Tx Ifta Form 2015

What is the Tx Ifta Form

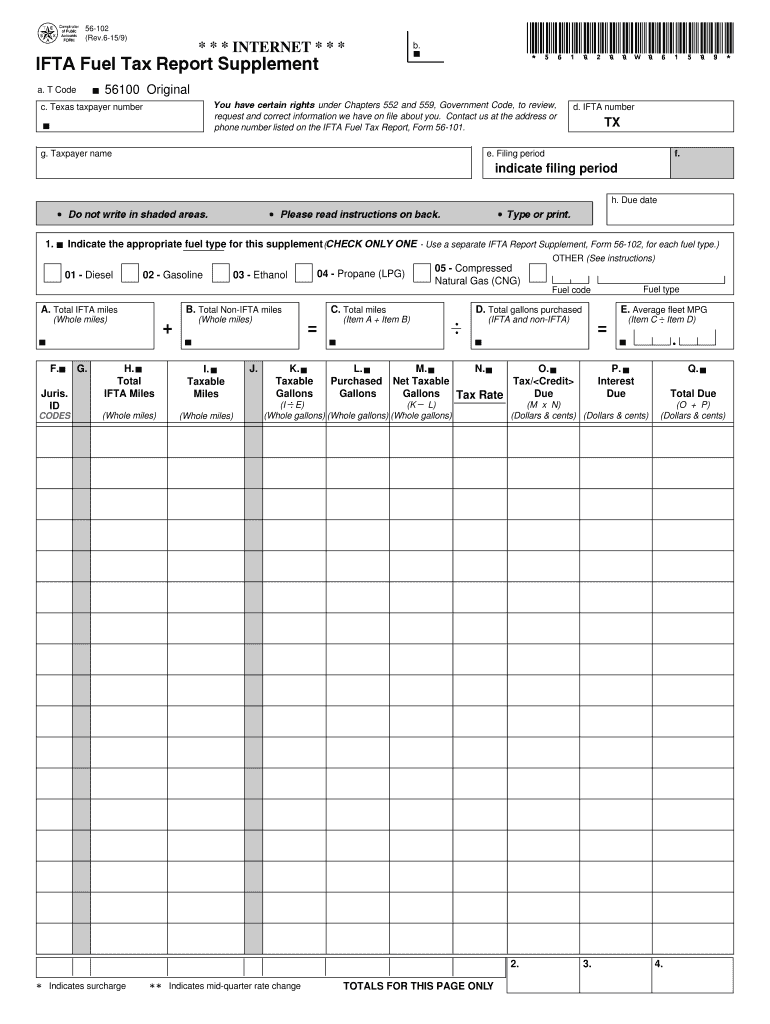

The Tx Ifta Form, or Texas International Fuel Tax Agreement Form, is a document used by interstate motor carriers to report fuel use and pay fuel taxes. This form is essential for businesses that operate commercial vehicles across state lines. It simplifies the process of reporting and paying fuel taxes to multiple jurisdictions, ensuring compliance with state laws and regulations.

How to use the Tx Ifta Form

Using the Tx Ifta Form involves several steps to ensure accurate reporting of fuel consumption. First, gather all necessary data, including miles traveled in each state and fuel purchased. Next, fill out the form with the required information, ensuring that all entries are accurate. After completing the form, submit it to the appropriate state agency, either electronically or by mail, depending on your preference and state requirements.

Steps to complete the Tx Ifta Form

Completing the Tx Ifta Form requires careful attention to detail. Follow these steps:

- Collect records of total miles traveled and fuel purchased in each state.

- Fill in your business information, including name and address.

- Report the miles traveled and fuel purchased for each jurisdiction.

- Calculate the total fuel tax owed based on your reported data.

- Review the form for accuracy before submission.

Legal use of the Tx Ifta Form

The Tx Ifta Form is legally recognized for reporting fuel taxes in compliance with the International Fuel Tax Agreement. Proper use of this form ensures that businesses meet their tax obligations while avoiding penalties. It is crucial to maintain accurate records and submit the form within the designated filing periods to uphold legal compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Tx Ifta Form are typically set quarterly. Businesses must submit their forms and payments by the end of the month following each quarter. For example, the deadlines for the first quarter would be April 30, for the second quarter July 31, and so forth. It is essential to keep track of these dates to avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

The Tx Ifta Form can be submitted through various methods. Many states offer online submission options, which provide a convenient way to file the form electronically. Alternatively, businesses can mail their completed forms to the designated state agency. In some cases, in-person submissions may also be accepted, but this varies by state. Always check with your local agency for specific submission guidelines.

Quick guide on how to complete tx ifta 2015 form

Effortlessly Prepare Tx Ifta Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to find the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly and without delays. Manage Tx Ifta Form on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

A Simple Method to Edit and eSign Tx Ifta Form

- Find Tx Ifta Form and click Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your amendments.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Edit and eSign Tx Ifta Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tx ifta 2015 form

Create this form in 5 minutes!

How to create an eSignature for the tx ifta 2015 form

How to make an eSignature for your Tx Ifta 2015 Form online

How to create an electronic signature for the Tx Ifta 2015 Form in Chrome

How to generate an eSignature for putting it on the Tx Ifta 2015 Form in Gmail

How to make an eSignature for the Tx Ifta 2015 Form from your smartphone

How to create an electronic signature for the Tx Ifta 2015 Form on iOS

How to generate an eSignature for the Tx Ifta 2015 Form on Android OS

People also ask

-

What is the Tx Ifta Form and why is it important?

The Tx Ifta Form is a crucial document for businesses operating in multiple states, as it helps report fuel taxes for interstate commerce. Filing this form accurately is essential to comply with state regulations and avoid penalties. Utilizing airSlate SignNow can simplify the process of completing and submitting your Tx Ifta Form digitally.

-

How can airSlate SignNow help me with my Tx Ifta Form?

airSlate SignNow streamlines the process of filling out the Tx Ifta Form by providing an intuitive platform for electronic signatures and document management. With our solution, you can easily complete, sign, and send your Tx Ifta Form from any device, ensuring timely compliance and reducing administrative burdens.

-

What are the pricing options for using airSlate SignNow for the Tx Ifta Form?

airSlate SignNow offers flexible pricing plans designed to fit various business needs, including options for single users and teams. You can choose a plan that suits your requirements while ensuring you can efficiently manage your Tx Ifta Form and other documents without breaking the bank.

-

Is it easy to integrate airSlate SignNow with other software for Tx Ifta Form management?

Yes, airSlate SignNow provides seamless integration with various software applications, allowing you to manage your Tx Ifta Form alongside your existing tools. Whether you use accounting software or document management systems, our platform ensures a smooth workflow and easy data transfer.

-

What features does airSlate SignNow offer for managing Tx Ifta Forms?

airSlate SignNow includes features like customizable templates, electronic signatures, and real-time tracking, specifically designed to enhance your Tx Ifta Form management. These tools help you create, sign, and store your documents securely, improving efficiency and compliance.

-

Can I access my Tx Ifta Form on mobile devices?

Absolutely! airSlate SignNow is optimized for mobile use, allowing you to access, complete, and sign your Tx Ifta Form from anywhere, at any time. This flexibility ensures that you can manage your documents on the go, making compliance easier.

-

What are the benefits of using airSlate SignNow for the Tx Ifta Form compared to traditional methods?

Using airSlate SignNow for your Tx Ifta Form offers numerous benefits over traditional paper methods, including speed, convenience, and enhanced security. By digitizing the process, you reduce the risk of errors, save time on document handling, and ensure that your information is securely stored and easily accessible.

Get more for Tx Ifta Form

- Summons dispossessory form

- Mag 12 01 notice of appeal georgiacourts form

- Mag 30 02 dispossessory proceeding affidavit form

- Mag 10 07 special agents affidavit of service administrative office georgiacourts form

- Provider locator form

- Montgomery county rental application form

- Wisconsin residential lease form 19

- Statement security deposit accounting form

Find out other Tx Ifta Form

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free