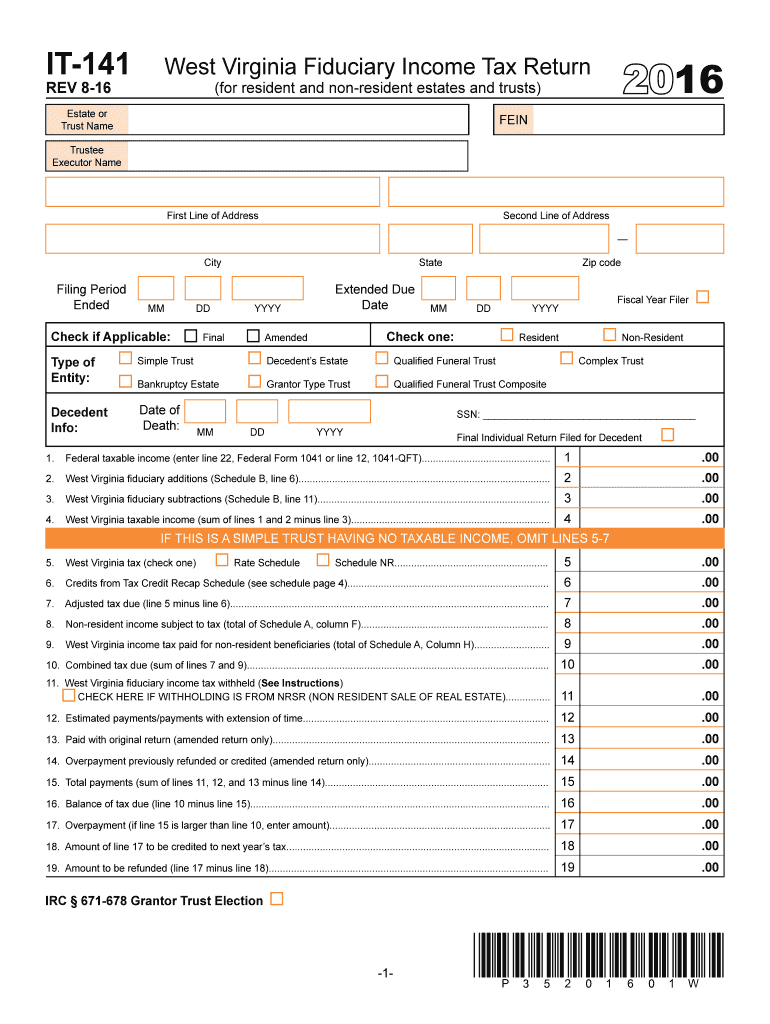

Wv it 141 Form 2016

What is the Wv It 141 Form

The Wv It 141 Form is a tax document used in West Virginia for individuals and businesses to report their income and calculate their state tax liability. This form is essential for ensuring compliance with state tax laws and is designed to gather necessary financial information from taxpayers. It includes sections for reporting various types of income, deductions, and credits applicable under West Virginia tax regulations.

How to use the Wv It 141 Form

To use the Wv It 141 Form effectively, taxpayers should first gather all relevant financial documents, including W-2s, 1099s, and any other income statements. Once the necessary information is collected, individuals can fill out the form, ensuring that all sections are completed accurately. After completing the form, taxpayers can submit it electronically or by mail, depending on their preference and the guidelines provided by the West Virginia State Tax Department.

Steps to complete the Wv It 141 Form

Completing the Wv It 141 Form involves several key steps:

- Gather all necessary documents, such as income statements and previous tax returns.

- Fill out personal information, including name, address, and Social Security number.

- Report all sources of income, including wages, self-employment income, and interest.

- Claim any deductions or credits that apply to your situation.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or print it out for mailing.

Legal use of the Wv It 141 Form

The Wv It 141 Form is legally recognized by the state of West Virginia for tax reporting purposes. It is important for taxpayers to ensure that the form is filled out accurately and submitted by the designated deadlines to avoid penalties. The form must be signed, and electronic signatures are accepted, aligning with state regulations regarding digital documentation.

Filing Deadlines / Important Dates

Taxpayers must be aware of key deadlines associated with the Wv It 141 Form to ensure timely filing. Generally, the form is due on April fifteenth of each year for individual taxpayers. However, extensions may be available under certain circumstances, and it is advisable to check with the West Virginia State Tax Department for any updates or changes to deadlines.

Form Submission Methods (Online / Mail / In-Person)

The Wv It 141 Form can be submitted through various methods to accommodate different preferences:

- Online: Taxpayers can file the form electronically through the West Virginia State Tax Department's online portal.

- Mail: Completed forms can be printed and sent via postal service to the appropriate tax office address.

- In-Person: Taxpayers may also choose to deliver their forms in person at designated tax offices.

Quick guide on how to complete wv it 141 2016 form

Your assistance manual on how to prepare your Wv It 141 Form

If you are wondering how to construct and submit your Wv It 141 Form, here are several quick tips on how to simplify tax filing.

First, you simply need to create your airSlate SignNow account to revolutionize how you handle documentation online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to modify, produce, and finalize your tax forms effortlessly. By utilizing its editor, you can alternate between text, checkboxes, and eSignatures, and revert to amend details whenever necessary. Optimize your tax management with sophisticated PDF editing, eSigning, and easy sharing.

Follow the steps below to finalize your Wv It 141 Form in just a few minutes:

- Create your account and start working on PDFs within moments.

- Utilize our directory to locate any IRS tax form; browse through versions and schedules.

- Click Obtain form to access your Wv It 141 Form in our editor.

- Complete the necessary fillable sections with your information (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-recognized eSignature (if required).

- Review your document and correct any errors.

- Save modifications, print your copy, send it to your intended recipient, and download it to your device.

Utilize this guide to file your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper may lead to an increase in return errors and delays in refunds. Naturally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct wv it 141 2016 form

FAQs

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

How do I fill out the IT-2104 form if I live in NJ?

Do you work only in NY? Married? Kids? If your w-2 shows NY state withholding on your taxes, fill out a non-resident NY tax return which is fairly simple. If it doesn't, you don't fill out NY at all. If it shows out NYC withholding you enter that as well on the same forms.Then you would fill out your NJ returns as well with any withholding for NJ. Make sure to put any taxes paid to other states on your reciprocal states (nj paid, on NY return and vice versa)

Create this form in 5 minutes!

How to create an eSignature for the wv it 141 2016 form

How to create an eSignature for your Wv It 141 2016 Form online

How to make an electronic signature for your Wv It 141 2016 Form in Google Chrome

How to create an electronic signature for signing the Wv It 141 2016 Form in Gmail

How to generate an electronic signature for the Wv It 141 2016 Form right from your smartphone

How to make an eSignature for the Wv It 141 2016 Form on iOS devices

How to generate an eSignature for the Wv It 141 2016 Form on Android devices

People also ask

-

What is the Wv It 141 Form and why is it important?

The Wv It 141 Form is a tax form used in West Virginia to report income and calculate tax liabilities. Understanding and accurately completing the Wv It 141 Form is crucial for compliance with state tax laws, ensuring you avoid penalties and maintain good standing with tax authorities.

-

How can airSlate SignNow help with completing the Wv It 141 Form?

airSlate SignNow simplifies the process of completing the Wv It 141 Form by allowing users to easily fill out, sign, and send their documents electronically. With our user-friendly interface, businesses can ensure that their forms are completed accurately and efficiently, saving time and reducing errors.

-

Is there a cost associated with using airSlate SignNow for the Wv It 141 Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Our cost-effective solutions make it easy for users to manage their documentation, including the Wv It 141 Form, without breaking the bank.

-

What features does airSlate SignNow offer for the Wv It 141 Form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, specifically designed to enhance the completion of forms like the Wv It 141 Form. These features ensure that your documents are processed smoothly and securely.

-

Can I integrate airSlate SignNow with other software for the Wv It 141 Form?

Absolutely! airSlate SignNow offers seamless integrations with various popular software applications, allowing you to streamline your workflow when handling the Wv It 141 Form. Integrating with tools like CRMs and project management software enhances efficiency and keeps your documents organized.

-

What are the benefits of using airSlate SignNow for the Wv It 141 Form over traditional methods?

Using airSlate SignNow for the Wv It 141 Form provides numerous benefits, including faster processing times, reduced paper usage, and improved compliance. Our electronic signature capabilities ensure that your forms are signed and submitted promptly, while also maintaining security and authenticity.

-

Is airSlate SignNow secure for handling sensitive information on the Wv It 141 Form?

Yes, security is a top priority for airSlate SignNow. We use advanced encryption and security protocols to protect sensitive information submitted through the Wv It 141 Form, ensuring that your data remains confidential and secure throughout the process.

Get more for Wv It 141 Form

Find out other Wv It 141 Form

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online