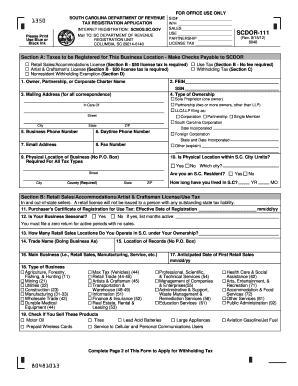

Scdor 111 Form

What is the SCDOR 111?

The SCDOR 111 form, officially known as the South Carolina Department of Revenue Form 111, is a crucial document used for tax purposes in the state of South Carolina. This form is primarily utilized by individuals and businesses to report specific tax information to the South Carolina Department of Revenue. It is essential for ensuring compliance with state tax regulations and accurately reporting income and deductions.

How to Obtain the SCDOR 111

Obtaining the SCDOR 111 form is straightforward. It can be downloaded directly from the South Carolina Department of Revenue's official website. Alternatively, individuals can request a physical copy by contacting the department's customer service. It is advisable to ensure that you are using the most current version of the form to avoid any compliance issues.

Steps to Complete the SCDOR 111

Completing the SCDOR 111 form involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Carefully fill out the form, ensuring that all required fields are completed accurately.

- Double-check calculations to avoid errors that could lead to penalties.

- Sign and date the form to validate your submission.

Once completed, the form can be submitted electronically or via mail, depending on your preference and the requirements set by the South Carolina Department of Revenue.

Legal Use of the SCDOR 111

The SCDOR 111 form holds legal significance as it serves as an official record of your tax reporting to the state. Properly completing and submitting this form ensures that you are in compliance with South Carolina tax laws. Failure to submit the form or inaccuracies in the information provided can result in legal consequences, including fines or audits.

Key Elements of the SCDOR 111

Understanding the key elements of the SCDOR 111 form is essential for accurate completion. Important components include:

- Personal identification information, such as your name and Social Security number.

- Details regarding income sources, including wages, dividends, and other earnings.

- Deductions and credits that may apply to your tax situation.

- Signature line to validate the information provided.

Form Submission Methods

The SCDOR 111 form can be submitted through various methods to accommodate different preferences:

- Online Submission: Many taxpayers opt to file electronically, which is often faster and more efficient.

- Mail: The completed form can be printed and sent via postal service to the appropriate address provided by the South Carolina Department of Revenue.

- In-Person: Individuals may also choose to deliver their forms in person at designated Department of Revenue offices.

Quick guide on how to complete scdor 111

Prepare Scdor 111 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a suitable eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Scdor 111 on any device with the airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

The easiest way to modify and eSign Scdor 111 with ease

- Obtain Scdor 111 and click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Mark relevant sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your modifications.

- Choose how you wish to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Scdor 111 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the scdor 111

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the scdor 111 form?

The scdor 111 form is a crucial document used for declaring the ownership of personal property in South Carolina. Understanding how to correctly fill this form can help you avoid potential legal issues regarding property taxes.

-

How can airSlate SignNow help with the scdor 111 form?

airSlate SignNow streamlines the process of filling out the scdor 111 form by allowing users to eSign and send documents effortlessly. Our platform ensures that your forms are securely completed and delivered, eliminating paperwork hassles.

-

Is there a cost associated with using airSlate SignNow for the scdor 111 form?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. You can start with a free trial to explore features, including those for the scdor 111 form, before committing to a plan.

-

What features does airSlate SignNow offer for managing the scdor 111 form?

airSlate SignNow provides a user-friendly interface, customizable templates, and robust eSignature capabilities to facilitate the completion of the scdor 111 form. Our solution also ensures compliance with legal standards for digital signatures.

-

How does airSlate SignNow ensure the security of my scdor 111 form?

Security is paramount at airSlate SignNow. We utilize encryption protocols and secure cloud storage to protect sensitive documents, including the scdor 111 form, ensuring that your data remains confidential throughout the signing process.

-

Can I integrate airSlate SignNow with other software for the scdor 111 form?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, making it easy to manage documents like the scdor 111 form across different platforms. This improves workflow efficiency and keeps all your files organized.

-

What benefits does airSlate SignNow provide for handling the scdor 111 form?

Using airSlate SignNow for the scdor 111 form signNowly speeds up the process of document management. It not only reduces the burden of paperwork but also enhances collaboration among parties involved in the signing process.

Get more for Scdor 111

- 13212 irs relocation travel guideinternal revenue service form

- Transmittal of shop drawings equipment data material form

- Gsa 2419 certification of progress payments under fixed price construction contracts form

- Contact record general services administration gsa form

- Findings of fact for contract modification gsa form

- Request for qualifications california courts state of california form

- Restaurant food handler certification application city of dallas form

- Download order form camera check point

Find out other Scdor 111

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT