3 21 15 Foreign Partnership WithholdingInternal Revenue IRS Gov 2013

What is the 3 21 15 Foreign Partnership WithholdingInternal Revenue IRS gov

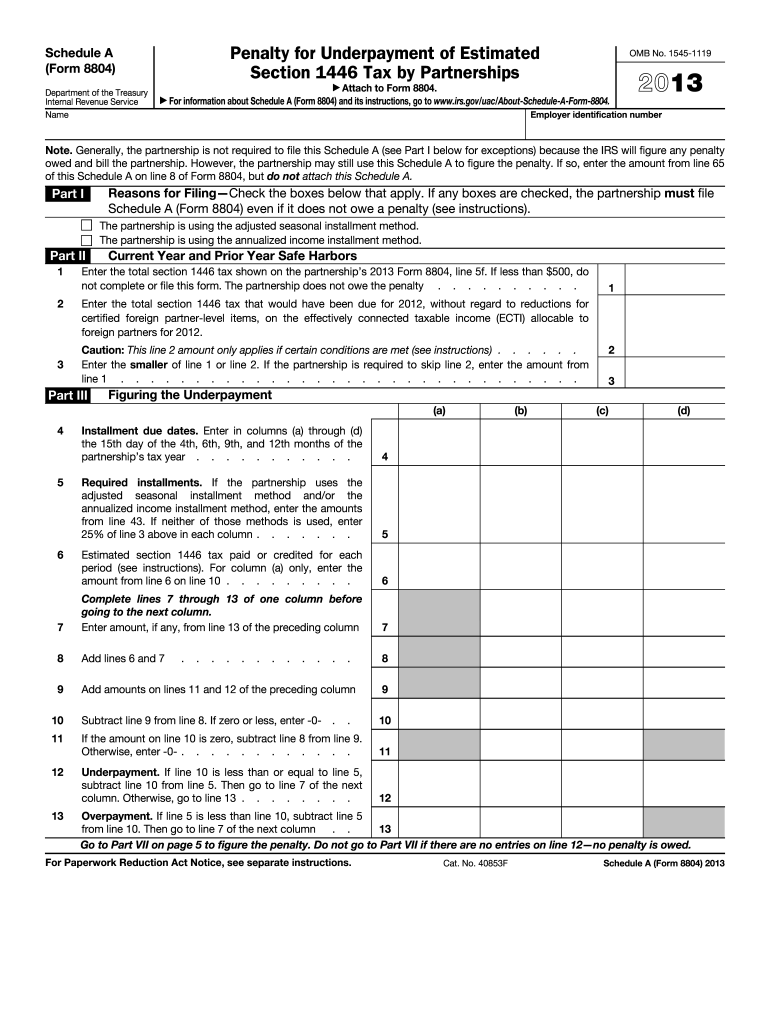

The 3 21 15 Foreign Partnership WithholdingInternal Revenue IRS gov form is a tax document specifically designed for foreign partnerships operating within the United States. This form is essential for ensuring compliance with U.S. tax regulations and is used to report income that is subject to withholding tax. It is crucial for foreign entities to understand the implications of this form, as it helps determine the appropriate amount of tax to withhold from U.S. source income. Proper completion of this form is vital for avoiding penalties and ensuring that all tax obligations are met.

Steps to complete the 3 21 15 Foreign Partnership WithholdingInternal Revenue IRS gov

Completing the 3 21 15 Foreign Partnership WithholdingInternal Revenue IRS gov form involves several key steps:

- Gather necessary information, including the partnership's name, address, and taxpayer identification number.

- Identify the specific types of income that are subject to withholding and calculate the appropriate withholding amount.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the IRS by the specified deadline, either electronically or via mail.

How to obtain the 3 21 15 Foreign Partnership WithholdingInternal Revenue IRS gov

The 3 21 15 Foreign Partnership WithholdingInternal Revenue IRS gov form can be obtained directly from the IRS website. It is important to ensure that you are using the most current version of the form to comply with tax regulations. Alternatively, tax professionals and accountants may provide access to the form as part of their services. Always verify that you are using the correct form to avoid complications during the filing process.

Legal use of the 3 21 15 Foreign Partnership WithholdingInternal Revenue IRS gov

The legal use of the 3 21 15 Foreign Partnership WithholdingInternal Revenue IRS gov form is essential for foreign partnerships to fulfill their tax obligations in the United States. This form must be filed in accordance with IRS guidelines to ensure that all income is reported accurately and that the correct amount of tax is withheld. Failure to use this form appropriately can result in significant penalties, including fines and interest on unpaid taxes, making it crucial for foreign partnerships to adhere to the legal requirements associated with this form.

Filing Deadlines / Important Dates

Filing deadlines for the 3 21 15 Foreign Partnership WithholdingInternal Revenue IRS gov form are critical to avoid penalties. Typically, the form must be submitted by the 15th day of the third month following the end of the partnership's tax year. It is advisable to stay updated on any changes to deadlines that may occur annually. Marking these important dates on a calendar can help ensure timely compliance with filing requirements.

Penalties for Non-Compliance

Non-compliance with the requirements of the 3 21 15 Foreign Partnership WithholdingInternal Revenue IRS gov form can lead to severe penalties. These may include monetary fines, interest on unpaid taxes, and potential legal action from the IRS. It is essential for foreign partnerships to understand the importance of timely and accurate filing to avoid these consequences. Regular consultation with tax professionals can help mitigate risks associated with non-compliance.

Quick guide on how to complete 32115 foreign partnership withholdinginternal revenue irsgov

Discover the easiest method to complete and sign your 3 21 15 Foreign Partnership WithholdingInternal Revenue IRS gov

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow offers a superior way to fill out and sign your 3 21 15 Foreign Partnership WithholdingInternal Revenue IRS gov and associated forms for public services. Our intelligent electronic signature system equips you with all the tools needed to handle paperwork swiftly and in compliance with formal standards - robust PDF editing, management, security, signing, and sharing features are all available within an intuitive interface.

Only a few steps are needed to fill out and sign your 3 21 15 Foreign Partnership WithholdingInternal Revenue IRS gov:

- Upload the editable template to the editor using the Get Form button.

- Check which information you need to include in your 3 21 15 Foreign Partnership WithholdingInternal Revenue IRS gov.

- Navigate through the fields with the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the blanks with your information.

- Modify the content with Text boxes or Images from the top menu.

- Emphasize what is important or Blackout sections that are no longer needed.

- Select Sign to generate a legally binding electronic signature using your preferred method.

- Add the Date next to your signature and finish your task with the Done button.

Store your finished 3 21 15 Foreign Partnership WithholdingInternal Revenue IRS gov in the Documents folder of your profile, download it, or transfer it to your chosen cloud storage. Our service also provides flexible file sharing options. There’s no requirement to print out your forms when you need to submit them to the relevant public office - send them via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it today!

Create this form in 5 minutes or less

Find and fill out the correct 32115 foreign partnership withholdinginternal revenue irsgov

Create this form in 5 minutes!

How to create an eSignature for the 32115 foreign partnership withholdinginternal revenue irsgov

How to generate an electronic signature for your 32115 Foreign Partnership Withholdinginternal Revenue Irsgov online

How to generate an electronic signature for the 32115 Foreign Partnership Withholdinginternal Revenue Irsgov in Chrome

How to make an electronic signature for putting it on the 32115 Foreign Partnership Withholdinginternal Revenue Irsgov in Gmail

How to generate an electronic signature for the 32115 Foreign Partnership Withholdinginternal Revenue Irsgov straight from your smart phone

How to make an electronic signature for the 32115 Foreign Partnership Withholdinginternal Revenue Irsgov on iOS devices

How to generate an eSignature for the 32115 Foreign Partnership Withholdinginternal Revenue Irsgov on Android OS

People also ask

-

What is the 3 21 15 Foreign Partnership Withholding policy by the IRS?

The 3 21 15 Foreign Partnership Withholding policy from the IRS pertains to tax obligations for foreign partnerships that earn income in the United States. It outlines how and when these partnerships must withhold taxes on U.S.-sourced income. Understanding this policy is crucial for compliance and avoiding potential penalties.

-

How does airSlate SignNow help with compliance regarding the 3 21 15 Foreign Partnership Withholding?

airSlate SignNow provides tools that facilitate the electronic signing and management of important tax documents, including those related to the 3 21 15 Foreign Partnership Withholding. This helps businesses stay compliant with IRS requirements by ensuring all documents are securely signed and appropriately handled.

-

Is there a cost associated with using airSlate SignNow for IRS-related documents?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that assist in managing documents related to the 3 21 15 Foreign Partnership Withholding, ensuring you get a cost-effective solution for your compliance needs.

-

What features of airSlate SignNow are beneficial for managing IRS documents?

Some key features of airSlate SignNow that are beneficial for managing IRS documents include customizable templates, secure eSigning, real-time tracking of document status, and integration with other business applications. These features streamline the process, making it easier to handle documents related to the 3 21 15 Foreign Partnership Withholding efficiently.

-

Can airSlate SignNow integrate with accounting software for IRS compliance?

Absolutely! airSlate SignNow can easily integrate with popular accounting software, enhancing your ability to manage documents related to the 3 21 15 Foreign Partnership Withholding. This integration allows for a seamless flow of information, helping to maintain accurate records and ensure compliance with IRS regulations.

-

What benefits does airSlate SignNow offer for businesses handling IRS forms?

airSlate SignNow offers numerous benefits for businesses handling IRS forms, including enhanced security for sensitive tax documents, reduced turnaround time for signing, and easy access to audit trails. Specifically, it simplifies the management of forms related to the 3 21 15 Foreign Partnership Withholding, ensuring a smoother compliance process.

-

How does airSlate SignNow ensure the security of documents related to the IRS?

airSlate SignNow prioritizes the security of all documents, including those related to the 3 21 15 Foreign Partnership Withholding, by using advanced encryption and secure data storage. Our platform also includes multi-factor authentication to provide an extra layer of protection, ensuring your sensitive IRS documents remain confidential and secure.

Get more for 3 21 15 Foreign Partnership WithholdingInternal Revenue IRS gov

Find out other 3 21 15 Foreign Partnership WithholdingInternal Revenue IRS gov

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy