Sales Tax Rate Sheet Texas Form 2007

What is the Sales Tax Rate Sheet Texas Form

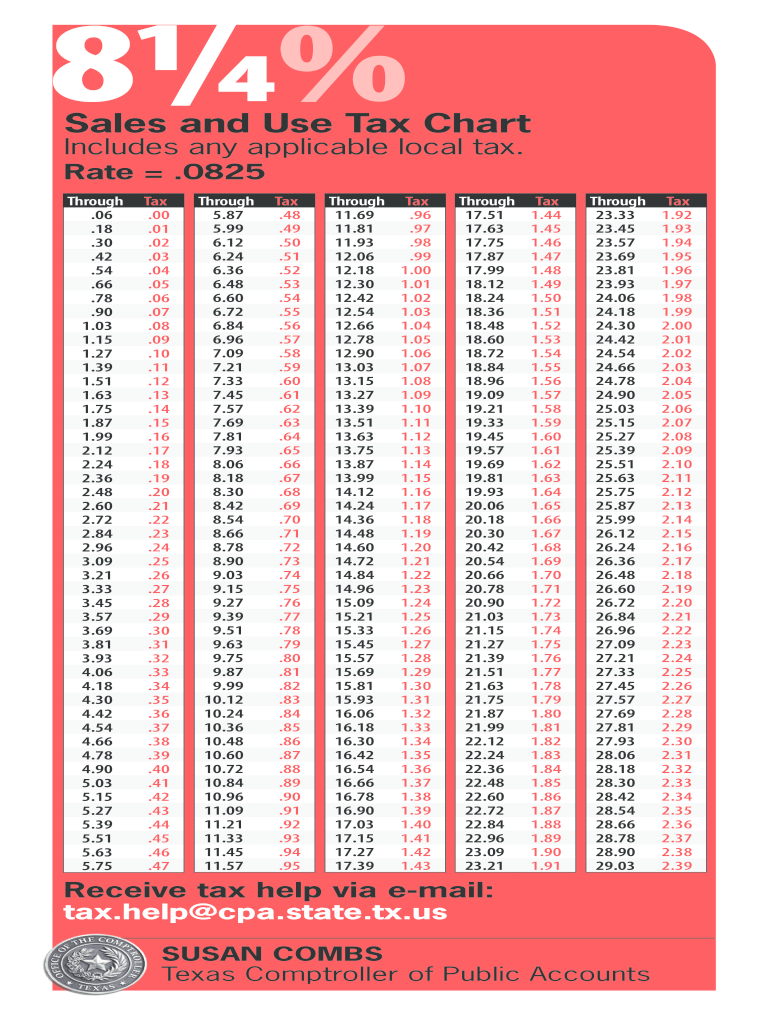

The Sales Tax Rate Sheet Texas Form is an essential document used by businesses operating in Texas to report and calculate sales tax obligations. This form provides a detailed overview of the various sales tax rates applicable across different jurisdictions within the state. It is crucial for ensuring compliance with Texas tax laws and helps businesses accurately determine the amount of sales tax they need to collect from customers.

How to use the Sales Tax Rate Sheet Texas Form

To effectively use the Sales Tax Rate Sheet Texas Form, businesses should first identify the specific tax rate that applies to their sales based on the location of their operations. The form lists various tax rates by city and county, allowing users to pinpoint the correct rate. Once the appropriate rate is identified, businesses can apply it to their sales transactions to calculate the total sales tax due. This ensures that they collect the correct amount from customers and remain compliant with state regulations.

Steps to complete the Sales Tax Rate Sheet Texas Form

Completing the Sales Tax Rate Sheet Texas Form involves several straightforward steps:

- Gather necessary information about your business location and sales activities.

- Review the form to identify the applicable sales tax rates based on your business's location.

- Calculate the sales tax for each transaction by multiplying the sales amount by the appropriate tax rate.

- Document the calculated sales tax on the form, ensuring accuracy for reporting purposes.

- Keep a copy of the completed form for your records and for future reference during tax filings.

Legal use of the Sales Tax Rate Sheet Texas Form

The Sales Tax Rate Sheet Texas Form is legally recognized when used in accordance with Texas state tax laws. Businesses must ensure that they are using the most current version of the form to comply with any updates in tax rates or regulations. Proper completion and retention of this form can protect businesses from potential audits and penalties related to sales tax miscalculations or non-compliance.

Key elements of the Sales Tax Rate Sheet Texas Form

Key elements of the Sales Tax Rate Sheet Texas Form include:

- Jurisdiction Information: Details on various cities and counties, each with its corresponding sales tax rate.

- Effective Dates: Information on when specific tax rates are applicable, ensuring businesses use the correct rates during their reporting periods.

- Rate Changes: Notifications of any changes in tax rates that may affect businesses and their sales tax collections.

Form Submission Methods

The Sales Tax Rate Sheet Texas Form can typically be submitted through various methods, including:

- Online Submission: Many businesses prefer to file electronically through the Texas Comptroller's website, ensuring quick processing.

- Mail: Businesses can also print the completed form and send it via postal mail to the appropriate tax office.

- In-Person: For those who prefer personal interaction, forms can be submitted at designated tax offices throughout Texas.

Quick guide on how to complete sales tax rate sheet texas 2007 form

Complete Sales Tax Rate Sheet Texas Form seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and eSign your documents quickly and without delays. Manage Sales Tax Rate Sheet Texas Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign Sales Tax Rate Sheet Texas Form effortlessly

- Locate Sales Tax Rate Sheet Texas Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and has the same legal standing as a traditional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Forget about misplaced or lost documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Edit and eSign Sales Tax Rate Sheet Texas Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sales tax rate sheet texas 2007 form

Create this form in 5 minutes!

How to create an eSignature for the sales tax rate sheet texas 2007 form

How to generate an eSignature for the Sales Tax Rate Sheet Texas 2007 Form in the online mode

How to generate an electronic signature for your Sales Tax Rate Sheet Texas 2007 Form in Google Chrome

How to generate an eSignature for putting it on the Sales Tax Rate Sheet Texas 2007 Form in Gmail

How to make an electronic signature for the Sales Tax Rate Sheet Texas 2007 Form right from your smart phone

How to create an eSignature for the Sales Tax Rate Sheet Texas 2007 Form on iOS

How to create an eSignature for the Sales Tax Rate Sheet Texas 2007 Form on Android OS

People also ask

-

What is the Sales Tax Rate Sheet Texas Form?

The Sales Tax Rate Sheet Texas Form is a document used by businesses in Texas to determine the applicable sales tax rates based on location. This form provides essential information to help businesses comply with state tax regulations and ensures accurate tax collections.

-

How can I obtain the Sales Tax Rate Sheet Texas Form?

You can easily access the Sales Tax Rate Sheet Texas Form by visiting the Texas Comptroller’s website or through various online platforms. Additionally, airSlate SignNow enables you to fill, sign, and send this form quickly and securely, simplifying the process.

-

Are there any costs associated with the Sales Tax Rate Sheet Texas Form?

The Sales Tax Rate Sheet Texas Form itself is free to obtain from official sources. However, if you choose to use airSlate SignNow for document management and e-signature services, there are subscription plans available that can be cost-effective for your business needs.

-

What features does airSlate SignNow offer for handling the Sales Tax Rate Sheet Texas Form?

airSlate SignNow provides a user-friendly interface to easily create, edit, and sign the Sales Tax Rate Sheet Texas Form. Features such as templates, cloud storage, and secure sharing options ensure that you manage your tax documents efficiently and effectively.

-

Can I integrate airSlate SignNow with my existing accounting software for the Sales Tax Rate Sheet Texas Form?

Yes, airSlate SignNow offers integrations with various accounting and financial software, allowing for seamless management of the Sales Tax Rate Sheet Texas Form. This ensures that your tax information is synchronized across platforms for better record-keeping and compliance.

-

What are the benefits of using airSlate SignNow for the Sales Tax Rate Sheet Texas Form?

Using airSlate SignNow to handle the Sales Tax Rate Sheet Texas Form enhances your workflow efficiency by streamlining e-signatures and document management. It reduces paperwork, saves time, and helps maintain compliance with state regulations, providing peace of mind for your business operations.

-

Is the Sales Tax Rate Sheet Texas Form necessary for all businesses?

The Sales Tax Rate Sheet Texas Form is essential for any business operating in Texas that sells taxable goods or services. Failing to utilize this form may lead to incorrect sales tax collections, resulting in compliance issues and potential penalties.

Get more for Sales Tax Rate Sheet Texas Form

Find out other Sales Tax Rate Sheet Texas Form

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP