1 32 12 IRS Relocation Travel GuideInternal Revenue Service Form

What is the 1 32 12 IRS Relocation Travel GuideInternal Revenue Service

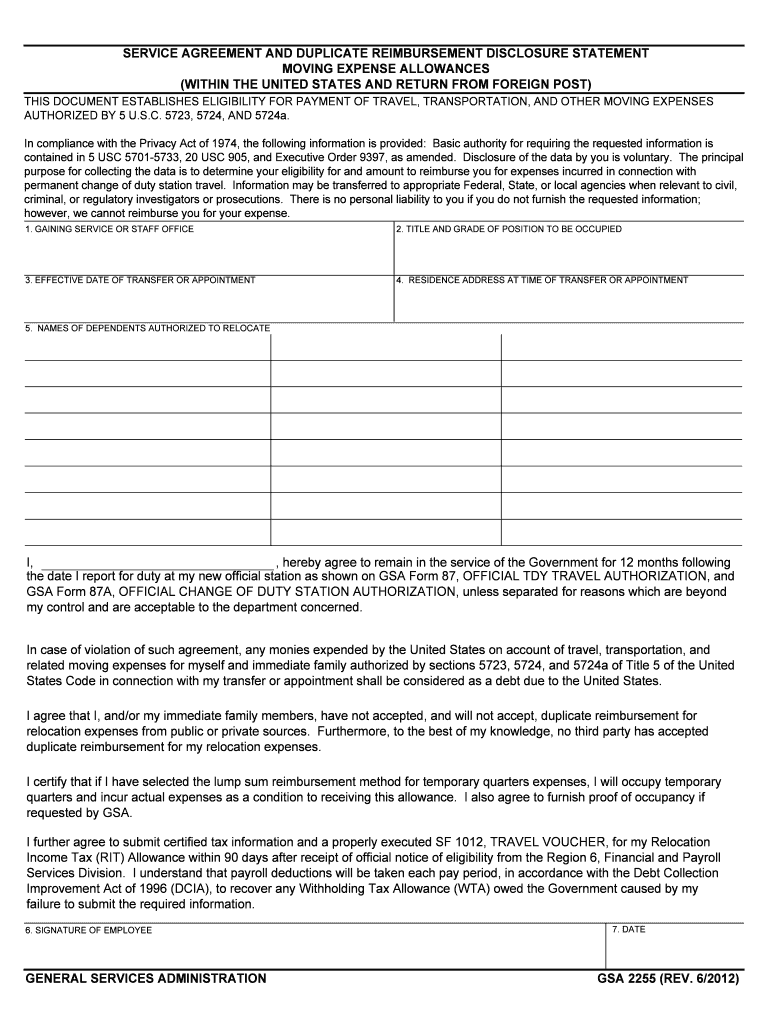

The 1 32 12 IRS Relocation Travel GuideInternal Revenue Service is a specific form used by taxpayers to claim deductions related to moving expenses incurred during a job relocation. This form is essential for individuals who have changed their primary place of residence for work-related reasons. It outlines the necessary information required by the IRS to process these claims effectively. Understanding this form is crucial for ensuring that all eligible expenses are accounted for and that taxpayers receive the benefits they are entitled to under current tax laws.

How to use the 1 32 12 IRS Relocation Travel GuideInternal Revenue Service

Using the 1 32 12 IRS Relocation Travel GuideInternal Revenue Service involves several steps to ensure proper completion and submission. Taxpayers should begin by gathering all relevant documentation, including receipts for moving expenses and proof of employment changes. The form itself requires detailed information about the move, including dates, locations, and the nature of the job change. Once completed, the form can be submitted either electronically or via mail, depending on the taxpayer's preference and the IRS guidelines. It is important to keep copies of all submitted documents for future reference.

Steps to complete the 1 32 12 IRS Relocation Travel GuideInternal Revenue Service

Completing the 1 32 12 IRS Relocation Travel GuideInternal Revenue Service involves a systematic approach:

- Gather all necessary documents, including receipts and proof of employment.

- Fill out the form with accurate details regarding the relocation.

- Calculate the total moving expenses that are eligible for deduction.

- Review the form for completeness and accuracy.

- Submit the form either electronically or by mail as per IRS instructions.

Following these steps carefully will help ensure that the form is processed smoothly and that all eligible deductions are claimed.

Legal use of the 1 32 12 IRS Relocation Travel GuideInternal Revenue Service

The legal use of the 1 32 12 IRS Relocation Travel GuideInternal Revenue Service is governed by IRS regulations regarding moving expense deductions. Taxpayers must ensure that they meet the eligibility criteria outlined by the IRS, which typically includes being employed and relocating for a job. It is essential to maintain accurate records of all expenses and to submit the form within the designated time frame. Non-compliance with IRS regulations can result in penalties or disallowance of the claimed deductions.

Filing Deadlines / Important Dates

Filing deadlines for the 1 32 12 IRS Relocation Travel GuideInternal Revenue Service align with the general tax filing deadlines set by the IRS. Typically, individual taxpayers must submit their forms by April fifteenth of the following tax year. However, if a taxpayer requires an extension, they must file for an extension before the original deadline. It is crucial to stay informed about any changes in deadlines that may occur, as these can impact the ability to claim moving expenses.

Required Documents

To complete the 1 32 12 IRS Relocation Travel GuideInternal Revenue Service, several documents are required:

- Receipts for all moving expenses, including transportation and storage costs.

- Proof of employment change, such as an offer letter or employment contract.

- Documentation of the previous and new addresses.

- Any additional forms or schedules that may be required by the IRS for deductions.

Having these documents ready will facilitate a smoother filing process and ensure compliance with IRS requirements.

Quick guide on how to complete 13212 irs relocation travel guideinternal revenue service

Complete 1 32 12 IRS Relocation Travel GuideInternal Revenue Service effortlessly on any gadget

Online document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly and without hassle. Manage 1 32 12 IRS Relocation Travel GuideInternal Revenue Service on any device with the airSlate SignNow Android or iOS applications and enhance any document-related operation today.

How to modify and eSign 1 32 12 IRS Relocation Travel GuideInternal Revenue Service without difficulty

- Find 1 32 12 IRS Relocation Travel GuideInternal Revenue Service and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your method of sending the form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow manages all your document management needs with just a few clicks from any device you prefer. Modify and eSign 1 32 12 IRS Relocation Travel GuideInternal Revenue Service and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 13212 irs relocation travel guideinternal revenue service

How to generate an electronic signature for the 13212 Irs Relocation Travel Guideinternal Revenue Service online

How to make an electronic signature for the 13212 Irs Relocation Travel Guideinternal Revenue Service in Chrome

How to generate an electronic signature for putting it on the 13212 Irs Relocation Travel Guideinternal Revenue Service in Gmail

How to make an eSignature for the 13212 Irs Relocation Travel Guideinternal Revenue Service straight from your mobile device

How to make an electronic signature for the 13212 Irs Relocation Travel Guideinternal Revenue Service on iOS

How to create an eSignature for the 13212 Irs Relocation Travel Guideinternal Revenue Service on Android

People also ask

-

What is the 1 32 12 IRS Relocation Travel GuideInternal Revenue Service?

The 1 32 12 IRS Relocation Travel GuideInternal Revenue Service is a comprehensive document that outlines the tax implications of relocating for work, including eligible expenses for deductions. This guide helps employees and employers understand the IRS regulations regarding relocation travel expenses, ensuring compliance and optimizing tax benefits.

-

How can I access the 1 32 12 IRS Relocation Travel GuideInternal Revenue Service?

You can easily access the 1 32 12 IRS Relocation Travel GuideInternal Revenue Service through our airSlate SignNow platform. Simply sign up for an account, and you can download the guide as part of our document management tools, making the process seamless for your business.

-

What features does the airSlate SignNow offer for managing relocation documents?

airSlate SignNow provides powerful features for managing relocation documents, including eSigning, document templates, and automated workflows. With the 1 32 12 IRS Relocation Travel GuideInternal Revenue Service, users can ensure their documentation is compliant with IRS guidelines while streamlining their relocation processes.

-

Is the 1 32 12 IRS Relocation Travel GuideInternal Revenue Service included in my subscription?

Yes, the 1 32 12 IRS Relocation Travel GuideInternal Revenue Service is included in all airSlate SignNow subscriptions. This ensures that all users have access to essential IRS information when managing their relocation travel documents, providing added value to your subscription.

-

How does airSlate SignNow help with compliance regarding IRS relocation travel expenses?

airSlate SignNow helps maintain compliance with IRS regulations by providing users with access to the 1 32 12 IRS Relocation Travel GuideInternal Revenue Service. This guide outlines the necessary documentation and expense eligibility, assisting businesses in staying compliant while maximizing their tax deductions.

-

Can I integrate airSlate SignNow with other software to manage relocation processes?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions, enhancing your ability to manage relocation processes. By utilizing the 1 32 12 IRS Relocation Travel GuideInternal Revenue Service within these integrations, you can streamline workflows and ensure compliance with IRS guidelines.

-

What are the benefits of using the 1 32 12 IRS Relocation Travel GuideInternal Revenue Service with airSlate SignNow?

Using the 1 32 12 IRS Relocation Travel GuideInternal Revenue Service with airSlate SignNow offers several benefits, including simplified document management, compliance assurance, and access to expert resources. This combination enables businesses to efficiently manage relocation expenses while staying informed about IRS regulations.

Get more for 1 32 12 IRS Relocation Travel GuideInternal Revenue Service

- Summer camp form 16 breslau mennonite church breslaumc

- Permission to register kwantlen polytechnic form

- Season registration form kids christian hockey league kidshockey

- Rmt intake 4 docx form

- Roe web client employer consent form fill out ampamp sign online

- Responsible driver program registration and inform

- Canada application british columbia form

- Scientific games and bclc sign five year extension form

Find out other 1 32 12 IRS Relocation Travel GuideInternal Revenue Service

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors