Confidential Tax Information Authorization 2015

What is the Confidential Tax Information Authorization

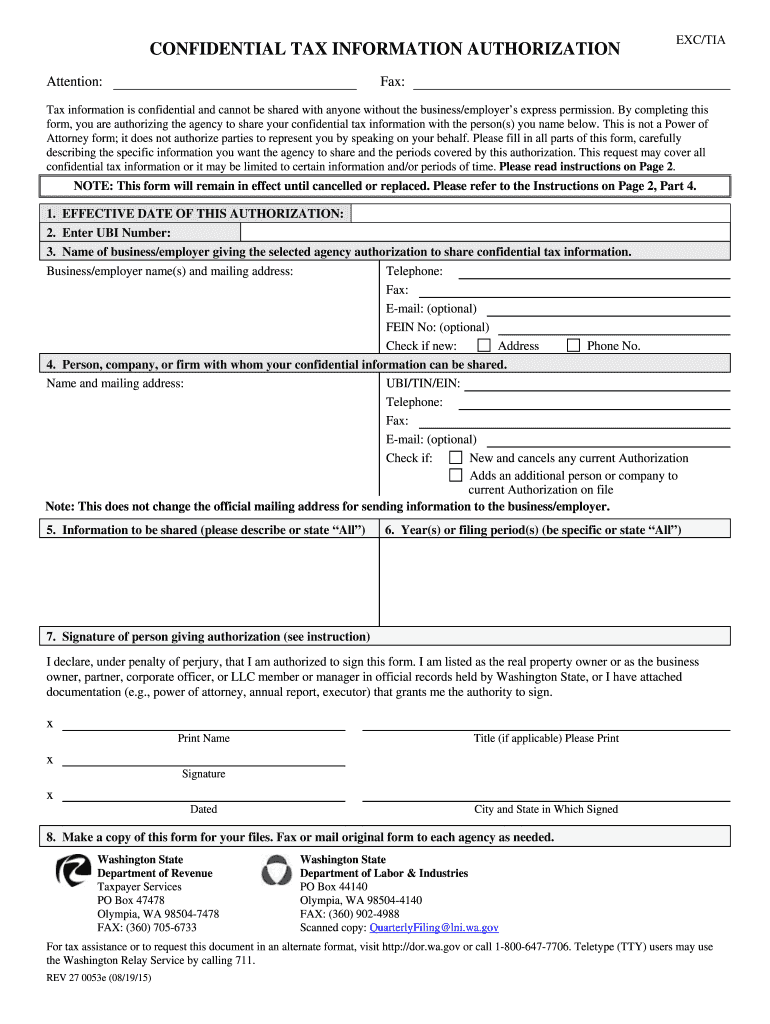

The Confidential Tax Information Authorization is a crucial form used by individuals and businesses to grant permission for a third party to access their confidential tax information. This form is essential for ensuring that tax-related details are shared securely and in compliance with legal requirements. By completing this authorization, taxpayers can designate specific individuals or entities, such as tax professionals, to receive sensitive information from the IRS or state tax authorities.

How to use the Confidential Tax Information Authorization

Using the Confidential Tax Information Authorization involves a straightforward process. First, you need to obtain the form, which is typically available through the IRS or state tax authority websites. After acquiring the form, fill in the required fields, including your personal information, the details of the person or entity you are authorizing, and the specific tax years or types of information to be disclosed. Once completed, you must sign and date the form to validate it. Finally, submit the form according to the instructions provided, either electronically or via mail.

Steps to complete the Confidential Tax Information Authorization

Completing the Confidential Tax Information Authorization requires careful attention to detail. Follow these steps for accurate submission:

- Obtain the form from the IRS or your state tax authority.

- Fill in your name, address, and taxpayer identification number.

- Provide the name and contact information of the authorized individual or entity.

- Specify the tax years or types of information you are authorizing access to.

- Sign and date the form to confirm your authorization.

- Submit the completed form as directed, ensuring it reaches the appropriate agency.

Legal use of the Confidential Tax Information Authorization

The legal use of the Confidential Tax Information Authorization is governed by federal and state laws that protect taxpayer information. This form must be used in compliance with the Internal Revenue Code and applicable state regulations. It is important to ensure that the individual or entity you authorize is qualified to handle sensitive tax information. Misuse of this authorization can lead to legal repercussions, including penalties for unauthorized disclosure of confidential information.

Required Documents

When completing the Confidential Tax Information Authorization, certain documents may be necessary to support your request. These may include:

- Your valid identification, such as a driver's license or passport.

- Any previous tax returns or documents relevant to the tax years specified.

- Proof of the relationship to the authorized individual or entity, if applicable.

Having these documents ready can facilitate a smoother authorization process and ensure compliance with legal requirements.

IRS Guidelines

The IRS provides specific guidelines for the use of the Confidential Tax Information Authorization. These guidelines detail how to properly complete the form, the types of information that can be disclosed, and the rights of the taxpayer. It is essential to review these guidelines to ensure that your authorization is valid and that you understand your rights regarding confidentiality and data protection. Adhering to IRS guidelines helps prevent issues related to unauthorized access or misuse of tax information.

Quick guide on how to complete confidential tax information authorization ctia dor wa

Your assistance manual on how to prepare your Confidential Tax Information Authorization

If you’re curious about how to finalize and submit your Confidential Tax Information Authorization, here are some concise instructions on how to simplify tax processing.

To begin, you merely need to set up your airSlate SignNow profile to change how you manage documents online. airSlate SignNow is a highly user-friendly and efficient document solution that allows you to modify, create, and finalize your tax papers with ease. With its editor, you can alternate between text, checkboxes, and eSignatures and return to edit information as needed. Streamline your tax management with advanced PDF editing, eSigning, and easy sharing capabilities.

Follow the steps below to finalize your Confidential Tax Information Authorization in a matter of minutes:

- Create your account and begin working on PDFs in moments.

- Utilize our library to obtain any IRS tax document; browse through different versions and schedules.

- Click Obtain form to launch your Confidential Tax Information Authorization in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Signature Tool to append your legally-binding eSignature (if required).

- Examine your document and rectify any mistakes.

- Store changes, print your version, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes digitally with airSlate SignNow. Please be aware that submitting on paper may increase return errors and cause refund delays. It’s essential to verify the IRS website for filing guidelines in your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct confidential tax information authorization ctia dor wa

Create this form in 5 minutes!

How to create an eSignature for the confidential tax information authorization ctia dor wa

How to make an eSignature for the Confidential Tax Information Authorization Ctia Dor Wa online

How to generate an electronic signature for the Confidential Tax Information Authorization Ctia Dor Wa in Google Chrome

How to create an electronic signature for putting it on the Confidential Tax Information Authorization Ctia Dor Wa in Gmail

How to create an electronic signature for the Confidential Tax Information Authorization Ctia Dor Wa right from your smartphone

How to make an electronic signature for the Confidential Tax Information Authorization Ctia Dor Wa on iOS

How to make an eSignature for the Confidential Tax Information Authorization Ctia Dor Wa on Android OS

People also ask

-

What is a CTIA form and how does it work with airSlate SignNow?

A CTIA form is a standardized document that is essential for compliance with industry regulations. With airSlate SignNow, you can easily create, send, and eSign CTIA forms, streamlining the process while ensuring legal adherence and security.

-

How can airSlate SignNow help with CTIA form compliance?

airSlate SignNow provides features specifically designed to enhance compliance with CTIA form requirements. With its secure electronic signatures and audit trails, you can ensure that all your CTIA forms meet legal standards while simplifying tracking and management.

-

What are the pricing plans for using airSlate SignNow with CTIA forms?

airSlate SignNow offers a variety of pricing plans that cater to different business sizes and needs. Whether you're a small business or a larger enterprise, you can choose a plan that allows you to efficiently manage your CTIA forms while remaining budget-friendly.

-

Can I integrate airSlate SignNow with other applications for managing CTIA forms?

Yes, airSlate SignNow easily integrates with various applications, including CRM and document management systems. This makes it simple to import, manage, and send CTIA forms directly from the tools you already use.

-

What features does airSlate SignNow offer for handling CTIA forms?

airSlate SignNow includes features such as customizable templates, bulk sending, and automated workflows specifically tailored for CTIA forms. These tools help streamline document management and enhance efficiency across your organization.

-

How does airSlate SignNow ensure the security of my CTIA forms?

Security is a top priority for airSlate SignNow. All CTIA forms are protected using industry-standard encryption and offer secure access controls, ensuring that your sensitive information remains safe throughout the signing process.

-

What are the benefits of using airSlate SignNow for CTIA forms?

Using airSlate SignNow for CTIA forms allows for faster processing and greater accuracy. The platform reduces the need for paper documents, enabling your business to operate more efficiently while maintaining compliance with CTIA requirements.

Get more for Confidential Tax Information Authorization

Find out other Confidential Tax Information Authorization

- Can I eSign Kentucky Quitclaim Deed

- eSign Maine Quitclaim Deed Free

- How Do I eSign New York Quitclaim Deed

- eSign New Hampshire Warranty Deed Fast

- eSign Hawaii Postnuptial Agreement Template Later

- eSign Kentucky Postnuptial Agreement Template Online

- eSign Maryland Postnuptial Agreement Template Mobile

- How Can I eSign Pennsylvania Postnuptial Agreement Template

- eSign Hawaii Prenuptial Agreement Template Secure

- eSign Michigan Prenuptial Agreement Template Simple

- eSign North Dakota Prenuptial Agreement Template Safe

- eSign Ohio Prenuptial Agreement Template Fast

- eSign Utah Prenuptial Agreement Template Easy

- eSign Utah Divorce Settlement Agreement Template Online

- eSign Vermont Child Custody Agreement Template Secure

- eSign North Dakota Affidavit of Heirship Free

- How Do I eSign Pennsylvania Affidavit of Heirship

- eSign New Jersey Affidavit of Residence Free

- eSign Hawaii Child Support Modification Fast

- Can I eSign Wisconsin Last Will and Testament