Form 8804 Schedule a Penalty for Underpayment of Estimated Section 1446 Tax by Partnerships 2014

What is the Form 8804 Schedule A Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships

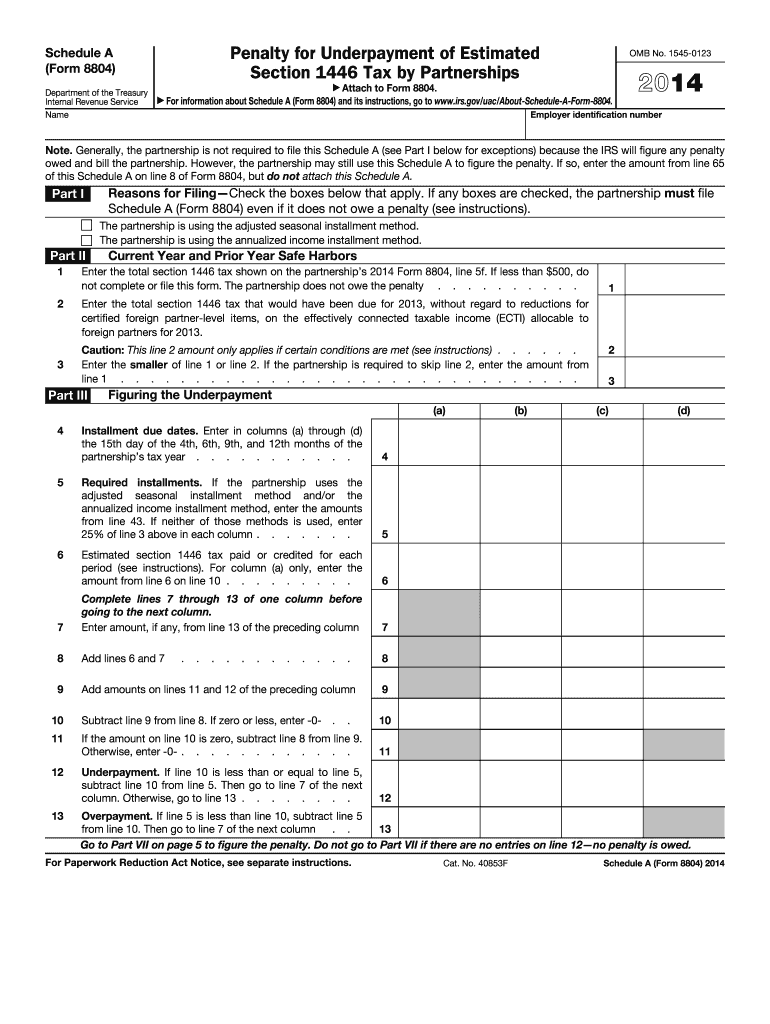

The Form 8804 Schedule A is specifically designed for partnerships that are subject to Section 1446 of the Internal Revenue Code. This form addresses penalties incurred due to underpayment of estimated taxes owed by partnerships. Partnerships that have foreign partners must ensure compliance with these tax obligations to avoid penalties. The penalties can arise if the partnership fails to pay the required estimated tax amounts on time, which can lead to additional financial burdens and complications in tax filings.

Steps to complete the Form 8804 Schedule A Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships

Completing the Form 8804 Schedule A involves several key steps:

- Gather necessary financial information, including partnership income and deductions.

- Calculate the total estimated tax liability for the partnership.

- Determine the amount of tax that has already been paid or credited.

- Calculate any penalties for underpayment by comparing the estimated tax due with the amounts already paid.

- Complete the form accurately, ensuring all fields are filled out as required.

- Review the completed form for accuracy and compliance with IRS guidelines.

How to obtain the Form 8804 Schedule A Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships

The Form 8804 Schedule A can be obtained directly from the Internal Revenue Service (IRS) website. It is crucial to ensure that you are using the most current version of the form to avoid issues with your submission. Additionally, many tax preparation software solutions include this form, allowing for easier completion and filing. Always ensure that you are accessing official resources to obtain the form to guarantee its validity.

Penalties for Non-Compliance

Failing to comply with the requirements of the Form 8804 Schedule A can result in significant penalties. These penalties may include interest on the unpaid tax amount and additional fines for late payments. The IRS may assess these penalties based on the amount of underpayment and the duration of the non-compliance. It is essential for partnerships to stay informed about their tax obligations to avoid these financial repercussions.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of the Form 8804 Schedule A. These guidelines outline the necessary information required, deadlines for submission, and the penalties associated with underpayment. Partnerships should familiarize themselves with these guidelines to ensure compliance and minimize the risk of incurring penalties. Regular consultation with tax professionals can also provide clarity on these regulations.

Filing Deadlines / Important Dates

Partnerships must adhere to strict filing deadlines for the Form 8804 Schedule A. Typically, the form is due on the 15th day of the fourth month following the end of the partnership's tax year. It is crucial to mark these dates on your calendar to ensure timely submission. Missing these deadlines can lead to penalties and interest on unpaid taxes, which can significantly increase the financial burden on the partnership.

Quick guide on how to complete 2014 form 8804 schedule a penalty for underpayment of estimated section 1446 tax by partnerships

Discover the simplest method to complete and sign your Form 8804 Schedule A Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow offers a superior way to complete and sign your Form 8804 Schedule A Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships and associated forms for public services. Our intelligent eSignature solution equips you with all the necessary tools to handle paperwork swiftly and in compliance with official standards - robust PDF editing, management, security, signing, and sharing features all available within a user-friendly interface.

Only a few steps are needed to complete and sign your Form 8804 Schedule A Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships:

- Upload the editable template to the editor using the Get Form button.

- Verify the information you need to include in your Form 8804 Schedule A Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships.

- Move between the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the fields with your information.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is important or Conceal sections that are no longer relevant.

- Click on Sign to create a valid eSignature using your preferred method.

- Place the Date next to your signature and conclude your work with the Done button.

Store your completed Form 8804 Schedule A Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships in the Documents folder of your profile, download it, or transfer it to your preferred cloud storage. Our solution also offers versatile form sharing. There’s no need to print your templates when you can send them directly to the proper public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Experience it today!

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 8804 schedule a penalty for underpayment of estimated section 1446 tax by partnerships

FAQs

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 8804 schedule a penalty for underpayment of estimated section 1446 tax by partnerships

How to generate an eSignature for your 2014 Form 8804 Schedule A Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships online

How to generate an electronic signature for the 2014 Form 8804 Schedule A Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships in Google Chrome

How to create an electronic signature for putting it on the 2014 Form 8804 Schedule A Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships in Gmail

How to generate an eSignature for the 2014 Form 8804 Schedule A Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships from your smartphone

How to make an eSignature for the 2014 Form 8804 Schedule A Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships on iOS devices

How to generate an electronic signature for the 2014 Form 8804 Schedule A Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships on Android devices

People also ask

-

What is the Form 8804 Schedule A Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships?

The Form 8804 Schedule A Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships is a penalty imposed on partnerships that do not sufficiently pay their estimated Section 1446 tax. Partnerships must accurately calculate and remit these payments to avoid penalties. It’s essential to stay compliant with IRS guidelines to prevent any unnecessary financial burdens.

-

How can airSlate SignNow help me manage my Form 8804 Schedule A compliance?

airSlate SignNow assists businesses in preparing and eSigning documents related to Form 8804 Schedule A compliance. Our user-friendly platform streamlines the process of managing tax documents, ensuring timely submissions. By utilizing our services, you can minimize the risk of penalties for underpayment efficiently.

-

What features does airSlate SignNow offer for handling Form 8804 Schedule A?

airSlate SignNow offers features such as customizable templates for Form 8804 Schedule A and automatic reminders for key deadlines. The platform also provides eSignature capabilities to ensure your documents are signed legally and securely. These features enhance the overall efficiency of handling your tax compliance documents.

-

Is there a pricing plan for using airSlate SignNow for Form 8804 Schedule A?

Yes, airSlate SignNow provides various pricing plans designed to cater to businesses of all sizes. Our cost-effective solutions allow you to choose a plan that fits your budget while ensuring your Form 8804 Schedule A documents are handled professionally. You can find detailed pricing information on our website.

-

What benefits can I expect from using airSlate SignNow for Form 8804 Schedule A?

Using airSlate SignNow for your Form 8804 Schedule A documents streamlines the eSigning and submission process, helping you avoid penalties for underpayment. Our solution enhances collaboration among team members and clients, ensuring smoother communication. Additionally, it provides an archive of signed documents for future reference.

-

Can airSlate SignNow integrate with other accounting tools for tax compliance?

Absolutely! airSlate SignNow can integrate seamlessly with various accounting and tax software tools. This integration allows users to manage their Form 8804 Schedule A alongside their financial data, facilitating a comprehensive approach to tax compliance. Such interoperability ensures that your information remains synchronized and accurate.

-

How secure is airSlate SignNow for managing sensitive tax documents like Form 8804 Schedule A?

airSlate SignNow prioritizes the security of your sensitive tax documents, including Form 8804 Schedule A. We employ industry-standard encryption and secure storage to protect your data from unauthorized access. Our commitment to security ensures that your business remains compliant while keeping your information safe.

Get more for Form 8804 Schedule A Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships

- Kids r first child care centre preschool parent handbook kidsrfirstchildcare form

- Us passport renewal fillable savable form

- Sterilization record log form

- Thrift savings plan form 76

- Insinkerator rebate form

- Form to apply for an original license or to change or renew an existing license

- Irs form 4989

- Distinguished veteran pass application for pass terms and form

Find out other Form 8804 Schedule A Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself