Form 8804 Schedule a Penalty for Underpayment of Estimated Section 1446 Tax by Partnerships 2016

What is the Form 8804 Schedule A Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships

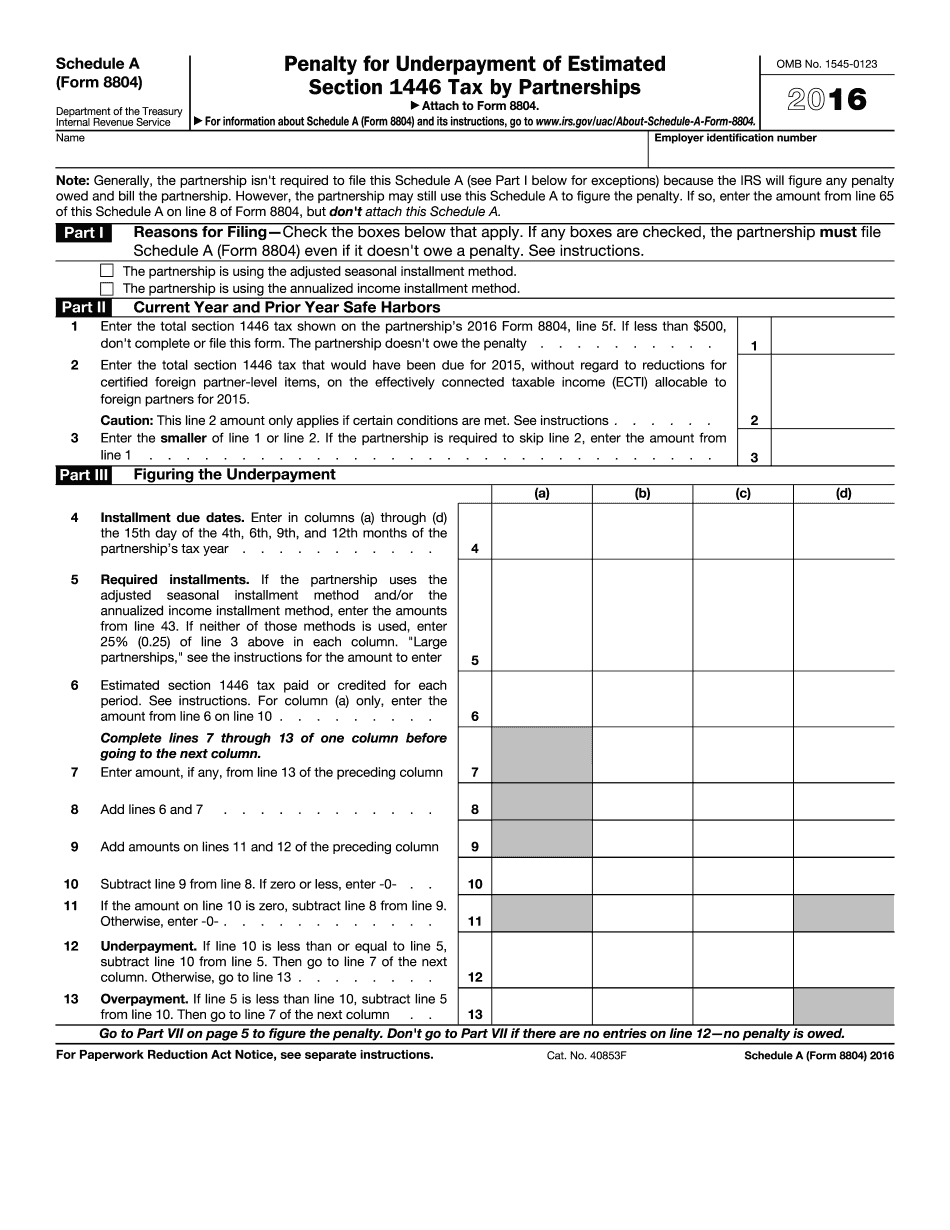

The Form 8804 Schedule A is specifically designed for partnerships to report and pay the estimated Section 1446 tax. This tax applies to foreign partners who receive effectively connected income from a partnership engaged in a trade or business in the United States. When partnerships fail to pay the required estimated tax, they may incur a penalty. This penalty is calculated based on the amount of underpayment and the duration of the underpayment period. Understanding this form is vital for compliance and to avoid unnecessary financial repercussions.

Steps to Complete the Form 8804 Schedule A Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships

Completing the Form 8804 Schedule A involves several critical steps:

- Gather all necessary financial documents related to the partnership's income and expenses.

- Calculate the total income that is effectively connected with the U.S. trade or business.

- Determine the estimated tax liability for the partnership based on the income calculated.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the specified deadline to avoid penalties.

Legal Use of the Form 8804 Schedule A Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships

The legal use of the Form 8804 Schedule A is essential for partnerships that have foreign partners. It serves as a formal declaration of the estimated tax owed and is recognized by the IRS as a legitimate means of reporting tax liabilities. Partnerships must ensure that they comply with all IRS guidelines to avoid legal complications. Using the form correctly helps maintain transparency and accountability in tax reporting.

Filing Deadlines / Important Dates

Partnerships must be aware of the key deadlines associated with the Form 8804 Schedule A to avoid penalties. Typically, the form must be filed by the 15th day of the fourth month following the close of the partnership's tax year. For partnerships operating on a calendar year, this means the deadline is April 15. It is crucial to keep track of these dates and plan accordingly to ensure timely submission.

Penalties for Non-Compliance

Failure to comply with the requirements of the Form 8804 Schedule A can result in significant penalties. The IRS may impose fines based on the amount of tax owed and the length of time the payment is overdue. Additionally, interest may accrue on any unpaid tax amounts, further increasing the financial burden. Understanding these penalties emphasizes the importance of timely and accurate filing.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 8804 Schedule A. These guidelines outline the necessary information required, the calculation methods for estimated taxes, and the acceptable submission methods. Adhering to these guidelines is essential for ensuring that the form is processed correctly and that the partnership remains in good standing with the IRS.

Quick guide on how to complete 2016 form 8804 schedule a penalty for underpayment of estimated section 1446 tax by partnerships

Uncover the most efficient method to complete and endorse your Form 8804 Schedule A Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships

Are you still spending time preparing your official documents on physical copies instead of completing them online? airSlate SignNow provides a superior alternative to fill out and sign your Form 8804 Schedule A Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships and related forms for public services. Our intelligent eSignature solution equips you with everything necessary to manage paperwork swiftly and according to official standards - robust PDF editing, handling, securing, signing, and sharing tools all accessible within a user-friendly interface.

Only a few steps are required to successfully complete and sign your Form 8804 Schedule A Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships:

- Import the editable template to the editor by clicking the Get Form button.

- Check what details you need to enter in your Form 8804 Schedule A Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships.

- Move between the fields using the Next option to ensure you don’t overlook anything.

- Utilize Text, Check, and Cross tools to fill in the blanks with your information.

- Enhance the content with Text boxes or Images from the upper toolbar.

- Emphasize what is signNow or Obscure sections that are no longer relevant.

- Press Sign to create a legally enforceable eSignature using any method you prefer.

- Add the Date next to your signature and complete your task by clicking the Done button.

Store your finalized Form 8804 Schedule A Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships in the Documents folder in your profile, download it, or transfer it to your desired cloud storage. Our service also provides adaptable form sharing options. There's no requirement to print your forms when you need to submit them to the appropriate public office - accomplish it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Experience it now!

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 8804 schedule a penalty for underpayment of estimated section 1446 tax by partnerships

FAQs

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 8804 schedule a penalty for underpayment of estimated section 1446 tax by partnerships

How to generate an eSignature for your 2016 Form 8804 Schedule A Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships in the online mode

How to generate an eSignature for the 2016 Form 8804 Schedule A Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships in Google Chrome

How to create an eSignature for signing the 2016 Form 8804 Schedule A Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships in Gmail

How to create an eSignature for the 2016 Form 8804 Schedule A Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships from your mobile device

How to make an eSignature for the 2016 Form 8804 Schedule A Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships on iOS devices

How to create an eSignature for the 2016 Form 8804 Schedule A Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships on Android

People also ask

-

What is airSlate SignNow 8804?

airSlate SignNow 8804 is an efficient eSignature solution that allows businesses to send, sign, and manage documents online. It simplifies the signing process and streamlines workflow, ensuring documents are completed faster and securely.

-

How much does airSlate SignNow 8804 cost?

The pricing for airSlate SignNow 8804 varies based on the plan selected. There are several options available to fit different business needs, and each plan offers features that cater to both small and large enterprises.

-

What key features does airSlate SignNow 8804 offer?

airSlate SignNow 8804 provides a robust suite of features, including document templates, collaborative signing, and real-time tracking of document status. These tools help enhance productivity and ensure that important documents are handled efficiently.

-

Is airSlate SignNow 8804 secure for sensitive documents?

Yes, airSlate SignNow 8804 prioritizes security with advanced encryption and compliance with major regulations like GDPR. This ensures that sensitive documents are handled safely and securely throughout the signing process.

-

Can airSlate SignNow 8804 integrate with other applications?

Absolutely! airSlate SignNow 8804 supports integrations with many popular applications including Google Drive, Salesforce, and Dropbox. This functionality allows users to seamlessly incorporate eSigning capabilities into their existing workflows.

-

What are the benefits of using airSlate SignNow 8804?

Using airSlate SignNow 8804 brings numerous benefits, including reduced turnaround time for document approvals and enhanced collaboration among team members. It also eliminates the need for printing, scanning, and mailing, making it an eco-friendly option.

-

Is there a free trial available for airSlate SignNow 8804?

Yes, airSlate SignNow 8804 offers a free trial for new users to explore its features and functionality. This allows prospective customers to experience the benefits firsthand before committing to a subscription.

Get more for Form 8804 Schedule A Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships

Find out other Form 8804 Schedule A Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template