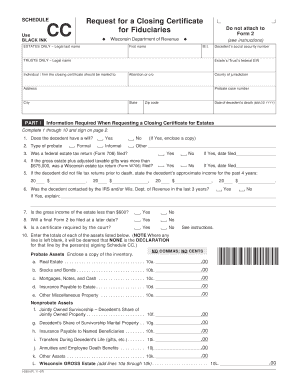

Wisconsin Schedule Cc Form

What is the Wisconsin Schedule CC

The Wisconsin Schedule CC is a specific form used for reporting certain tax-related information. It is primarily utilized by individuals and entities in Wisconsin to disclose the details of tax credits and deductions. This form is essential for ensuring compliance with state tax regulations and helps taxpayers accurately report their financial activities to the Wisconsin Department of Revenue.

How to use the Wisconsin Schedule CC

Using the Wisconsin Schedule CC involves several steps to ensure accurate completion. Taxpayers must first gather all necessary financial documents, including income statements and records of any applicable deductions. Once the relevant information is compiled, individuals can fill out the form, ensuring that all sections are completed accurately. After filling out the Schedule CC, it should be submitted along with the main tax return to the appropriate tax authority.

Steps to complete the Wisconsin Schedule CC

Completing the Wisconsin Schedule CC requires careful attention to detail. Here are the key steps:

- Gather all relevant financial documents, such as W-2 forms and receipts for deductions.

- Download or obtain a copy of the Schedule CC form from the Wisconsin Department of Revenue website.

- Fill out the form, ensuring that all required fields are completed accurately.

- Double-check the information for accuracy and completeness.

- Submit the completed form along with your main tax return by the designated deadline.

Legal use of the Wisconsin Schedule CC

The legal use of the Wisconsin Schedule CC is governed by state tax laws. It is important for taxpayers to understand that submitting this form is not only a requirement but also a means to ensure compliance with Wisconsin tax regulations. Failure to accurately complete and submit the Schedule CC can result in penalties or audits by the state tax authority.

Key elements of the Wisconsin Schedule CC

The Wisconsin Schedule CC includes several key elements that taxpayers must be aware of. These elements typically encompass:

- Identification information, including taxpayer name and social security number.

- Details regarding income sources and amounts.

- Information on tax credits and deductions being claimed.

- Signature and date to certify the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Wisconsin Schedule CC align with the general tax filing deadlines in the state. Typically, individual taxpayers must submit their forms by April 15 of each year. It is crucial for taxpayers to be aware of any changes in deadlines or extensions that may apply, as these can affect their filing obligations.

Quick guide on how to complete wisconsin schedule cc

Complete Wisconsin Schedule Cc effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely retain it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without issues. Manage Wisconsin Schedule Cc on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

How to modify and eSign Wisconsin Schedule Cc with ease

- Locate Wisconsin Schedule Cc and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tiring form searches, or errors that require printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device of your choosing. Alter and eSign Wisconsin Schedule Cc and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wisconsin schedule cc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Wisconsin Schedule CC?

The Wisconsin Schedule CC is a crucial document for reporting campaign finance activities in Wisconsin. It helps ensure transparency in political contributions and expenditures. Using airSlate SignNow, you can easily manage and eSign your Schedule CC documents efficiently.

-

How does airSlate SignNow simplify the process of filling out the Wisconsin Schedule CC?

airSlate SignNow offers user-friendly templates and electronic signature capabilities that streamline the completion of the Wisconsin Schedule CC. This allows users to fill out forms quickly without the hassle of printing or scanning. The platform also stores your documentation securely for easy access.

-

Is there a cost associated with using airSlate SignNow for the Wisconsin Schedule CC?

airSlate SignNow provides various pricing plans to cater to different user needs, making it a cost-effective solution for filing the Wisconsin Schedule CC. Many users find that the time saved by using our service justifies the pricing. Check our website for detailed pricing options that fit your budget.

-

What features does airSlate SignNow offer for managing the Wisconsin Schedule CC?

airSlate SignNow includes features like customizable templates, electronic signatures, and document tracking to enhance your experience with Wisconsin Schedule CC filings. These features improve efficiency and accuracy, making it simple to stay organized and compliant. Users can also store their documents securely within the platform.

-

Can I integrate airSlate SignNow with other applications for Wisconsin Schedule CC management?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your workflow when managing the Wisconsin Schedule CC. This means you can connect with your favorite CRM tools, cloud storage, and other document management systems effortlessly. Integrations improve collaboration and streamline the entire process.

-

What are the benefits of using airSlate SignNow for the Wisconsin Schedule CC?

Using airSlate SignNow for the Wisconsin Schedule CC offers benefits such as increased efficiency, reduced paperwork, and secure eSigning capabilities. Users appreciate the intuitive interface that makes the process faster and easier. Additionally, the solution helps you remain compliant with state regulations effortlessly.

-

How secure is the information I submit for the Wisconsin Schedule CC through airSlate SignNow?

airSlate SignNow prioritizes the security of your data when submitting the Wisconsin Schedule CC. The platform utilizes advanced encryption and security protocols to protect your information. You can trust that your documents remain confidential and secure while using our service.

Get more for Wisconsin Schedule Cc

Find out other Wisconsin Schedule Cc

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe