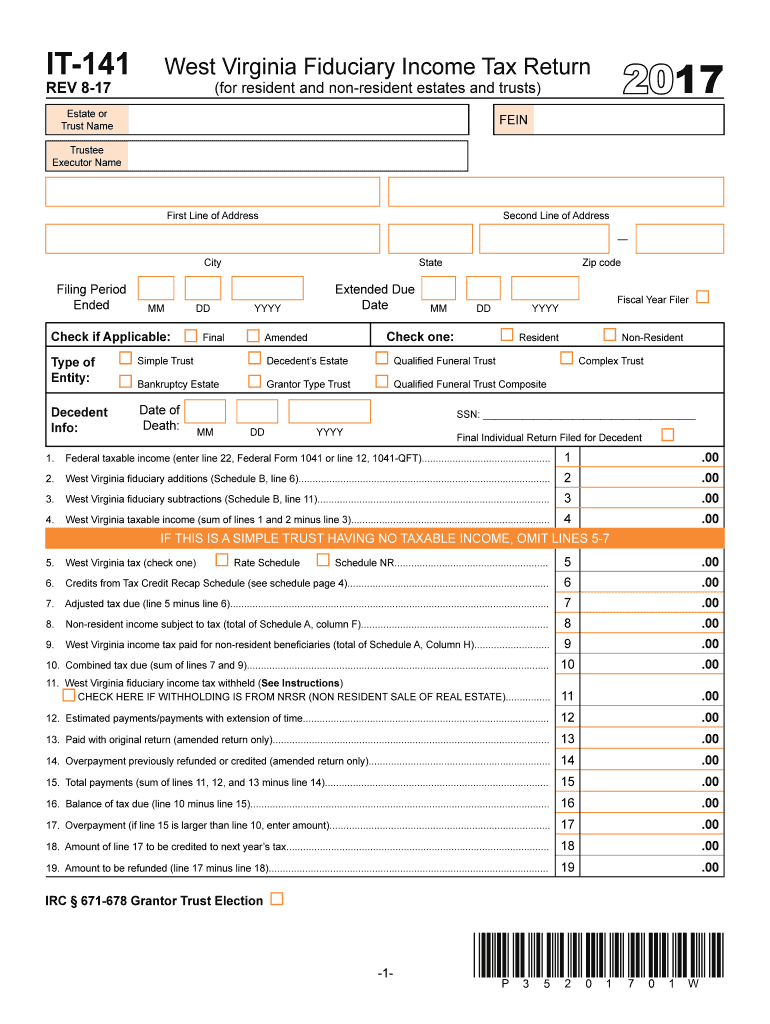

Wv it 141 Form 2017

What is the Wv It 141 Form

The Wv It 141 Form is a state tax form used in West Virginia for individual income tax returns. This form is essential for residents who need to report their income, deductions, and credits to the West Virginia State Tax Department. It is designed to help individuals accurately calculate their tax liability for the year, ensuring compliance with state tax laws. The form includes sections for personal information, income details, and various deductions that may apply, making it a comprehensive tool for taxpayers.

How to use the Wv It 141 Form

Using the Wv It 141 Form involves several steps to ensure accurate completion and submission. Taxpayers should begin by gathering all necessary documentation, including W-2 forms, 1099s, and records of any deductions or credits. After collecting this information, individuals can fill out the form either electronically or by hand. It is important to follow the instructions carefully, ensuring that all sections are completed and that calculations are accurate. Once the form is filled out, it can be submitted online or mailed to the appropriate state tax office.

Steps to complete the Wv It 141 Form

Completing the Wv It 141 Form involves a systematic approach:

- Gather Documentation: Collect all income statements and deduction records.

- Fill Out Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Report Income: Input all sources of income, including wages, interest, and dividends.

- Claim Deductions: Identify and enter any eligible deductions, such as medical expenses or mortgage interest.

- Calculate Tax: Use the provided tables or formulas to determine your tax liability.

- Review and Sign: Double-check all entries for accuracy and sign the form.

- Submit the Form: Choose your submission method, either electronically or by mail.

Legal use of the Wv It 141 Form

The Wv It 141 Form is legally recognized as the official document for filing individual income taxes in West Virginia. To ensure its legal validity, taxpayers must adhere to state guidelines regarding completion and submission. This includes providing accurate information and signing the form where required. The form must be submitted by the designated filing deadline to avoid penalties. By using this form correctly, individuals can fulfill their legal obligations and avoid issues with the West Virginia State Tax Department.

Filing Deadlines / Important Dates

Filing deadlines for the Wv It 141 Form are crucial for compliance. Typically, the form must be submitted by April fifteenth of each year for the previous tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply if they need additional time to file. Staying informed about these dates helps prevent late filing penalties and ensures timely processing of tax returns.

Form Submission Methods (Online / Mail / In-Person)

There are several methods for submitting the Wv It 141 Form, providing flexibility for taxpayers. The form can be filed online through the West Virginia State Tax Department's website, which offers a streamlined process for electronic submissions. Alternatively, individuals may choose to print the completed form and mail it to the appropriate tax office. In-person submissions are also accepted at designated tax offices, allowing for direct interaction with tax officials. Each method has its own advantages, and taxpayers should select the one that best suits their needs.

Quick guide on how to complete wv it 141 2017 2019 form

Your assistance manual on how to prepare your Wv It 141 Form

If you’re wondering how to complete and submit your Wv It 141 Form, here are some concise guidelines on how to facilitate tax filing.

To begin, you simply need to set up your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely intuitive and powerful document solution that enables you to alter, generate, and finalize your tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, and return to modify answers as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and accessible sharing.

Follow the guidelines below to complete your Wv It 141 Form in just a few minutes:

- Create your account and start working on PDFs within minutes.

- Utilize our catalog to locate any IRS tax form; browse through various versions and schedules.

- Click Get form to access your Wv It 141 Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Select the Sign Tool to place your legally-binding eSignature (if needed).

- Examine your document and correct any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Keep in mind that submitting in writing can increase return errors and delay refunds. Additionally, before e-filing your taxes, review the IRS website for declaration rules specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct wv it 141 2017 2019 form

FAQs

-

What is the new procedure in filling out the AIIMS 2019 form? What is the last date to fill out its form?

AIIMS has introduced the PAAR facility (Prospective Applicant Advanced Registration) for filling up the application form. Through PAAR facility, the process application form is divided into two steps- basic registration and final registration.Basic Registration:On this part you have to fill up your basic details like Full name, parent’s name, date of birth, gender, category, state of domicile, ID proof/number and others. No paAIIMS Final RegistrationA Code will be issued to the candidates who complete the Basic Registration. You have to use the same code to login again and fill the form.At this stage, candidates are required to fill out the entire details of their personal, professional and academic background. Also, they have to submit the application fee as per their category.Here I have explained the two steps for AIIMS 2019 form.For more details visit aim4aiims’s website:About AIIMS Exam 2019

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

Create this form in 5 minutes!

How to create an eSignature for the wv it 141 2017 2019 form

How to make an eSignature for your Wv It 141 2017 2019 Form in the online mode

How to generate an eSignature for your Wv It 141 2017 2019 Form in Google Chrome

How to make an electronic signature for signing the Wv It 141 2017 2019 Form in Gmail

How to make an electronic signature for the Wv It 141 2017 2019 Form straight from your mobile device

How to make an eSignature for the Wv It 141 2017 2019 Form on iOS devices

How to create an electronic signature for the Wv It 141 2017 2019 Form on Android OS

People also ask

-

What is the Wv It 141 Form and why do I need it?

The Wv It 141 Form is a tax return document used in West Virginia to report income and calculate state tax liability. Businesses and individuals alike need this form to ensure they comply with state tax regulations and avoid potential penalties. Utilizing airSlate SignNow can simplify the process of preparing and submitting the Wv It 141 Form with ease.

-

How does airSlate SignNow assist with the Wv It 141 Form?

airSlate SignNow provides an efficient platform to electronically sign and send the Wv It 141 Form. With its user-friendly interface, you can fill out, sign, and securely share your form without the hassle of printing or mailing. This streamlines your tax submission process while maintaining the document's integrity.

-

Is there a cost associated with using airSlate SignNow for the Wv It 141 Form?

Yes, airSlate SignNow offers a variety of pricing plans tailored to fit your needs, including features for managing the Wv It 141 Form. The pricing is competitive, making it a cost-effective solution for businesses looking to manage their documents efficiently. You can choose a plan that provides the best value based on your volume of transactions.

-

What features does airSlate SignNow offer for the Wv It 141 Form?

With airSlate SignNow, you get features like document templates, secure e-signatures, and automated workflows that enhance the management of the Wv It 141 Form. Additionally, you can track the status of your documents in real-time, ensuring you stay informed throughout the signing process. This not only saves time but also reduces errors.

-

Can I integrate airSlate SignNow with other software when working on the Wv It 141 Form?

Absolutely! airSlate SignNow supports integration with various applications, allowing you to streamline your workflow when dealing with the Wv It 141 Form. Whether it's accounting software or other document management tools, you can enhance your productivity by connecting these platforms effortlessly.

-

How secure is my information when using airSlate SignNow for the Wv It 141 Form?

The security of your information is paramount at airSlate SignNow. We utilize advanced encryption standards to protect your data while handling the Wv It 141 Form and any associated documents. This ensures that all personal and financial information remains confidential and secure from unauthorized access.

-

Can I access the Wv It 141 Form on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to access the Wv It 141 Form on the go. This flexibility enables you to fill out and e-sign documents from anywhere, making it easier to manage your tax forms even while traveling or away from your desk.

Get more for Wv It 141 Form

- Your 3 letters of authorization a briggs form

- Fillabe cobra notices form

- Wisconsin judicial commission complaint form

- Sample employment application form template carnival restaurant

- Texas mailing address change form

- Share purchase us agreement template form

- Share repurchase agreement template form

- Share purchase agreement template 787747452 form

Find out other Wv It 141 Form

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form