Mc366 Form

What is the MC366?

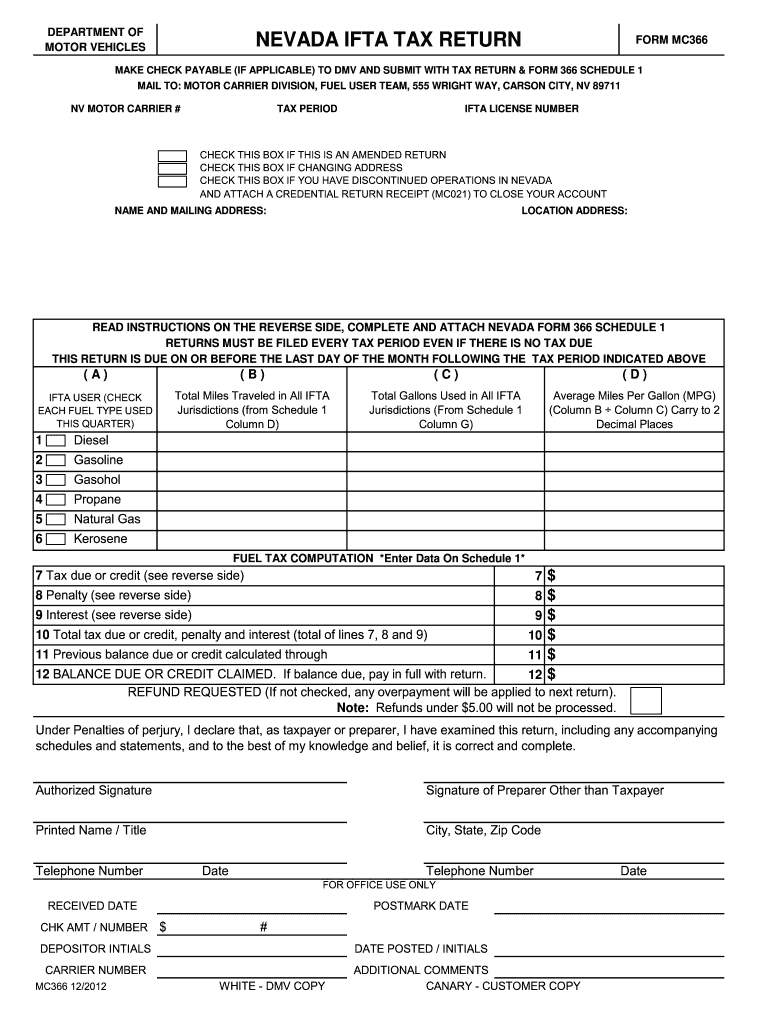

The MC366 is a form used in Nevada for reporting and paying the International Fuel Tax Agreement (IFTA) taxes. This form is essential for businesses that operate commercial vehicles across state lines, ensuring compliance with fuel tax regulations. The MC366 provides a standardized way to calculate the fuel taxes owed based on miles traveled and fuel consumed in each jurisdiction. Understanding the MC366 is crucial for maintaining legal compliance and avoiding potential penalties.

How to Use the MC366

Using the MC366 involves several steps to ensure accurate reporting and payment of fuel taxes. First, gather all necessary data, including mileage records and fuel purchase receipts for each jurisdiction. Next, fill out the form by entering the total miles traveled and the gallons of fuel purchased in each state. After calculating the tax owed based on the rates applicable to each jurisdiction, submit the completed form along with the payment. It is important to keep copies of all submitted documents for your records.

Steps to Complete the MC366

Completing the MC366 requires careful attention to detail. Follow these steps:

- Collect mileage and fuel purchase records for the reporting period.

- Fill in the total miles driven and fuel purchased for each state on the form.

- Calculate the total tax owed by applying the appropriate tax rates.

- Review the form for accuracy and completeness.

- Submit the form by the due date, along with any required payment.

Legal Use of the MC366

The MC366 is legally recognized as a valid document for reporting fuel taxes under the IFTA. To ensure its legal standing, the form must be completed accurately and submitted on time. Compliance with state and federal regulations regarding fuel tax reporting is essential. The use of a reliable eSignature solution, like signNow, can enhance the legitimacy of the submitted document, providing a digital certificate that verifies the signature.

Filing Deadlines / Important Dates

Filing deadlines for the MC366 are typically quarterly. It is essential to be aware of these dates to avoid late fees or penalties. The deadlines usually fall on the last day of the month following the end of each quarter. For example, for the first quarter ending March 31, the form must be filed by April 30. Keeping a calendar of these important dates can help ensure timely submissions.

Required Documents

When completing the MC366, certain documents are necessary to support the information reported. These may include:

- Mileage logs detailing miles driven in each jurisdiction.

- Receipts for fuel purchases, indicating the amount and type of fuel.

- Previous IFTA returns, if applicable, for reference and consistency.

Having these documents readily available can streamline the completion process and enhance accuracy.

Quick guide on how to complete mc366

Prepare Mc366 effortlessly on any device

Online document management has become increasingly favored by companies and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, enabling you to access the required form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Mc366 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to alter and electronically sign Mc366 with ease

- Locate Mc366 and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you want to share your form, either by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Mc366 and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mc366

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is mc366 in airSlate SignNow?

The mc366 refers to a specific plan or feature set within airSlate SignNow that allows businesses to streamline their document signing processes. With mc366, users can seamlessly send and eSign documents while ensuring compliance and security. This feature enhances productivity by reducing the time it takes to manage approvals.

-

How much does mc366 cost for users?

The pricing for mc366 in airSlate SignNow varies depending on the number of users and specific business needs. Typically, businesses can expect competitive pricing that offers signNow savings compared to traditional document signing methods. To get a tailored quote for mc366, visit our pricing page for more details.

-

What features does mc366 include?

The mc366 plan includes a comprehensive set of features such as custom templates, in-person signing, and advanced document tracking. Users also benefit from features like secure cloud storage and integration with various third-party applications. This robust functionality makes mc366 a powerful tool for businesses of all sizes.

-

How can mc366 improve my business workflow?

By implementing mc366, businesses can signNowly enhance their workflow efficiency through automated document management. This solution reduces manual errors and speeds up the execution of contracts and agreements. As a result, companies save time and resources while providing a better customer experience.

-

Does mc366 integrate with other software?

Yes, mc366 integrates seamlessly with a variety of popular business applications such as CRM systems, project management tools, and cloud storage services. This interoperability allows users to incorporate airSlate SignNow into their existing workflows easily. Thus, businesses can maximize their productivity without the need to switch platforms.

-

What are the benefits of using mc366 for document signing?

The mc366 plan offers numerous benefits, including enhanced security features, compliance with legal standards, and a user-friendly interface. Users can track the status of their documents in real-time, ensuring transparency and accountability. Moreover, mc366 helps to reduce paper usage, contributing to a more eco-friendly business operation.

-

Can I try mc366 before committing?

Yes, airSlate SignNow offers a free trial for users interested in exploring the mc366 plan. This allows potential customers to experience its features and benefits firsthand before making a purchase decision. Signing up for the trial is easy and provides a risk-free opportunity to enhance your document signing process.

Get more for Mc366

Find out other Mc366

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP