Child Tax Credit Worksheet Form

What is the Child Tax Credit Worksheet?

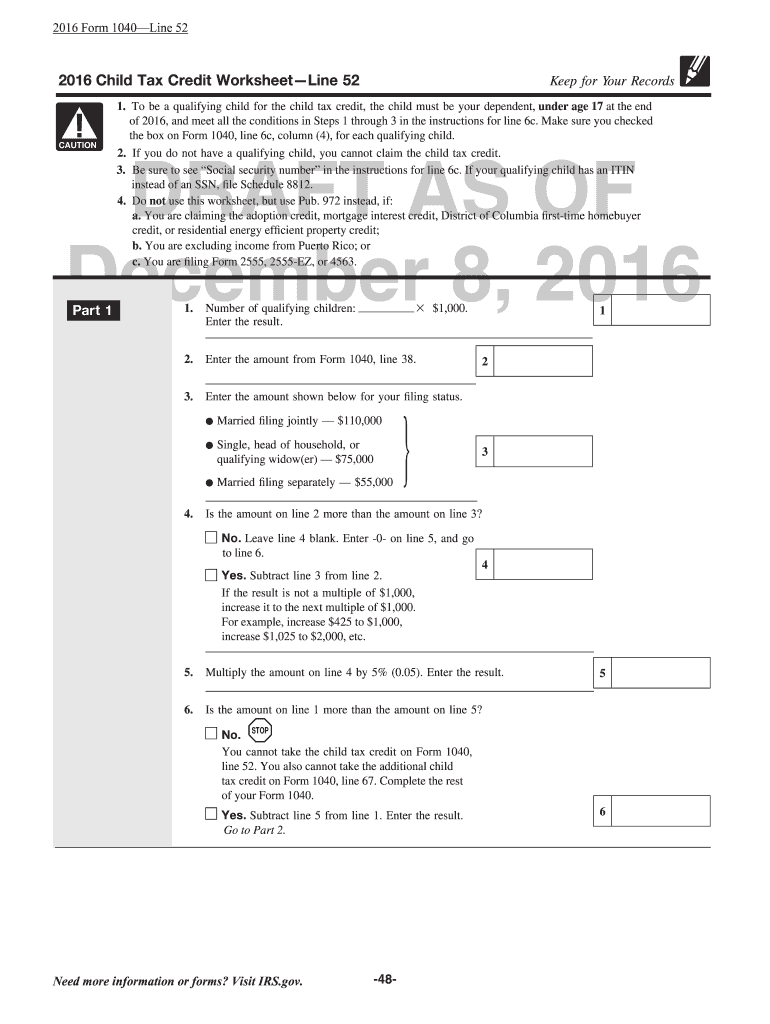

The Child Tax Credit Worksheet is a crucial document used by taxpayers in the United States to determine eligibility for the Child Tax Credit. This credit is designed to provide financial relief to families with dependent children. The worksheet helps individuals calculate the amount of credit they may qualify for based on their income, filing status, and the number of qualifying children. Understanding this worksheet is essential for maximizing tax benefits and ensuring compliance with IRS regulations.

How to Obtain the Child Tax Credit Worksheet

To obtain the 2014 Child Tax Credit Worksheet, taxpayers can visit the official IRS website or request it through tax preparation software. The worksheet is typically included in tax filing packages, making it accessible for individuals preparing their taxes. Additionally, it can be found in various tax-related publications and resources provided by the IRS. Ensuring you have the correct version for the tax year is vital for accurate calculations.

Steps to Complete the Child Tax Credit Worksheet

Completing the Child Tax Credit Worksheet involves several key steps:

- Gather necessary documents, including your tax return, Social Security numbers for all qualifying children, and income information.

- Fill in your filing status and the number of qualifying children you are claiming.

- Calculate your modified adjusted gross income (MAGI) to determine eligibility based on income thresholds.

- Follow the worksheet instructions to compute the amount of credit you may claim.

- Review your calculations for accuracy before including the credit on your tax return.

Legal Use of the Child Tax Credit Worksheet

The Child Tax Credit Worksheet must be completed accurately to ensure compliance with IRS regulations. It serves as a supporting document for the claims made on your tax return. Failing to provide accurate information can result in penalties or delays in processing your tax return. Utilizing electronic tools like signNow can help ensure that your worksheet is filled out correctly and securely, maintaining legal validity.

Key Elements of the Child Tax Credit Worksheet

Several key elements are essential to understand when working with the Child Tax Credit Worksheet:

- Filing Status: Your filing status (single, married filing jointly, etc.) impacts your eligibility and credit amount.

- Qualifying Children: The worksheet requires details about each child, including their age and relationship to you.

- Income Limits: There are specific income thresholds that determine eligibility for the credit.

- Credit Amount: The worksheet will guide you in calculating the total credit based on the information provided.

IRS Guidelines

The IRS provides detailed guidelines for completing the Child Tax Credit Worksheet. These guidelines outline eligibility requirements, income limits, and how to properly claim the credit on your tax return. Familiarizing yourself with these guidelines is important to ensure compliance and maximize your potential tax benefits. The IRS updates these guidelines periodically, so it is advisable to refer to the latest information for the relevant tax year.

Quick guide on how to complete child tax credit worksheet

Effortlessly Create Child Tax Credit Worksheet on Any Device

The rise of online document management has become a favored choice among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to generate, amend, and electronically sign your documents quickly and without interruptions. Handle Child Tax Credit Worksheet across any platform using airSlate SignNow's Android or iOS applications and enhance your document-centered workflows today.

The simplest way to alter and electronically sign Child Tax Credit Worksheet effortlessly

- Obtain Child Tax Credit Worksheet and then click Get Form to begin.

- Utilize the features we provide to fill out your document.

- Mark important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere moments and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious searches for forms, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Child Tax Credit Worksheet while ensuring outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the child tax credit worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2014 child tax credit form?

The 2014 child tax credit form refers to the IRS form used to claim the Child Tax Credit for eligible children. This credit can signNowly reduce your tax bill, making it important for qualifying families. It's essential to complete the form accurately to ensure you receive the full benefits.

-

How can I access the 2014 child tax credit form?

You can access the 2014 child tax credit form on the official IRS website or through tax preparation software. If you prefer, airSlate SignNow offers an easy way to eSign and manage your tax documents electronically, ensuring you can handle the form efficiently.

-

What are the benefits of using airSlate SignNow for the 2014 child tax credit form?

Using airSlate SignNow can simplify your filing process for the 2014 child tax credit form. With our user-friendly platform, you can sign and share documents securely, reducing the hassle of printing and mailing, thus streamlining your tax preparation experience.

-

Are there any costs associated with using airSlate SignNow for the 2014 child tax credit form?

airSlate SignNow offers competitive pricing plans designed to meet the needs of businesses and individuals. The cost-effectiveness of our solution means you can manage your 2014 child tax credit form without breaking the bank, making it a smart choice for your tax needs.

-

Can I store my 2014 child tax credit form in airSlate SignNow?

Yes, airSlate SignNow allows you to store your 2014 child tax credit form securely in the cloud. This means you can access it anytime, from anywhere, ensuring all your important tax documents are organized and readily available for future reference.

-

What features does airSlate SignNow offer for tax forms like the 2014 child tax credit form?

AirSlate SignNow provides a range of features tailored to make handling tax forms easier, including eSigning, templates for common forms, and automated workflows. These features help users efficiently manage documents, including the 2014 child tax credit form, minimizing errors and saving time.

-

Is airSlate SignNow compliant with IRS requirements for the 2014 child tax credit form?

Absolutely! airSlate SignNow complies with industry standards and IRS requirements, ensuring that your 2014 child tax credit form and other tax documents are processed securely and legally. This compliance helps give you peace of mind as you manage your tax filings.

Get more for Child Tax Credit Worksheet

- Reviewer hacienda pr form

- California form 3809 2017

- 2018 form 592 f foreign partner or member annual return 2018 form 592 f foreign partner or member annual return

- Virginia form 2017 2019

- 2017 form 3538 franchise tax board

- It 140 2016 form

- 2017 request for pre dissolution tax abatement form

- 2017 form 3537 payment for automatic franchise tax board

Find out other Child Tax Credit Worksheet

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document