Wv Form 103 2017

What is the Wv Form 103

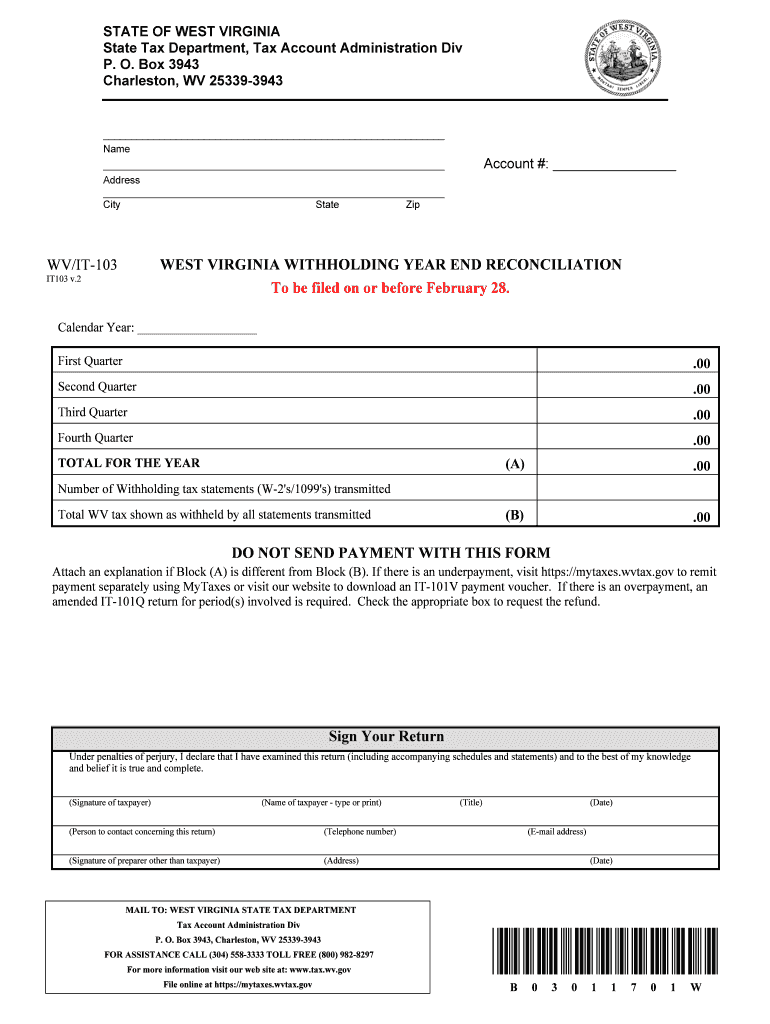

The Wv Form 103 is a tax form used in West Virginia for reporting and calculating the state income tax for individuals. It is essential for residents and non-residents who earn income within the state. This form allows taxpayers to report their income, claim deductions, and calculate their tax liability. Understanding the purpose and requirements of the Wv Form 103 is crucial for accurate tax reporting and compliance with state regulations.

How to use the Wv Form 103

Using the Wv Form 103 involves several steps to ensure accurate completion. First, gather all necessary financial documents, including W-2s and 1099s, that detail your income. Next, fill out the form by entering your personal information, income details, and any applicable deductions. After completing the form, review it carefully for accuracy. Finally, submit the form by the designated deadline, either electronically or by mail, to ensure compliance with state tax laws.

Steps to complete the Wv Form 103

Completing the Wv Form 103 requires a systematic approach. Follow these steps:

- Gather all relevant income documents, such as W-2s and 1099s.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from all sources accurately.

- Claim any deductions you are eligible for, such as standard deductions or itemized deductions.

- Calculate your total tax liability based on the provided tax tables.

- Review the completed form for any errors or omissions.

- Submit the form by the deadline to the appropriate state tax authority.

Legal use of the Wv Form 103

The Wv Form 103 is legally recognized by the West Virginia state government for tax reporting purposes. It must be completed accurately and submitted by the specified deadlines to avoid penalties. Taxpayers should ensure that all information provided on the form is truthful and in compliance with state tax laws. Using the form incorrectly or failing to submit it can result in legal repercussions, including fines or audits.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Wv Form 103. Typically, the form must be submitted by April fifteenth of each year for the previous tax year. In cases where the deadline falls on a weekend or holiday, the due date may be extended to the next business day. Staying informed about these dates helps taxpayers avoid late fees and ensures timely compliance with state tax requirements.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Wv Form 103. The form can be filed online through the West Virginia state tax website, which offers a convenient and efficient method for e-filing. Alternatively, taxpayers can print the completed form and mail it to the appropriate tax office. Some individuals may also choose to submit the form in person at designated tax offices. Each method has its advantages, and taxpayers should select the one that best suits their needs.

Quick guide on how to complete wv form 103 2017 2019

Your assistance manual on how to prepare your Wv Form 103

If you're interested in learning how to create and send your Wv Form 103, here are some concise guidelines on how to simplify the process of tax submission.

Initially, you simply need to create your airSlate SignNow account to change how you manage documents online. airSlate SignNow is an exceptionally user-friendly and effective document management solution that enables you to modify, generate, and finalize your tax forms effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures, and revisit to modify details as necessary. Enhance your tax administration with advanced PDF editing, eSigning, and seamless sharing.

Complete the following steps to achieve your Wv Form 103 in just a few minutes:

- Sign up for your account and begin editing PDFs within moments.

- Utilize our directory to locate any IRS tax form; explore various versions and schedules.

- Click Get form to access your Wv Form 103 in our editor.

- Complete the required fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-recognized eSignature (if necessary).

- Review your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Keep in mind that submitting a paper form can increase return errors and delay refunds. It is advisable to refer to the IRS website for submission guidelines in your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct wv form 103 2017 2019

Create this form in 5 minutes!

How to create an eSignature for the wv form 103 2017 2019

How to generate an eSignature for your Wv Form 103 2017 2019 in the online mode

How to generate an electronic signature for the Wv Form 103 2017 2019 in Chrome

How to create an eSignature for putting it on the Wv Form 103 2017 2019 in Gmail

How to create an eSignature for the Wv Form 103 2017 2019 right from your mobile device

How to make an eSignature for the Wv Form 103 2017 2019 on iOS devices

How to make an electronic signature for the Wv Form 103 2017 2019 on Android OS

People also ask

-

What is Wv Form 103 and why is it important?

Wv Form 103 is a crucial document used for various official purposes in West Virginia. Understanding its requirements and how to properly fill it out can save you time and help you avoid potential legal issues.

-

How can airSlate SignNow help with Wv Form 103?

airSlate SignNow provides an intuitive platform to electronically sign and send Wv Form 103 securely. This streamlines the process, making it easier to manage important documents without the hassle of printing or mailing.

-

Is there a cost associated with using airSlate SignNow for Wv Form 103?

airSlate SignNow offers a cost-effective solution for handling Wv Form 103. Our pricing plans are designed to fit the needs of businesses of all sizes, allowing you to choose a plan that meets your document management requirements.

-

What features does airSlate SignNow offer for Wv Form 103?

With airSlate SignNow, you get features like easy document editing, templates for Wv Form 103, and customizable workflows. This enhances productivity and ensures that your forms are handled efficiently.

-

Can I integrate airSlate SignNow with other applications for Wv Form 103?

Yes, airSlate SignNow easily integrates with popular applications such as Google Drive, Dropbox, and Salesforce. This allows you to manage Wv Form 103 alongside your other critical documents seamlessly.

-

What are the benefits of using airSlate SignNow for Wv Form 103?

Using airSlate SignNow for Wv Form 103 provides numerous benefits, including reduced turnaround times and enhanced document security. You can also track document status in real time, ensuring a smoother signing process.

-

Is airSlate SignNow user-friendly for handling Wv Form 103?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it simple to navigate and manage Wv Form 103. Even those with minimal tech skills can easily send and sign documents without difficulty.

Get more for Wv Form 103

Find out other Wv Form 103

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure