. Following these steps helps ensure compliance and reduces the risk of errors that could lead to penalties.

Legal use of the Form 8965

The legal use of the Form 8965 is governed by IRS regulations. To be considered valid, the form must be completed accurately and submitted in accordance with tax filing deadlines. It is important to ensure that the claimed exemption meets the criteria established by the IRS. Inaccurate or fraudulent claims can result in penalties, including fines or additional tax liabilities. Therefore, understanding the legal implications of the form and maintaining compliance with IRS guidelines is essential for taxpayers seeking exemptions from health insurance penalties.

Eligibility Criteria

Eligibility for using the Form 8965 is based on specific criteria outlined by the IRS. To qualify for an exemption, individuals must meet one of several conditions, such as experiencing a financial hardship that prevents them from obtaining coverage, being a member of certain religious sects, or being incarcerated. Additionally, those who are part of a health care sharing ministry may also qualify. Each exemption type has its own requirements, so it is important to review these details carefully to determine if you are eligible to use the form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8965 align with the general tax return deadlines set by the IRS. Typically, individual tax returns are due on April fifteenth of each year. If you are claiming an exemption, it is essential to submit the Form 8965 along with your tax return by this deadline. In cases where extensions are filed, be aware of the extended deadlines and ensure that the form is included with any late submissions. Staying informed about these important dates helps prevent penalties associated with late filings.

Form Submission Methods

The Form 8965 can be submitted through various methods, depending on how you file your tax return. If you are filing electronically, the form is typically included as part of your electronic submission. For those filing by mail, the completed form should be attached to your paper tax return. It is important to follow the instructions provided by the IRS for your chosen filing method to ensure that your form is processed correctly. Keeping a copy of the submitted form is advisable for your records and future reference.

Quick guide on how to complete form 8965

Complete Form 8965 effortlessly on any device

Online document management has become increasingly popular among enterprises and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can access the correct template and securely store it online. airSlate SignNow provides all the resources necessary to create, edit, and eSign your documents swiftly without delays. Manage Form 8965 on any device with airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to edit and eSign Form 8965 effortlessly

- Find Form 8965 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight signNow sections of the documents or obscure sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, and errors that necessitate printing new copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Modify and eSign Form 8965 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8965

Create this form in 5 minutes!

How to create an eSignature for the form 8965

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the 2014 form 8965?

The 2014 form 8965 is used to claim a health coverage exemption as part of the Affordable Care Act reporting requirements. It's essential for individuals who are not required to obtain health insurance coverage and need to report their exemptions when filing taxes.

-

How can airSlate SignNow help with the 2014 form 8965?

airSlate SignNow provides an easy-to-use platform for securely eSigning and sending the 2014 form 8965. By streamlining the process, users can effectively manage their documents and ensure timely submission to the IRS.

-

Is airSlate SignNow suitable for businesses dealing with the 2014 form 8965?

Yes, airSlate SignNow is particularly suitable for businesses that handle multiple client forms, including the 2014 form 8965. Its efficiency and collaborative features make it an ideal choice for managing and executing necessary documentation flawlessly.

-

What features in airSlate SignNow support the 2014 form 8965 process?

airSlate SignNow offers features like customizable templates and secure cloud storage, which are beneficial for managing the 2014 form 8965. These tools simplify the preparation and signing process, ensuring compliance with legal requirements efficiently.

-

Are there any costs associated with using airSlate SignNow for the 2014 form 8965?

While airSlate SignNow offers various pricing plans, it provides robust functionality for managing documents like the 2014 form 8965 at a cost-effective rate. Users can choose a plan that best fits their needs and budget without compromising on service quality.

-

Can I integrate airSlate SignNow with other applications for handling the 2014 form 8965?

Absolutely! airSlate SignNow offers integration capabilities with various business applications, making it easier to manage the 2014 form 8965 seamlessly. This ensures that all your necessary tools work together, enhancing overall workflow efficiency.

-

What are the benefits of using airSlate SignNow for the 2014 form 8965?

Using airSlate SignNow for the 2014 form 8965 simplifies the eSigning process and reduces the time spent on paperwork. It provides a secure solution that enhances compliance, and increases efficiency, allowing users to focus on their core operations.

Get more for Form 8965

Find out other Form 8965

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe